The corporate crypto treasury movement has reached a critical turning point, transitioning from an era of guaranteed premiums to what Coinbase Research calls a “player-versus-player” competitive phase.

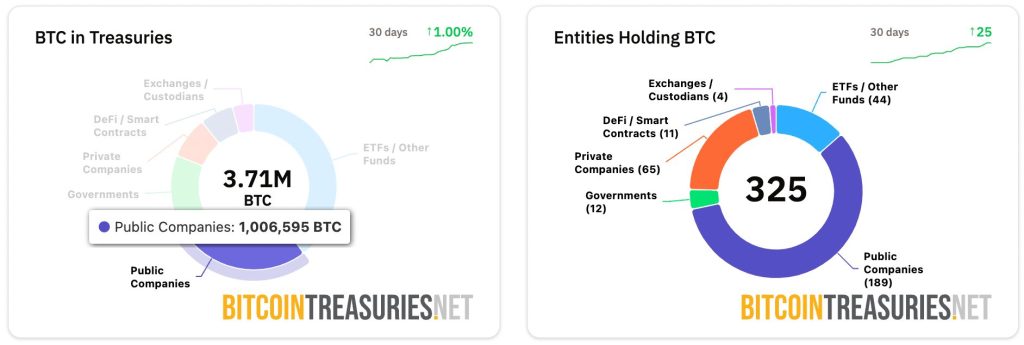

Public companies now hold over 1 million Bitcoin worth $110 billion, with digital asset treasuries controlling $215 billion across 213 entities.

However, new research warns that most participants face potential failure during adverse credit cycles.

Strategy Leads Corporate Crypto Movement Despite Mounting Pressures

MicroStrategy, now operating as Strategy Inc, leads the pack with 638,460 BTC after recording $14.05 billion in unrealized gains during Q2 2025.

The company’s aggressive accumulation strategy inspired dozens of imitators, but early movers like Strategy enjoyed substantial premiums to net asset value that have since compressed under competitive pressure.

The transformation began in 2020 when Michael Saylor’s Strategy pioneered the corporate Bitcoin treasury model using convertible bonds and equity raises.

Mining firms like MARA Holdings followed with 52,477 BTC, while newcomers like Jack Mallers’ XXI amassed 43,514 BTC, and Japan’s Metaplanet targeted 210,000 BTC by 2027.

However, the space has fundamentally shifted. Nasdaq tightened supervision requirements for digital asset treasuries, demanding shareholder approval for certain transactions.

Saylor's Strategy Inc. reverses stock sale restrictions as Bitcoin premium erodes and purchasing slows down.#Bitcoin #Strategy #Saylorhttps://t.co/t2RZmD3n3I

— Cryptonews.com (@cryptonews) August 19, 2025

Strategy abandoned its self-imposed 2.5x market-to-net-asset-value threshold for stock sales after funding pressures mounted, while facing multiple class-action lawsuits over business practices.

Coinbase Research identifies this transition as moving beyond simple MicroStrategy copycat strategies toward execution-dependent success.

The scarcity premium benefiting early adopters has dissipated, forcing companies to differentiate themselves through strategic positioning rather than merely accumulating Bitcoin.

Corporate Treasuries Face Structural Vulnerabilities in Rising Rate Environment

Earlier last month, Sentora research identified critical flaws in corporate Bitcoin strategies, warning that “idle Bitcoin on a corporate balance sheet is not a scalable strategy in a rising-rate world.”

Most Bitcoin treasury companies operate as either unprofitable entities or rely heavily on mark-to-market gains for solvency.

The strategy mirrors historical wealth-building through leveraged acquisition of scarce assets, but lacks Bitcoin’s evolution from digital property to yield-generating capital.

Unlike real estate, which generates rental income, Bitcoin treasury companies engage in negative-carry trades, borrowing fiat currency to acquire non-yielding assets without adequate risk mitigation mechanisms.

Strategy utilizes $3.7 billion in ultra-low coupon convertible bonds and $5.5 billion in perpetual preferred shares to finance acquisitions.

Similarly, Metaplanet continues its aggressive accumulation, doubling Bitcoin holdings every 60 days while utilizing zero-interest convertible bonds worth ¥270.36 billion.

Metaplanet finalizes $1.45B share sale to fund Bitcoin purchases, holdings hit $2.25B with 20,136 $BTC as sixth-largest corporate holder.#Bitcoin #Metaplanethttps://t.co/Q2Pgfgpsn7

— Cryptonews.com (@cryptonews) September 10, 2025

The company recently finalized its $1.45 billion stock sale to fund massive Bitcoin purchases, issuing 385 million shares with settlement scheduled for September 16.

Rising interest rates amplify negative carry effects, while Bitcoin price stagnation over 2-3 years could erode conviction and make equity issuance dilutive.

Market Saturation and Regulatory Scrutiny Challenge New Entrants

Glassnode analyst James Check has earlier raised concerns over the strategy’s longevity, arguing easy gains have vanished for new entrants as markets mature.

BitcoinTreasuries data shows new entities adding BTC holdings at scale are joining every month, but investors increasingly expect clear differentiation beyond basic Bitcoin accumulation.

Crypto analyst Ran Neuner claimed many treasury firms operate as exit vehicles for insiders rather than genuine market buyers.

Companies often receive crypto contributions from existing holders in exchange for shares that later trade at massive premiums, allowing early contributors to cash out while retail investors pay 2-4x net asset value.

The Financial Times reported in August that 154 US-listed companies raised $98.4 billion for crypto purchases in 2025, up dramatically from $33.6 billion raised by 10 companies previously.

Just this month, forward Industries raised $1.65 billion for Solana-based treasuries backed by Galaxy Digital and Jump Crypto, while corporate Ethereum holdings reached $28 billion across multiple entities.

Despite being the leading firm, Strategy was recently denied S&P 500 inclusion despite meeting technical criteria, with the index committee expressing concerns over Bitcoin-heavy business models and high volatility risks.

The broader movement faces warnings that participants may not survive credit cycles due to structural vulnerabilities in environments with rising interest rates.

However, Coinbase Research maintains a constructive outlook for large-cap crypto names that benefit from continued DEX capital flows.

Coinbase Research argues that increased competition forces companies beyond simple MicroStrategy copying, potentially driving more strategic capital allocation and sustained buying pressure as firms compete for investor attention.

The post Crypto Treasury ‘Easy Money’ Era Ends as Companies Enter ‘Player vs Player’ Competition – Good for Investors? appeared first on Cryptonews.