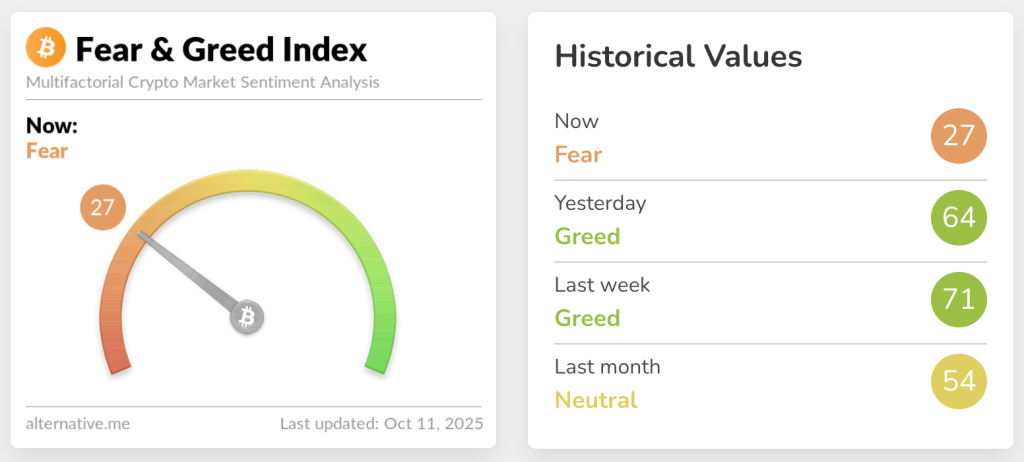

The crypto Fear and Greed Index plunged from 64 (Greed) to 27 (Fear) within 24 hours following President Donald Trump’s announcement of 100% tariffs on Chinese imports, triggering what CoinGlass described as “the largest liquidation event in crypto history.”

Over 1.66 million traders were liquidated with total losses exceeding $19.33 billion, though actual figures may surpass $30 billion according to some estimates, as Binance only reports one liquidation order per second.

Tariff Shock Erases $1 Trillion in Three-Hour Cascade

Bitcoin crashed from above $122,000 to briefly below $102,000, wiping out all gains since August, while Ethereum tumbled from $4,783 to $3,400 before recovering.

The global crypto market cap fell over 9% in 24 hours to $3.8 trillion, with approximately $1 trillion erased in just three hours.

More than $7 billion in positions were liquidated in less than one hour of trading on Friday alone.

Long positions absorbed the bulk of damage, totaling $16.83 billion in losses compared to $2.49 billion from shorts.

Bitcoin led liquidations at $5.38 billion, followed by Ethereum at $4.43 billion, Solana at $2.01 billion, and XRP at $708 million.

Hyperliquid saw the largest single liquidation, an ETH-USDT position worth $203.36 million.

The exchange handled $10.3 billion or roughly 53% of all liquidations, followed by Bybit with $4.65 billion, Binance at $2.39 billion, and OKX at $1.21 billion.

The $10B liquidation figure floating around is fake, the real number is likely much higher, somewhere in the $30B–$40B+ range.

On Hyperliquid alone, nearly $7B was liquidated. Here’s the full breakdown for anyone interested:

Total liquidations since 20:45 UTC:

– Total Value:…— MLM (@mlmabc) October 11, 2025

The collapse dwarfed previous record events, including the March 2020 COVID crash that saw $1.2 billion in liquidations and the November 2022 FTX collapse with $1.6 billion.

Friday’s event was approximately 20 times larger than the COVID crash, with Brian Strugats of Multicoin Capital noting the focus now turns to “counterparty exposure and whether this triggers broader market contagion.”

October’s Historical Strength Faces Unprecedented Test

Yesterday, Economist Timothy Peterson noted that drops of more than 5% in October are “exceedingly rare,” occurring only four times in the past decade during October 2017, 2018, 2019, and 2021.

Following each previous drop, Bitcoin rebounded by 16% in 2017, 4% in 2018, and 21% in 2019, with only 2021 seeing a further 3% decline.

October ranks as Bitcoin’s second-best performing month on average since 2013, delivering average returns of 20.10% and trailing only November’s 46.02% average gain according to CoinGlass data.

