The Ethereum Foundation has triggered renewed anxiety among investors by offloading 200 ETH on September 23.

Analysis of on-chain data shows the sale was executed through two separate transactions of 100 ETH each, catching the attention of market observers.

Ethereum Foundation’s Recent Sell Off Follows Quick Disposal of 300 ETH

Just three days after selling 300 ETH for $763K DAI, the Ethereum Foundation has offloaded another 200 ETH for around $528K. Etherscan data shows the sale was made for 527,989 DAI, highlighting a trend of liquidation within the organization.

The #Ethereum Foundation sold 100 $ETH($264K) again in less than 3 days!#Ethereum Foundation has sold a total of 3,566 $ETH($9.94M) this year.https://t.co/xHfVttUPKg pic.twitter.com/TvRrGR0p4F

— Lookonchain (@lookonchain) September 23, 2024

Additionally, reports from Spot on Chain reveal that the Ethereum Foundation has been rapidly liquidating its ETH holdings throughout September, having sold 1,150 ETH for approximately $2.8 million. This brings the total sales for 2024 to an impressive $10 million, with 3,566 ETH already offloaded this year.

The Ethereum Foundation currently holds a portfolio valued at $726.7 million, with $724.38 million in ETH.

At press time, Ether trades at $2,664, a rise of 4.07% in the last 24 hours and 17.09% over the week, which is surprising given concerns that the Ethereum Foundation’s large selloffs could lead to more negative trends in the crypto market.

Some analysts suggest that the Foundation might sell ETH to reduce market volatility, converting the funds into DAI, a stablecoin pegged to the US dollar, to maintain a stable value despite market fluctuations.

Ethereum Foundation strategies reveal dynamic asset management. Selling ETH and buying DAI might be hedging against volatility or reallocating funds for stability or operational needs. $ETH $DAI

— Puppeteer (@GorillaPodcast1) September 23, 2024

However, this strategy has raised concerns, particularly about the Ethereum Foundation’s transparency regarding its spending. Critics are questioning whether the Foundation is properly disclosing its financial activities, especially as it continues to sell off large amounts of ETH.

In response to these worries, Josh Stark, a representative of the Ethereum Foundation, announced that a detailed report on the Foundation’s spending for 2022 and 2023 will be released soon.

1. First, we’ve been working on a new EF report, covering 2022 and 2023. We’re expecting to publish it before Devcon SEA.

Here’s a preview of spend information from the upcoming report (exact figures TBD). pic.twitter.com/jicVHOy5r7— Josh Stark (@0xstark) August 27, 2024

While the Ethereum Foundation’s actions may reflect a proactive approach to scale past a challenging market, the need for transparency in financial decisions is important.

Ethereum Faces Continued Outflows Amidst Mixed Market Signals

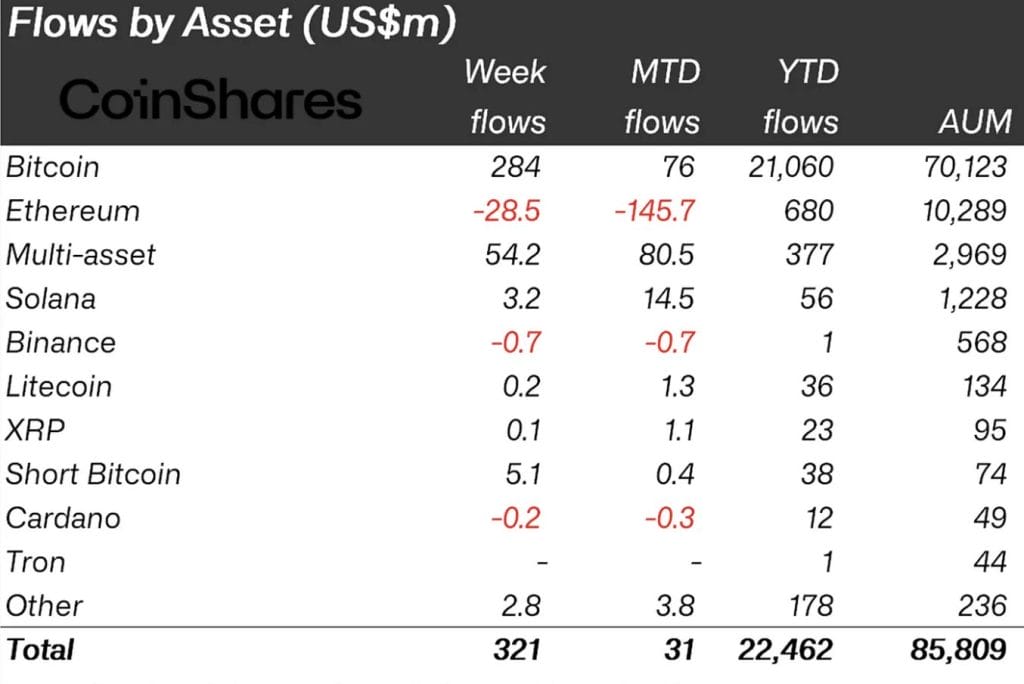

Recent data from CoinShares reveals a troubling trend for Ethereum, with weekly outflows reaching $28.5 million, even following the Federal Reserve’s recent 50 basis points rate cut.

The Federal Reserve’s recent 50 basis points rate cut refers to a decision to lower interest rates by 0.50%, which aims to stimulate economic growth by making borrowing cheaper.

For the month, total outflows have amounted to $145.7 million, reflecting deepening investor skepticism about the asset’s future. In stark contrast, Bitcoin has been attracting attention, seeing inflows of $284 million weekly and $76 million monthly.

These figures suggest that institutional investors remain cautious about Ethereum despite macroeconomic conditions that typically support riskier assets.

Coinglass data also shows an increase in Ethereum’s futures open interest, which rose by 0.69% to $12.09 billion today. Derivatives volume surged by 77.12% to $28.37 billion, hinting at a growing interest in Ethereum trading.

Despite the ETH downtrend, the recorded growth raises questions about Ethereum’s trajectory. While some traders are gearing up for potential market movements, the ongoing outflows indicate high distrust among investors.

The post Ethereum Foundation Offloads 200 ETH Amid Investors’ Bearish Sentiment appeared first on Cryptonews.