Ethereum has smashed multiple on-chain records in August 2025, showing a resurgence of activity across decentralized finance (DeFi) and institutional investment.

According to on-chain data, the network recorded its strongest activity since 2021, with decentralized exchange (DEX) volume climbing to $135 billion, total transactions reaching 48 million, and active addresses hitting 15 million.

Ethereum sets on-chain activity records

In August, DEX volume hit $135B, while transactions reached 48M and active addresses hit 15M. Also, @ethereum TVL has crossed $240B.

Over the last months, $ETH rose on ETF inflows despite low on-chain activity, but that’s finally changed. pic.twitter.com/biLtejY9Gz— CryptoRank.io (@CryptoRank_io) August 29, 2025

Total value locked (TVL) across Ethereum-based protocols surged to nearly $240 billion, marking a new high in decentralized finance participation.

Ethereum’s total transaction volume rose to $320 billion in August 2025, the highest in four years, driven by resurgent DeFi activity, institutional inflows, and sharply reduced transaction fees.

Ethereum ETF Boom Pushes Holdings to $30B, 5.4% of Market Cap

The boom coincides with a surge in spot Ethereum ETF activity in the United States.

Bloomberg ETF analyst James Seyffart reported that Ether ETFs have absorbed nearly $10 billion in inflows since July, bringing total flows since launch to $13.6 billion.

NEW: Ethereum ETFs are on an absolute tear. They've taken in nearly $10 billion since the start of July. Here's what their flows look like since launch — nearly $14 billion pic.twitter.com/Rd4WmCg3Mg

— James Seyffart (@JSeyff) August 29, 2025

August alone is expected to close with $4 billion in net inflows, positioning it as the second-largest month on record for Ethereum funds. By comparison, Bitcoin ETFs have registered $622.5 million in net outflows during the same period.

Daily ETF flows show this divergence. Between August 21 and 26, spot Ether ETFs attracted nearly $2 billion, dwarfing Bitcoin’s $171 million in inflows.

On one of the busiest trading days, August 26, Ethereum funds brought in $455 million in new capital, while Bitcoin ETFs managed just $81 million.

BlackRock’s iShares Ethereum Trust (ETHA) dominates the sector, with $17.2 billion in net assets, more than half the market. Fidelity’s FETH follows with $3.7 billion, while Bitwise’s ETHV has grown to $3.2 billion.

Data from SoSoValue shows U.S.-listed Ether ETFs now hold $30.17 billion in assets, equal to 5.4% of Ether’s total market capitalization.

The flow shift has been stark when compared with Bitcoin. Over the past five trading days, Ethereum ETFs attracted $1.83 billion in inflows, ten times the $171 million absorbed by Bitcoin funds.

Analysts say this marks Ethereum’s strongest monthly outperformance against Bitcoin since Ether ETFs launched in July 2024.

