The cryptocurrency market is experiencing important turbulence, with Ethereum ($ETH) serving as a main indicator of simply how low it might go.

The world’s second favourite cryptocurrency was on observe to probably hitting highs of $5,500 this 12 months, however current worth swings recommend the highway there may be trying more and more extra sophisticated.

Following a pointy 37% decline in response to Trump’s aggressive tariff insurance policies, $ETH rebounded dramatically, rising 35% after Eric Trump expressed assist for the asset. With two substantial worth actions in simply 4 days, Ethereum’s efficiency suggests stormy climate forward.

In my view, it’s a good time so as to add $ETH.

— Eric Trump (@EricTrump) February 3, 2025

Many look to 2025 with hopes for a possible bull run. That is largely because of Trump’s pro-crypto insurance policies, which have up to now comprised the signing of an Govt Order to determine a job drive to draft a complete regulatory framework for the trade and assess the feasibility of a strategic US cryptocurrency reserve.

Moreover, it’s thought that Bitcoin’s provide halving final 12 months, together with the robust risk of the US SEC approving spot altcoin ETFs, might drive crypto costs skyward.

However now Ethereum’s efficiency leaves many questioning if this can actually be the case.

ETH Worth Evaluation: A Excessive-Stakes Market

At its present worth of $2,749, Ethereum stays about 32% under its $4,016 peak reached through the Trump-driven surge.

Over the previous week, $ETH dipped under $2,800—3 times Bitcoin’s proportion drop. The asset’s relative energy index confirmed oversold situations thrice, plunging steeply all the way down to 10 twice within the final week—a uncommon incidence for any cryptocurrency.

What induced this? Trump’s stringent financial stance, extensively perceived as a commerce conflict on a number of fronts, with tariffs declared in opposition to Canada, Mexico, China and the European Union, triggered the most important 24-hour crypto liquidation on document, wiping out $10 billion in a single transfer.

#Trump, tariffs, turbulence. US imposes recent import duties on #Canada, #Mexico and #China. It is going to have a significant affect on world provide chains and markets. Time for rising markets together with India, to organize for and be resilient to, outflow shocks from world traders, says… pic.twitter.com/qL8Z1YHd6n

— CNBC-TV18 (@CNBCTV18Live) February 2, 2025

Nevertheless, the image is extra nuanced than it seems. Ethereum-based exchange-traded funds (ETFs) have recorded 4 consecutive days of inflows. A staggering $307.8 million poured in inside a single day—the best up to now this 12 months—led by BlackRock’s ETHA, which alone attracted $276.2 million.

This institutional backing is essential for sustaining $ETH above the $2,745 assist degree. A breach of this zone might place 4.26 million $ETH at a loss, probably triggering an $11 billion sell-off—a key threat issue to observe.

As Ethereum’s $ETH tumbles, smart-money traders transfer $9.2 million into Greatest Pockets

Ethereum could also be seesawing spectacularly, however one hotly-tipped token might nicely be one in every of 2025’s greatest performing property by the tip of the 12 months.

$BEST is the native utility token of Greatest Pockets, a next-generation cryptocurrency pockets that would take important market share away from Belief Pockets and MetaMask.

Extra of a helpful multi-purpose device than only a safe storage resolution, Greatest Pockets equips customers with numerous helpful features to assist them optimize their buying and selling and funding methods.

Simply the buzziest characteristic is the “Upcoming Tokens” device, which curates probably the most promising crypto tasks, permitting Greatest Pockets customers to make strikes earlier than anybody else available in the market.

It additionally aggregates crypto’s numerous yield farming alternatives to point out customers how greatest to place their portfolios to work.

Greatest Pockets presently helps over 1,000 cryptocurrencies.

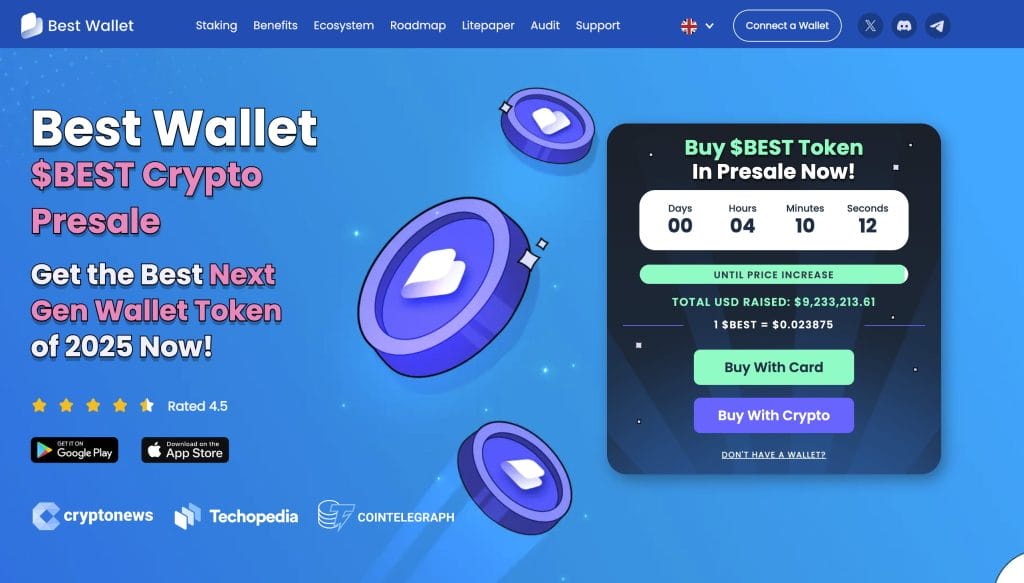

The $BEST token is presently priced at $0.023875, however this can rise by a fraction because the presale progresses by way of its rounds.

In fact, safety is a high precedence for a pockets. Greatest Pockets makes use of Fireblocks’ MPC-CMP encryption to maintain person property protected.

Having raised over $9.2 million, Greatest Pockets is a significant contender within the software program pockets market and will even outperform Ethereum’s $ETH this 12 months.

Observe Greatest Pockets on X and Telegram.

The put up Ethereum Faces $11B Promote-Off Menace – Will $ETH Fall Under $500? appeared first on Cryptonews.