Key Takeaways:

- Deutsche Bank is exploring issuing a stablecoin and developing tokenized deposit solutions for payments.

- Growing regulatory clarity in the EU and US is accelerating institutional interest in stablecoins.

- Deutsche Bank has expanded its crypto capabilities through partnerships.

Deutsche Bank is stepping deeper into the digital assets space, as Europe’s largest lender explores stablecoins and tokenized deposit solutions to modernize payments.

The bank is weighing whether to issue its own stablecoin or participate in a broader industry initiative, Sabih Behzad, Deutsche Bank’s head of digital assets and currencies transformation, said in an interview with Bloomberg.

It is also assessing the potential for developing tokenized deposits that could streamline transaction settlements.

Stablecoins Gain Traction as Alternative Payment Method

Stablecoins, which are pegged to fiat currencies such as the euro or dollar, along with tokenized deposits — blockchain-based representations of traditional bank deposits — are gaining traction as banks explore faster, cheaper payment methods.

While such technologies have been under development for years, tangible large-scale use cases remain limited.

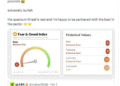

“We can certainly see the momentum of stablecoins along with a regulatory supportive environment, especially in the US,” Behzad noted.

“Banks have a wide variety of options available — everything from acting as a reserve manager to issuing their own stablecoin, either alone or in a consortium.”

Regulatory clarity is helping to accelerate interest. With EU-wide frameworks in place and stablecoin legislation moving through the US Congress, banks are increasingly confident about entering the sector.

Deutsche Bank is examining stablecoins and tokenized deposits, considering options such as issuing its own token or joining an industrywide initiative.https://t.co/QkJe9NRAX4 pic.twitter.com/R9cb2TVbuF

— ICO Drops (@ICODrops) June 7, 2025

Deutsche Bank is not alone. Spanish lender Banco Santander recently began early-stage work on a stablecoin and plans to offer crypto services through its digital banking arm.

Deutsche Bank’s asset management arm DWS Group, together with Flow Traders and Galaxy Digital, has also launched a joint venture to issue a euro-denominated token.

“I do see a role for a European stablecoin, or European banks working on a stablecoin, especially for settlement purposes in a digital world,” ING CEO Steven van Rijswijk said this week.

In parallel, JPMorgan’s Kinexys network — which supports blockchain-based payments — now processes more than $2 billion daily, though that still represents a small slice of JPMorgan’s $10 trillion in daily payment flows.

Deutsche Bank Deepens Push into Crypto

Deutsche Bank has been gradually building its digital assets capabilities.

Last year, it invested in Partior, a blockchain-based cross-border payments platform.

It also partnered with Swiss blockchain firm Taurus in 2023 to offer digital asset custody services to institutional clients.

Additionally, the bank is participating in Project Agorá, an initiative led by the Bank for International Settlements and several central banks aimed at exploring tokenization’s role in wholesale cross-border payments.

As reported, Citigroup has projected a dramatic rise in the stablecoin market, forecasting that its total market capitalization could soar from nearly $240 billion today to over $2 trillion by 2030.

The prediction says the growth in adoption would be driven by regulatory developments and increased interest from both financial institutions and the public sector.

The post Deutsche Bank Explores Stablecoins, Tokenized Deposits in Digital Assets Push appeared first on Cryptonews.