Drops of more than 5% in October are exceedingly rare. This has happened only 4 times in the past 10 years.

Oct 24 2017

Oct 11 2018

Oct 23 2019

Oct 21 2021

What happened next? 7 days later bitcoin was

2017: up 16%

2018: up 4%

2019: up 21%

2021: down -3% pic.twitter.com/mbFs19RbwL— Timothy Peterson (@nsquaredvalue) October 10, 2025

If history repeats and Bitcoin mirrors its strongest October rebound of 21% from 2019, a similar move from Friday’s $102,000 low would place the cryptocurrency around $124,000 within a week.

However, Trump’s tariff announcement scheduled for November 1 in response to Beijing’s export restrictions on rare earth elements creates ongoing policy uncertainty.

The president later hinted he could reverse tariffs if China changes course before the deadline, potentially triggering a short-term market recovery, though liquidation losses remain locked in.

According to Bloomberg, Caroline Mauron, co-founder of Orbit Markets, identified $100,000 as Bitcoin’s next major support level, below which “would signal the end of past three-year bull cycle.”

Bitcoin options markets reflected this view with the highest number of put strikes at $110,000 and the next highest at $100,000, according to Deribit data.

Analysts Split on Whether Liquidation Marks Bottom or More Pain Ahead

Jan3 founder Samson Mow maintained bullish sentiment, noting “there are still 21 days left in Uptober.”

MN Trading Capital founder Michael van de Poppe called the event “the bottom of the current cycle,” comparing it to the COVID-19 crash that marked the previous cycle’s low.

The Bitcoin Libertarian took a longer-term view, suggesting that “in a few years, Bitcoin will crash from $1M to $0.8M in a few hours.”

David Jeong, CEO at Tread.fi described in the Bloomberg report that the market is experiencing a “black swan event,” noting that many institutions likely didn’t expect this volatility level.

Similarly, Vincent Liu, chief investment officer at Kronos Research, said the rout was “sparked by US-China tariff fears but fueled by institutional over-leverage,” adding that crypto’s macro ties were now clear.

The Fear and Greed Index reading of 27 compares to 64 yesterday, 71 last week, and 54 last month, marking one of the fastest sentiment reversals in crypto history, with Bitcoin also touching over a 6-month low within hours.

Technical Analysis: Critical Support Tests for BTC and ETH

BTC currently trades around $111,522 after bouncing from the $102,000 low.

Immediate support sits at $110,000 to $113,000, with the $113,500 level identified as critical for triggering a relief rally.

$BTC dumped to $102,000 level and nearly took down the entire market.

Nearly $20,000,000,000 in long positions were liquidated which is the highest ever in crypto history.

Right now, Bitcoin is trying to reclaim $113,500 level and if that happens, you could see a relief rally. pic.twitter.com/F0UPgeTep2— Ted (@TedPillows) October 11, 2025

Resistance zones above current prices stand at $117,933, $124,475, and the recent high around $126,000.

The $20 billion liquidation cleared extreme leverage, potentially removing selling pressure, though the sustainability of any bounce depends on fundamental improvements.

Volume characteristics don’t demonstrate overwhelming conviction in either direction.

ETH trades at $3,833 after testing $3,400, with immediate resistance at the $4,000 psychological level necessary for upward momentum.

Support zones sit around $3,600 to $3,800, with failure to reclaim $4,000 likely triggering retests of these levels.

Higher resistance stands at $4,080, $4,265, and $4,783. RSI indicators reached oversold levels historically associated with reversals, though these can remain depressed during genuine bear markets.

Both assets face genuine uncertainty following the liquidation event.

Bitcoin must reclaim and hold above $113,500 to validate recovery scenarios toward $117,000-$120,000, while failure would likely result in retesting $102,000 or potentially $95,000-$100,000.

Ethereum needs sustained trading above $4,000 to trigger momentum toward $4,200-$4,500, with a breakdown risking moves toward $3,600-$3,800.

The clearing of leveraged positions removes immediate selling pressure, though the unresolved tariff and potential for additional volatility suggest consolidation between current levels and recent lows remains the most probable near-term outcome before directional clarity emerges.

The post Crypto Market Flips from ‘Greed’ to ‘Fear’ in 24 Hours – More Crash Coming? appeared first on Cryptonews.