Vitalik Buterin wants a more stable foundation for Ethereum’s long-term growth. He thinks low-risk DeFi protocols could be the steady income stream for Ethereum, like Google Search is for Google. This approach, he argues, would enable Ethereum to continue supporting experimental and cultural applications without compromising its financial resilience.

Buterin explained that DeFi doesn’t need to be flashy or revolutionary to be effective. Instead, it should serve as a dependable revenue source that is neither ethically questionable nor misaligned with Ethereum’s values.

He also urged developers to explore new forms of digital assets, such as basket currencies and flatcoins tied to consumer price indices, which could strengthen Ethereum’s role as a backbone for global financial innovation.

If you want to educate yourself on Ethereum and the future of $ETH, go read Vitalik’s new blog post.

Low-risk DeFi should definitely be a part of Ethereum. We’re nowhere near where we want to be, and this is just another showcase of where we’re heading. https://t.co/1lhYoohtCk pic.twitter.com/OS2rfXqpkR— Djani (@DjaniWhaleSkul) September 20, 2025

This debate surfaces as Ethereum’s DeFi ecosystem crosses the $100 billion total value locked (TVL) threshold for the first time since early 2022. That milestone shows both the recovery from the bear market and Ethereum’s continued dominance in DeFi.

According to DefiLlama data, Ethereum and its layer-2 solutions have 64.5% of total TVL, while Solana has less than 9%.

Onchain Activity Signals Strength

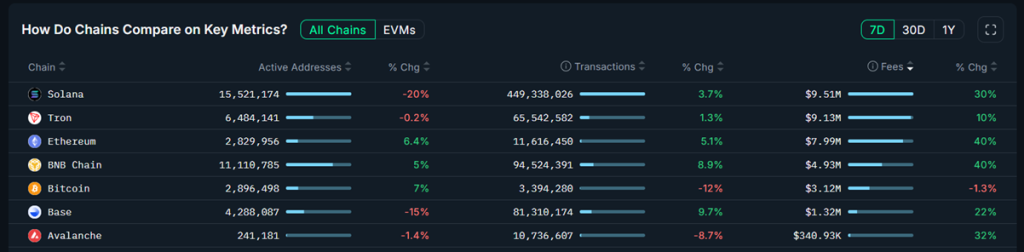

Ethereum’s fundamentals are improving in step with its DeFi resurgence. Fees on the network have increased by 40% over the past week, while the number of active wallet addresses has risen by 10%. Because all Ethereum transactions require ETH, higher usage directly contributes to demand for the token.

Rising fees also benefit validators, improving network security while fueling Ethereum’s automated burn mechanism, which steadily reduces supply.

This combination of higher activity and structural supply reduction reinforces Ethereum’s long-term investment case.

Caption: Blockchains ranked by 7-day fees, USD. Source: Nansen

At the same time, decentralized exchange (DEX) volumes have exceeded $3.5 trillion, showing Ethereum’s unmatched scale in decentralized applications.

Despite this strength, ETH has struggled in recent sessions, down 4.15% on the week and trading near $4,468. Daily trading volume has slipped more than 30% to $18 billion, reflecting a quieter but consolidating market.

Ethereum (ETH/USD) Price Prediction – Technical Outlook

Ethereum’s price prediction appears neutral, as the cryptocurrency is trading within a narrowing range, with price action confined to a symmetrical triangle since mid-September.

The 50-day EMA at $4,519 has capped gains, while the 200-day EMA at $4,394 continues to act as support. Volatility remains muted, but triangles like this usually resolve with a decisive move.

Momentum indicators show a market leaning cautious. The RSI at 40 reflects weakening strength, while repeated upper wicks near $4,587 highlight supply pressure. Still, the rising base of the pattern signals buyers are defending the $4,418–$4,394 zone.

A break below $4,394 would expose $4,350 and potentially $4,280. On the upside, reclaiming $4,520 could reopen $4,587 and $4,670, with a measured breakout pointing toward $4,760 and even $5,000.

For traders, watching for bullish candles near support is key. For investors, consolidation here could prove to be the foundation for Ethereum’s next major rally into 2026.

Presale Bitcoin Hyper ($HYPER) Combines BTC Security With Solana Speed

Bitcoin Hyper ($HYPER) is positioning itself as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM). Its goal is to expand the BTC ecosystem by enabling lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation.

By combining BTC’s unmatched security with Solana’s high-performance framework, the project opens the door to entirely new use cases, including seamless BTC bridging and scalable dApp development.

The team has put strong emphasis on trust and scalability, with the project audited by Consult to give investors confidence in its foundations.

Momentum is building quickly. The presale has already crossed $17.3 million, leaving only a limited allocation still available. At today’s stage, HYPER tokens are priced at just $0.012955—but that figure will increase as the presale progresses.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale

The post Ethereum Price Prediction: Coinbase Analysts Say the ETH Pullback is a Buy the Dip Signal appeared first on Cryptonews.