Enterprise capitalists largely took a cautious strategy to crypto final yr, regardless of digital asset costs rising in expectation of Donald Trump’s return to the White Home.

Pitchbook information from Feb. 7 exhibits that This autumn 2024 funding rebounded modestly from Q3. Nonetheless, the yr closed at almost the identical stage as 2023.

Moreover, This autumn deal worth climbed 13.6%, rising from $2.2b to $2.5. In distinction, the variety of offers fell 14.6%, dropping from 411 to 351.

The funding rebound exhibits that traders nonetheless again established groups and modern applied sciences. Nonetheless, the drop in deal depend reveals rising investor selectivity—a pattern that emerged in Q3. In the meantime, Pitchbook senior analyst Robert Le defined that this shift displays the crypto market’s normalization, with capital now specializing in fewer, extra promising initiatives.

“Three years in the past, anybody may elevate capital with a white paper and little or no traction,” Le mentioned. “Now, you’re seeing that’s not the case. Any founder going out to lift capital from the market proper now has to actually present a big quantity or traction or one thing else aside from a technical white paper.”

Steady Deal Stream, Escalating Valuations

For the total yr, crypto VC funding reached $10b from 1,940 offers, in comparison with $10.3b from 1,936 offers in 2023. Furthermore, valuations surged throughout all funding phases in 2024.

Seed-stage valuations jumped 70.2%, rising from $11.8m to $20m. In the meantime, early-stage figures greater than doubled—up 109% from $25m to $52.3m. In distinction, late-stage rounds elevated modestly by 3.8%, shifting from $43.7m to $45.3m. General, median valuations surged 78%, from $18m to $32.1m. This pattern exhibits fierce competitors on the earliest phases, particularly for infrastructure and decentralized AI startups.

Deal sizes mirrored the surge in valuations. For instance, the median verify on the seed stage jumped 20%, rising from $2.5m in 2023 to $3m in 2024. Equally, early-stage medians elevated by 26.9%, from $3.8m to $4.8m. In the meantime, late-stage deal sizes dipped barely by 1.6%, falling from $6.4m to $6.3m.

Supply: Pitchbook

This pattern means that founders at mature firms favor smaller, extra strategic rounds over bigger checks from earlier cycles. As well as, this cautious strategy displays unsure exit circumstances, ongoing macroeconomic strain and a want to attenuate dilution whereas extending runway.

Crypto Enterprise Capital Shifts Towards Infrastructure, AI and Strategic Acquisitions

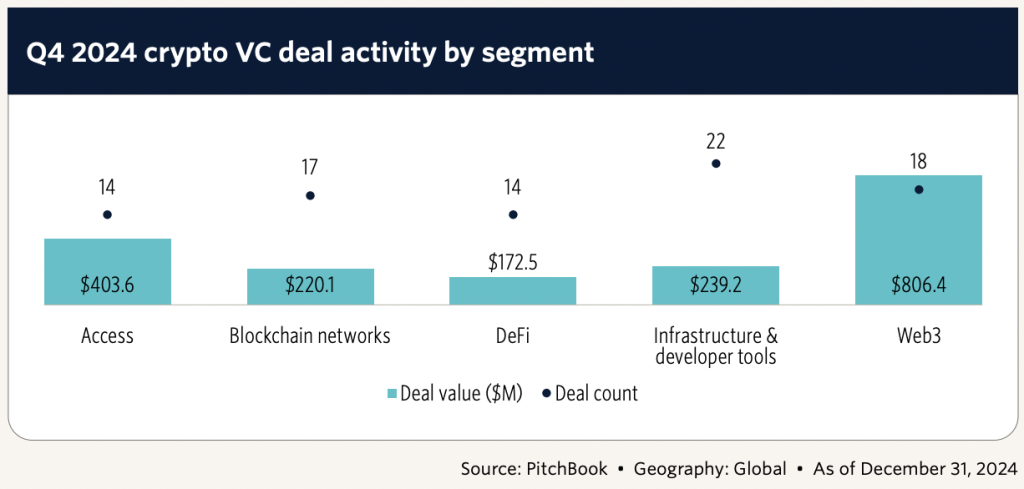

In This autumn, traders centered on infrastructure initiatives that enhance scalability, interoperability, and developer tooling. In the meantime, funding in decentralized AI gained momentum. Since mid-2024, each crypto-native and conventional VCs have proven robust curiosity in these startups.

In This autumn, M&A exercise continued, although at a slower tempo than in Q2 and Q3. Moreover, offers nonetheless included exchanges, custodians and decentralized id platforms. In the meantime, strategic consumers focused complementary capabilities as an alternative of merely absorbing smaller rivals.

In 2024, crypto enterprise capital traders proved resilient regardless of macro challenges and shifting US laws. They pushed seed and early-stage valuations larger by funding promising initiatives in high-performance blockchains, stablecoins and tokenization.

Conversely, late-stage companies raised smaller rounds to steadiness progress with warning. Wanting forward, Pitchbook mentioned it expects additional consolidation amongst infrastructure suppliers, exchanges and custody companies. Furthermore, traders plan to focus on next-generation protocols and AI-driven improvements.

Though 2024 funding fell in need of earlier peaks, regular totals and powerful valuations reveal a maturing market. This sample mirrors traits in different tech sectors which have refined their methods amid financial uncertainties.

The put up Crypto VC Funding in 2024 Did not Speed up Regardless of Trump-Fueled Value Rally appeared first on Cryptonews.