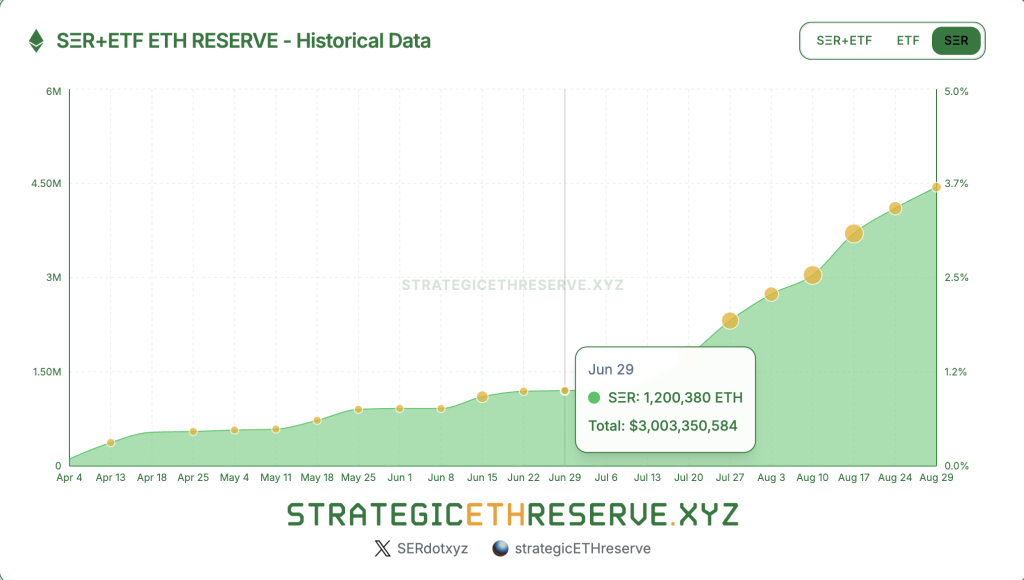

Ethereum Reserves Quadrupled Since April Amid ETF and Treasury Demand

Alongside ETFs, corporate treasuries are also fueling Ethereum’s supply squeeze. Data from the Strategic ETH Reserve (SER) dashboard shows that entities and ETFs together now hold 11.2 million ETH, equivalent to 9.3% of the circulating supply.

Of this, 6.78 million ETH sits in ETFs, while 4.44 million ETH is held by private firms and institutional reserves. The net supply change over the past week has been negative, with 669,500 ETH withdrawn from circulation, highlighting a tightening supply dynamic.

This concentration has nearly quadrupled since April, when reserves totaled around 3 million ETH.

The largest private accumulator is Bitmine Immersion Tech, which now holds 1.8 million ETH worth $7.75 billion after expanding its position by nearly 187% over the past month.

SharpLink Gaming ranks second with 797,700 ETH, while The Ether Machine and the Ethereum Foundation hold 345,400 ETH and 231,600 ETH, respectively.

The data suggests private entities are matching the intensity of ETF demand, accelerating Ethereum’s institutionalization.

This dual engine of ETF flows and treasury accumulation has translated into strong price action.

History Shows Ethereum’s Green Augusts Lead to Explosive Q4 Gains

Ethereum’s performance in August has historically carried strong implications for the months ahead, and this year is no exception. Data from CoinGlass shows that when Ether closes August in the green, subsequent months have delivered average gains of around 60%.

The pattern was clear in 2017, when a 92.9% August surge set the stage for another 91% rally into year-end during the ICO boom. In 2020, Ethereum rose 25.3% in August and then soared 69% through December amid DeFi’s first major wave.

Even in 2021, during an overheated bull market, ETH gained 35.6% in August and added another 17.8% in the fourth quarter.

The flip side is also clear: red August closes have historically led to year-end drawdowns averaging -14.1%. Analysts caution, however, that every bullish August has been followed by a negative September, with early pullbacks averaging 17% before strong Q4 rebounds.

Institutional flows appear to be reinforcing the cycle this time around. Blockchain firm Arkham reported that nine wallets acquiring $456.8 million in ETH this week, with an additional $164 million in purchases tracked through FalconX and Galaxy Digital.

Long-term Bitcoin holders are also rotating into Ether. One 2013-era wallet moved $83 million to Binance, while another whale, holding over $5 billion in BTC, has been steadily buying billions in ETH through Hyperliquid.

Arkham confirmed that four whale addresses scooped up another $357 million worth of ETH between August 27 and 28 alone.

THESE WHALES JUST BOUGHT $350M OF $ETH

4 Whale addresses bought $357.2M of ETH in the past 2 days alone. They have all been accumulating from FalconX at similar time schedules.

Are these whales buying the bottom?

Addresses:

0x566bd75621Db03B4d046e80F87F0A2B489c39Dd3… pic.twitter.com/374BhjPoEs— Arkham (@arkham) August 28, 2025

Technical analysts see striking similarities between ETH’s current market structure and its 2020–21 breakout. After consolidating for months between $1,000 and $2,000, Ether broke above $2,500 and is now testing higher levels near $4,800–$5,000.

This resistance zone, corresponding with its previous all-time high, has triggered a rejection, raising the possibility of a pullback to $3,600–$3,800 before any sustainable breakout. If the 2021 fractal repeats, ETH could be preparing for a parabolic run toward $6,000–$8,000.

Ethereum is currently trading at $4,332, down 4.1% in the past 24 hours and 6.1% on the week. Despite being 11% below its new all-time high of $4,946 set on August 24, the token remains up 16.6% over the past month and more than 73% in the last three months.

The post Ethereum Shatters On-Chain Records: $135B DEX Volume, 48M TXs, $240B TVL – What’s Driving It? appeared first on Cryptonews.