Ki Young Ju, CEO of on-chain data firm CryptoQuant, hinted in a Thursday X post that Bitcoin (BTC) may become a global currency by 2030, with Satoshi Nakamoto’s dream of a decentralized, peer-to-peer payment system potentially materializing even sooner.

The Evolution of Bitcoin Mining and CryptoQuant’s Predictions for Global Currency Adoption by 2030

In a detailed Thursday X post, Ju described how Bitcoin could evolve from a speculative asset to a low-volatility currency by 2030.

#Bitcoin will likely be used as a "currency" around 2030.

Bitcoin's mining difficulty, which reflects the intensity of competition, has consistently hit all-time highs, increasing by 378% over the past three years.

While 50 BTC could be mined with a single PC in 2009, it has… pic.twitter.com/lY8pRreZCl— Ki Young Ju (@ki_young_ju) October 24, 2024

This outlook stems from major changes in Bitcoin mining since its early days.

Back in 2009, solo miners could easily mine 50 BTC using just a personal computer.

However, the mining landscape has drastically changed, with difficulty surging by 378% over the last three years.

The difficulty of Bitcoin mining has increased by 3.9%, reaching a record high of 95.7 trillion.

This occurred alongside the network's seven-day average hashrate, which reached 724 EH/sThe rise in difficulty increases the computational power required, reflecting the… pic.twitter.com/0Sb0uM7TrQ

— Satoshi Talks (@Satoshi_Talks) October 23, 2024

Today, large-scale mining operations, often backed by institutional investors, dominate the sector.

As institutional players assume control, the barriers to entry in mining have risen, contributing to a more stable Bitcoin ecosystem.

Ju suggested that this increased stability could lead to a reduction in Bitcoin’s price volatility.

While such a development might make Bitcoin less attractive to day traders, it could enhance its appeal as a practical currency for everyday transactions.

As the ecosystem matures, these developments tie directly into the upcoming halving event, a pivotal moment in Bitcoin’s evolution.

Ju predicts that after the next halving, expected around April 2028, Bitcoin will enter a new phase.

BTC HALVING COMPLETED!

The #Bitcoin halving has happened!

Miners will now go from getting 6.25 $BTC to 3.125 $BTC per block reward.

NEXT HALVING IN 1388 DAYS / 2028!

Now brace up for the Greatest Wealth Transfer of our Lifetime! pic.twitter.com/780MczTt9H— futuristkwame.eth (@futuristkwame) April 20, 2024

Historically, Bitcoin has seen substantial price increases following halving events, but Ju believes that by 2028, institutional adoption will reach a critical mass, accelerating Bitcoin’s global acceptance as a currency.

The increasing presence of major fintech companies, such as Stripe’s recent entry into the stablecoin infrastructure space, could also accelerate Bitcoin’s transformation into a widely used currency.

Overcoming Barriers to Bitcoin Adoption and CryptoQuant’s Insights on Current Market Trends

Historically, Bitcoin’s volatility has hindered its use for transactions, with businesses and consumers hesitant to engage with an asset that fluctuates significantly in value.

However, Ju believes that this volatility is gradually decreasing as the Bitcoin ecosystem continues to mature.

He remarked, “As volatility decreases, Bitcoin’s role as a currency becomes increasingly inevitable,” adding that this trend could accelerate with institutional backing.

This stabilization may stem from advancements in protocol, the development of Layer 2 (L2) networks, or the use of Wrapped Bitcoin (WBTC), which integrates BTC into various ecosystems without the complexities of L2 infrastructure.

Nevertheless, Ju stressed that institutional support will be crucial for Bitcoin L2s to remain competitive.

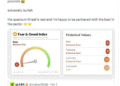

Bitcoin recently retraced after briefly touching $69,000 for the first time since June 2023, trading at $67,667 as of Thursday, showing a 1.66% change in the last 24 hours.

As Bitcoin approaches its previous all-time high, retail investors are cautiously reentering the market, although transfer activity remains low, according to data from CryptoQuant.

This more stable and maturing Bitcoin market could soon see the cryptocurrency making strides toward mainstream adoption, as predicted by CryptoQuant’s Ki Young Ju.

The post CryptoQuant CEO Predicts Bitcoin Could Be Used as a Mainstream Currency by 2030 appeared first on Cryptonews.