Ethereum (ETH) has reclaimed the $4,500 level, gaining 0.54% in the past 24 hours with a market capitalization of $543.9 billion. The renewed momentum follows a shift in global monetary sentiment as traders weigh the Federal Reserve’s path for interest rates and anticipate fresh easing that could boost digital assets like Ethereum.

Dallas Fed President Lorie Logan said Thursday that while the central bank’s September quarter-point rate cut was justified to cushion a cooling labor market, policymakers must remain cautious not to overstimulate the economy. Inflation remains above target, and rising tariffs could lead to higher prices in the short term.

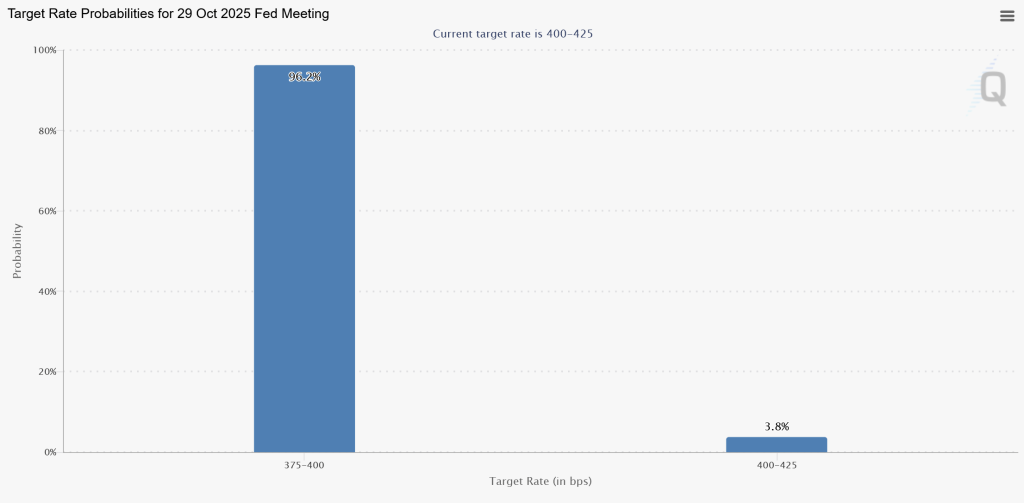

Still, markets remain confident that the Fed will proceed with further cuts. CME Group’s FedWatch Tool now assigns a 97% probability of a 25-basis-point cut in October, and an 85% chance of another reduction by December.

The postponed non-farm payrolls report, due to the U.S. government shutdown, hasn’t deterred traders, who are instead relying on alternative data pointing to a gradual softening of labor markets.

Why Rate Cut Bets Are Fueling ETH’s Momentum

Expectations of lower interest rates have become one of the strongest macro tailwinds for Ethereum. When borrowing costs fall, investors typically shift from yield-bearing assets into riskier, growth-oriented assets, such as technology stocks and cryptocurrencies. For Ethereum, this shift means more liquidity flowing into both the token itself and its surrounding decentralized finance (DeFi) ecosystem.

Ethereum, in particular, tends to benefit because it underpins most blockchain applications, from stablecoins to NFTs and staking protocols. As real-world yields ease, ETH staking — which currently offers an estimated annualized return of 3–4% — becomes comparatively more attractive. This helps explain why Ethereum has outperformed smaller altcoins in recent weeks.

Rising institutional participation also amplifies this dynamic. Funds anticipating easier monetary conditions often rebalance portfolios toward long-term innovation assets. If rate cuts materialize, capital inflows into Ethereum-based ETFs, staking products, and DeFi platforms could expand further, reinforcing ETH’s status as the second-largest asset in the market and a key barometer for crypto liquidity cycles.

Ethereum Price Prediction – Technical Outlook

Technically, the Ethereum price prediction remains bullish as ETH consolidates above $4,500, holding firm within a rising parallel channel formed since late September. The chart shows a pattern of higher highs and higher lows, underpinned by a bullish SMA crossover — with the 50-period average ($4,372) now above the 100-period ($4,294).

Momentum indicators remain supportive. The RSI near 58 signals the market has cooled from overbought levels but still holds positive traction. Recent candlesticks show smaller bodies and several Doji formations, indicating brief consolidation after a strong rally.

Ethereum holds steady above $4,500, riding a strong uptrend within an ascending channel. RSI cooling near 58 hints at healthy consolidation — a bounce from $4,440–$4,420 could fuel the next leg toward $4,675–$4,765. #Ethereum #ETH #Crypto pic.twitter.com/JxjWCnrAAL

— Arslan Ali (@forex_arslan) October 4, 2025

A potential bounce from the lower trendline near $4,440–$4,420 could offer an attractive buy-the-dip setup, targeting resistance at $4,675–$4,765. For downside protection, stops may be placed below $4,375, aligning with the short-term support level.

A break below that could expose $4,200, though as long as Ethereum maintains its channel, the bias remains upward.

Presale Maxi Doge ($MAXI) Blends Meme Power With Gym-Bro Energy

Maxi Doge ($MAXI) is a meme-fueled token designed for degens who thrive on 1000x leverage and relentless hustle. More than just a meme coin, $MAXI represents a community-driven culture that fuses trading intensity with gym-bro energy, caffeine, and competitive camaraderie.

By holding $MAXI, investors unlock staking rewards, trading contests, and access to gamified partner events. The smart contract has been audited by SolidProof and Coinsult, giving added confidence in the project’s foundations.

Momentum is strong. The presale has already raised over $2.7 million, with tokens priced at just $0.0002605. This figure will rise as the presale progresses, making early entry more attractive.

$MAXI holders gain access to:

- Staking rewards with dynamic APYs

- Trading contests with leaderboard prizes

- Community-driven partner events and future integrations

You can buy $MAXI on the official Maxi Doge website using ETH, BNB, USDT, USDC, or a bank card.

Visit the Official Maxi Doge Website Here

The post Ethereum Price Prediction: $4,500 Reclaimed – Why Rising Rate Cut Expectations Are Now Fueling ETH’s Momentum appeared first on Cryptonews.