The Ethereum price has struggled to make headway today, remaining at $2,644 as the market drops by 4% in 24 hours.

ETH is now up by a very healthy 15% in the past week, with a 4% loss in a month and 66% increase in the past year.

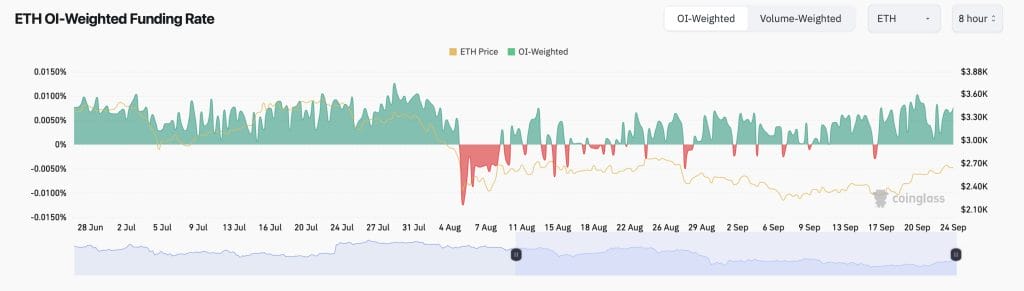

It’s likely that the next few weeks and months will bring further increases for the alt, with Coinglass data showing open interest in long Ethereum positions has increased substantially in recent days.

Investors seem to be betting that ETH will begin to test higher levels, with $3,000 being the next significant target on its horizon.

Ethereum Price Breakout – Open Interest Spike Points to $3,000 Target

What’s bullish about ETH’s chart right now is that its support (green) and resistance (red) levels indicate how it has been trading within a steadily climbing range.

And what we have seen this morning is the Ethereum price jump from its current support level, where it may begin a push towards its current resistance.

We’ve also seen ETH’s relative strength index (purple) rise from 40 this morning to just over 50, another sign of improving momentum.

It’s clear that a majority of traders believe that Ethereum’s general trend at the moment remains upward, with its average funding rate rising to 0.0076% today.

A positive funding rate means that more traders are going long on Ethereum than shorting it, as we saw in early August.

And in turn, this implies an expectation of a rising price, with $3,000 being the next big target for ETH.

It may take some time to reach this benchmark, however, given that Ethereum witnessed a net outflow last week among institutional investors.

Of course, the CoinGlass data above suggests that things are now turning, with the Fed’s rate cut last week serving as a catalyst for more optimism.

Ethereum remains one of the likeliest coins to benefit from an end-of-year surge, given its network’s sustained position as the largest layer-one platform in the sector.

It will also see the significant Pectra upgrade at some point in Q4 of this year or Q1 2025, bringing improved optimization and validation, among other things.

This will help secure its position in the face of increased competition from Solana, with ETH likely to remain very much in demand for some time to come.

The Ethereum price is likely to reach $3,000 by the end of October, before ending the year at around $3,500.

New High-Potential Altcoins for Quicker Gains

While ETH should comfortably reach $3,000 in the not-too-distant future, other coins may rise more dramatically in the coming weeks.

This includes smaller cap tokens and also presale coins, which can often rally hard after a successful raise.

While there are dozens of new presale coins around at the moment, one of the most notable is Memebet Token (MEMEBET).

Memebet Token is in the process of launching its own crypto-friendly casino, and has already raised $250,000 in its recently opened presale.

Memebet Token arguably boasts some of the strongest fundamentals of any new coin right now, with its gambling platform set to provide more than 1,000 crypto-native games once it launches.

This will include virtual slots and table games, as well a comprehensive sportsbook that will cover most major events.

Users will be able to place bets with established meme coins such as Pepe, Dogecoin, Bonk and Shiba Inu, yet they will be able to increase their rewards if they use MEMEBET.

As such, there will be a very strong incentive to hold MEMEBET, helping to boost demand for the coin, which will have a max supply of two billion.

Investors can join its sale by going to the official Memebet Token website, where 1 MEMEBET token costs $0.0253.

This price will rise numerous times before the sale ends, so buyers should act sooner rather than later.

Check Out MEMEBET Here

The post Ethereum Price Breakout – Open Interest Spike Points to $3,000 Target appeared first on Cryptonews.