BitMEX chairman Tom Lee believes Ethereum could one day surpass Bitcoin’s market dominance, drawing a comparison to how U.S. equities overtook gold after the United States abandoned the gold standard in 1971.

Speaking in an interview with ARK Invest CEO Cathie Wood on Thursday, Lee said, “Ethereum could flip Bitcoin similar to how Wall Street and equities flipped gold post-’71.”

Currently, Bitcoin’s market capitalization stands at roughly $2.17 trillion, about 4.6 times larger than Ethereum’s $476.33 billion, according to CoinMarketCap.

But Lee, who also oversees BitMine’s Ethereum accumulation strategy, argues that Ethereum’s long-term potential mirrors the rise of the U.S. dollar after 1971, when it became a “fully synthetic” fiat currency.

Tom Lee Compares Ethereum’s Rise to Post-Gold-Standard Dollar Dominance

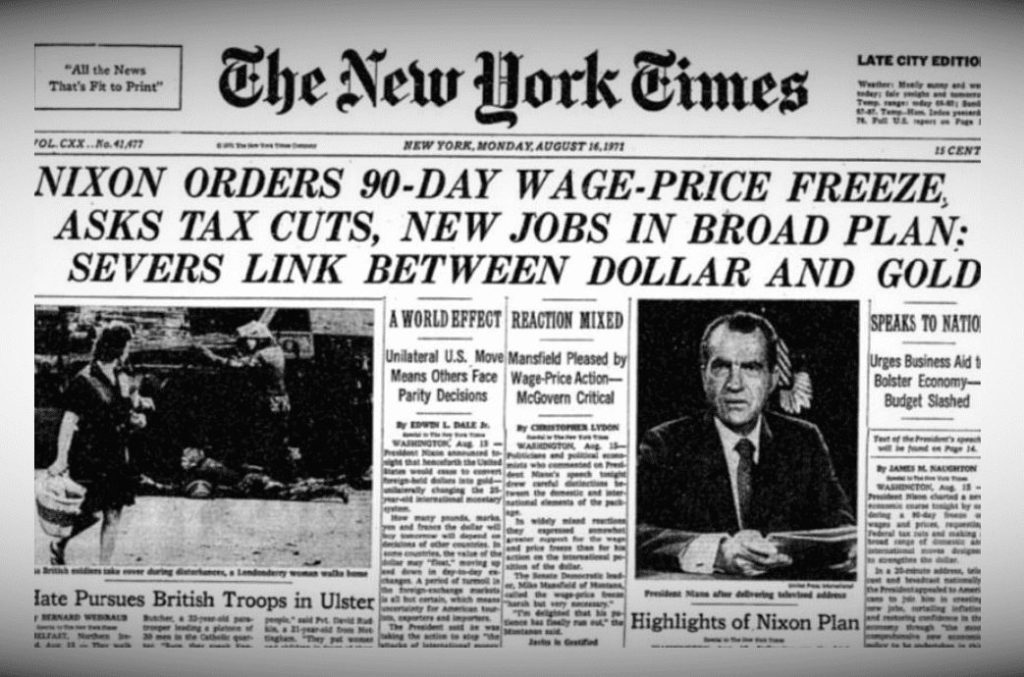

Lee’s argument draws on historical parallels. When President Richard Nixon ended dollar-gold convertibility in 1971, gold initially surged, but over time, U.S. equities exploded in value, their market capitalization dwarfing gold’s.

Gold remained finite and valuable, but stocks, which represent innovation, productivity, and expansion, became the growth engine of the economy.

Lee’s argument suggests the same dynamic could play out in crypto. Bitcoin, like gold, is scarce and reliable but fundamentally inert.

Ethereum, by contrast, functions as a productive digital ecosystem powering smart contracts, decentralized finance (DeFi), tokenized assets, and digital identity infrastructure, “the blockchain backbone of a tokenized Wall Street,” as Lee put it.

“When the U.S. left the gold standard, the immediate beneficiary was gold,” Lee said. “But Wall Street created products that made the dollar dominant. Today, equities’ market cap is $40 trillion, while gold’s is $2 trillion.”

He added that Ethereum’s role in tokenizing real-world assets, driving decentralized applications, and enabling on-chain finance could allow it to mirror that same rise. “As everything becomes tokenized, Ethereum could be the financial substrate of the digital economy,” Lee said.

