A new wave of institutional capital is preparing to enter the Binance ecosystem as B Strategy, a digital asset investment firm founded by former Bitmain executives, has announced the launch of a $1 billion BNB-focused treasury company.

The initiative, strategically backed by YZi Labs (formerly Binance Labs), is set to establish the first U.S.-listed BNB treasury vehicle, indicating a bold new chapter for the world’s fourth-largest cryptocurrency.

BNB-Focused Treasury Company Targets Ecosystem Growth and U.S. Market Listing

According to the announcement, the treasury company seeks to become what its founders call the “Berkshire Hathaway of the BNB ecosystem,” with a mandate not only to hold BNB but also to reinvest in the broader network.

That includes supporting core technology development, funding new projects, and driving community initiatives that expand adoption.

While domiciled in the U.S., the company will tap into B Strategy’s strong Asia-Pacific presence, leveraging liquidity and investor networks across Hong Kong, ASEAN, and the Middle East.

Several Asia-based family offices, including those connected to Binance founder Changpeng Zhao (CZ), are said to have anchored the initial raise.

.@BStrategyTech is launching a US-listed BNB Treasury Company targeting a $1B raise.

It aims to become the “Berkshire Hathaway of the BNB ecosystem.”

Beyond holding, it’ll reinvest into BNB’s infra, builders, and community –fueling capital into ecosystem growth.https://t.co/k3sxJIGYyN

— YZi Labs (@yzilabs) August 25, 2025

Co-founder Leon Lu echoed the sentiment, describing the treasury as a “maximize BNB-per-share” strategy that combines crypto-native expertise with the transparency and governance standards of U.S. public markets.

Additionally, BNB’s growing footprint across decentralized finance, stablecoin integration, and real-world asset adoption has made it one of the most widely used assets in the industry.

According to YZi Labs head Ella Zhang, this utility is translating into institutional recognition. “BNB is emerging as the cornerstone of Web3,” she said. “Its unmatched trading volume and builder incentives are driving mass adoption, and B Strategy is uniquely positioned to amplify this momentum.”

The move comes just weeks after 10X Capital, also backed by YZi Labs, launched a separate U.S.-based BNB treasury company targeting ecosystem investments.

@10XCapitalUSA launches $BNB treasury company backed by @YZiLabs targeting US public listing as corporate adoption explodes beyond Bitcoin-only strategies into BNB ecosystem.#BNB #Treasuryhttps://t.co/OaYEWjhoGV

— Cryptonews.com (@cryptonews) July 10, 2025

That effort, led by Galaxy Digital co-founder David Namdar and former CalPERS CIO Russell Read, is preparing for a public listing on a major U.S. exchange. The initiatives represent a major institutional push into BNB since Binance’s early days.

Additionally, BNB Network Company (BNC) recently purchased 200,000 BNB tokens worth $160 million, becoming the largest corporate holder of Binance Coin.

Nasdaq BNC buys 200K BNB for $160M becoming largest corporate $BNB holder globally following $500M private placement led by 10X Capital and YZi Labs.#BNB #Treasuryhttps://t.co/GT6ugwoBSV

— Cryptonews.com (@cryptonews) August 11, 2025

BNC’s move comes amid a wave of corporate BNB adoption in 2025. Hong Kong-listed Nano Labs was the first to make headlines in July, acquiring 74,315 BNB for $50 million at an average price of $672. The firm outlined plans to accumulate up to $1 billion worth of BNB, targeting 5–10% of the token’s circulating supply.

Windtree Therapeutics, a Nasdaq-listed biotechnology firm, followed with plans to allocate 99% of its $520 million funding round toward BNB purchases.

Biotech firm Windtree Therapeutics secures $520 million funding to build massive $BNB treasury as first Nasdaq-listed company targeting $BNB holdings.#BNB #Treasuryhttps://t.co/PRD2iINCb2

— Cryptonews.com (@cryptonews) July 25, 2025

The rapid expansion of corporate BNB treasuries shows the growing institutional confidence in Binance’s ecosystem and positions BNB alongside Bitcoin and Ether as a rising corporate reserve asset.

BNB Eyes $1,000 as Bulls Push Binance Coin Into Price Discovery

For Binance’s ecosystem, BNB’s latest rally could not have come at a more pivotal time. Now the world’s fourth-largest cryptocurrency, with a market capitalization above $120 billion, the token has surged past $850 and is pressing against record highs.

Its utility across trading, staking, and governance keeps it at the center of Binance’s Web3 ecosystem, where on-chain activity continues to climb. BNB touched $899.77 last week before retreating to around $847, but analysts say the bullish structure remains intact.

“Breaking above the prior ATH at $869 puts BNB into price discovery. The next resistance sits at $1,000,” one market analyst noted, indicating strong upward momentum across all timeframes despite softening MACD signals. Key support remains between $700 and $750.

The fundamentals are reinforcing the rally. Data from HODL wave cohorts shows both long-term and mid-term holders increasing their stakes through late July and August, with one-year wallets rising from 6.55% to 7.52% of supply.

This suggests investors are buying strength rather than waiting for dips, a bullish indicator that strengthens the case for higher prices.

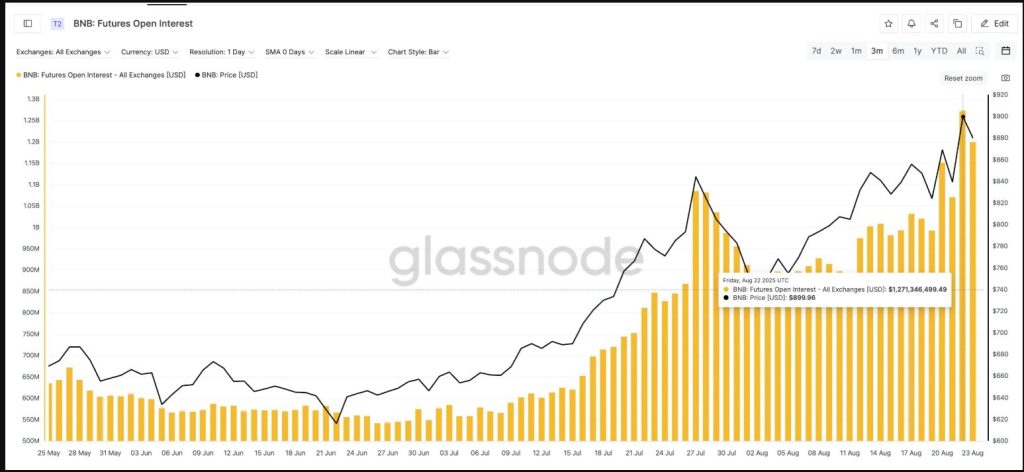

Meanwhile, derivatives markets are echoing the optimism. According to CoinGlass, BNB futures open interest has climbed to $1.27 billion, its highest in three months.

Rising open interest alongside spot price gains indicates leveraged traders are piling in, setting the stage for potential short squeezes that could accelerate a breakout past $900.

Technically, BNB faces stiff resistance at $898–$899, a level aligned with the key Fibonacci extension. A decisive close above this zone could unlock targets at $922, $952, and eventually $1,038.

If momentum holds, analysts suggest $1,000 may be less a ceiling than the next milestone in BNB’s expanding market narrative.

The post CZ Family Office Fuels $1B BNB Treasury Launch – BNB to $1K Before Weekend? appeared first on Cryptonews.