Signs of an Ethereum Power Shift: Market Leaders Hint at Looming Flippening as ETH Outpaces Bitcoin

Ethereum’s fundamentals already support the thesis. Ethereum’s price climbed 6.6% in the past 24 hours to $3,731.69, while Bitcoin rose 5.1% to $104,737.

The two largest cryptocurrencies continue to lead the market, but the discussion over whether Ethereum could eventually “flip” Bitcoin’s market capitalization, a concept long referred to as the “flippening,” has resurfaced among industry leaders.

In August, Ethereum co-founder and ConsenSys CEO Joseph Lubin predicted that Ethereum could surge “by 100 times” and overtake Bitcoin as the dominant monetary base.

Lubin said that Wall Street’s growing integration of decentralized technology could propel Ethereum’s value as financial institutions adopt staking, validator nodes, and Layer-2 solutions to replace outdated systems.

Ethereum co-founder @ethereumjoseph predicts a 100x $ETH rally as Wall Street adopts DeFi with the potential to flip Bitcoin's monetary base through institutional staking.#Ethereum #Bitcoinhttps://t.co/l6YqzBQGbL

— Cryptonews.com (@cryptonews) September 1, 2025

Lee also echoed this view in a separate CNBC appearance, calling Ethereum’s smart contracts “the next layer of the internet.”

Notably, the network regularly processes more transactions than Bitcoin, powers the majority of DeFi and NFT activity, and continues to attract institutional integration through tokenized bonds, funds, and corporate assets.

Meanwhile, “Rich Dad, Poor Dad” author Robert Kiyosaki added weight to Ethereum’s narrative, describing it as both a store of value and an industrial asset.

“Today, I believe silver and Ethereum are the best because they are stores of value, but more importantly, they are used in industry,” he said, calling both assets “hot, hot, hot” for the next cycle of wealth preservation.

Tom Lee predicts Ethereum rally to $5,500 soon, $12,000 by year-end as BitMine accumulates $7.65B treasury. #Ethereum #Rallyhttps://t.co/HV8oQB807D

— Cryptonews.com (@cryptonews) August 27, 2025

Lee recently predicted that Ethereum could rally to $5,500 in the near term, with a year-end target of $12,000.

While Bitcoin retains the edge in market value and brand recognition, Ethereum’s expanding utility and network activity are fueling speculation that a “flippening” could occur within the next cycle.

Lee’s comparison reframes the rivalry not as a contest of ideology, but of function. “Gold will always have value,” an analyst said. “But the future of finance was built on equities, and the future of blockchain may be built on Ethereum.”

Could Ethereum Ever Reach Bitcoin’s Market Value? Here’s What It Would Take

Now, to answer the question, Ethereum would need to rise by roughly 4.6 times its current price to match Bitcoin’s market capitalization, according to market data analyzed on October 17.

With 120.7 million ETH in circulation versus 19.9 million BTC, Ethereum’s larger supply explains its lower per-unit price.

To match Bitcoin’s market cap, Ethereum would need to trade around $17,379 per ETH, a level that would mark one of the biggest price surges in its history.

Analysts often view market capitalization as a fairer comparison than price alone. Bitcoin’s smaller supply supports its higher valuation per coin, while Ethereum’s strength lies in its diverse ecosystem, powering smart contracts, decentralized finance (DeFi), and tokenized assets that drive real-world use.

Historically, Ethereum has at times outpaced Bitcoin in performance. Historical data shows that across certain five-year spans, Ethereum’s average annualized return reached 60.4%, slightly ahead of Bitcoin’s 59.1%.

For Ethereum to close the market-cap gap, it would need years of sustained outperformance.

At a 20% annual growth rate, parity could take about 8.4 years; at 30%, roughly six years; and at 50%, under four years, assuming Bitcoin’s market value stays constant, an unlikely scenario.

Nearly a decade since launch, Ethereum commands about 21% of Bitcoin’s market size.

Its continued expansion and institutional adoption keep it the strongest challenger to Bitcoin’s dominance, though the long-awaited “flippening” remains a distant, theoretical milestone.

The post Ethereum to Overtake Bitcoin? BitMEX’s Tom Lee Predicts Wall Street-Style Flip appeared first on Cryptonews.