Goldman Sachs expects a series of consecutive 25 basis point Fed rate cuts ahead as fears of a U.S. recession ease.

According to The Economic Times, Goldman Sachs said on Wednesday that it expects the U.S. Federal Reserve to deliver consecutive 25-basis-point (bps) interest rate cuts from November 2024 through June 2025.

Last month, the U.S. central bank cut the overnight rate by half a percentage point, citing greater confidence that inflation will keep receding to its 2% annual target.

This comes as last month’s better-than-expected U.S. jobs data strengthens Goldman Sachs’ conviction that the next few FOMC meetings will bring smaller 25-basis-point cuts.

Goldman Sachs expects the Fed to reduce rates to a terminal funds rate of 3.25%—3.5% by June 2025, a prospect that breeds confidence in cryptocurrencies’ long-term outlook.

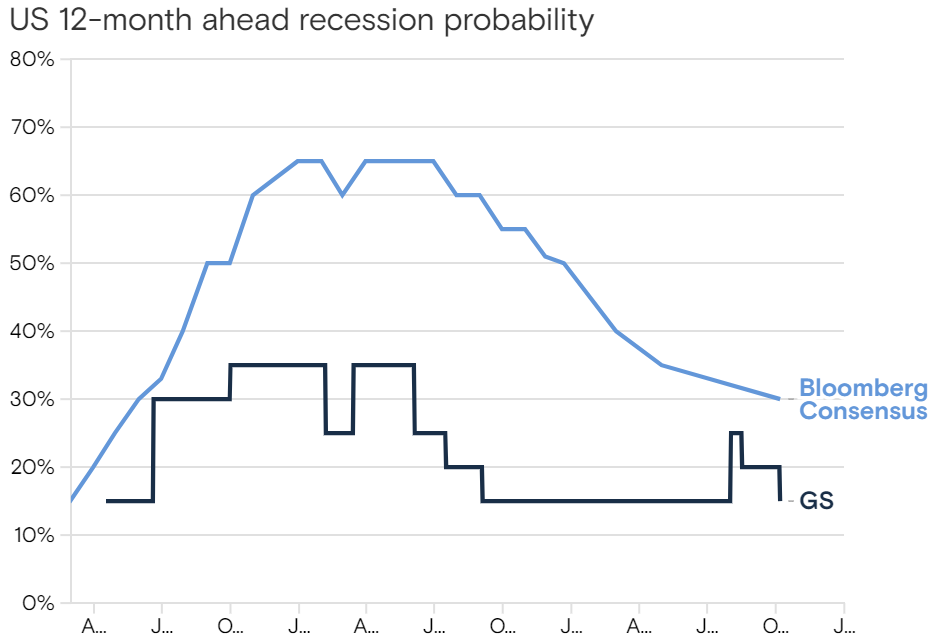

U.S. Recession Odds Fall to 15%

Fears that last month’s dovish rate cut would be too little, too late in tackling a looming U.S. recession are dissipating as stronger-than-expected U.S. jobs data foster optimism.

This follows a Goldman Sachs report earlier this month, de-escalating their anticipation for a US recession over the next 12 months to 15%, from its prior 20%, fuelled by signs of a still-solid job market.

The U.S. economy added 254,000 jobs in September, substantially surpassing Wall Street’s expectation of 147,000. The unemployment rate also dropped to 4.1%, while the annual pace of wage growth increased to 4.0% from 3.8% in August.

Meanwhile, the unemployment rate has returned below the threshold that activates the “Sahm rule” following a scare in August when the indicator flagged a potential recession.

This stronger-than-expected jobs report prompted macro traders to largely eliminate bets on another 50bps rate cut from the Federal Reserve in November.

According to the CME Fed Watch Tool, money markets are now pricing a 90.9% probability of a 25bps rate cut next month.

This supports the narrative that a soft landing for the U.S. economy is still achievable — meaning the Fed may succeed in bringing inflation under control without triggering a recession.

Additionally, the report dismissed the potential for escalating geopolitical tension to derail inflation progress, stating, “Conflict in the Middle East hasn’t changed Goldman Sach Research’s conviction that inflation will cool further.”

What Do More Fed Rate Cuts Mean For Crypto?

This development could stop recession fears from “overshadowing the bullish narrative of rate cuts from the Fed,” according to a recent 10x research report.

By easing fear, uncertainty, and doubt (FUD), the market is poised for what is anticipated to be a bullish concluding quarter to the year.

Interest rate cuts typically drive investors toward risk-on assets like cryptocurrencies as traditional investments become less appealing. Last month’s 0.5% cut in September laid the groundwork for this month’s rally, demonstrating this trend.

Lower interest rates can weaken the U.S. dollar, making cryptocurrencies more attractive as alternative stores of value.

This shift in monetary policy follows the European Central Bank’s (ECB) decision to reduce interest rates by 0.25% during its monetary policy meeting today.

BREAKING:

ECB cuts interest rates again by 0.25 percentage points.

We know what happens nextpic.twitter.com/B7jBiddGCt

— Bitcoin Magazine (@BitcoinMagazine) October 17, 2024

Goldman Sachs has projected that the ECB will continue to cut rates until the policy rate reaches 2% by June 2025.

With both the Fed and ECB leaning toward rate cuts, the environment appears ripe for a potential rally in risk assets, including cryptocurrencies.

As central banks ease monetary policies, the diminished returns on traditional investments could drive more investors toward crypto, paving the way for significant market gains.

The post Fed to Cut Rates to 3.25%–3.5% by June as Recession Fears Ease: Goldman Sachs appeared first on Cryptonews.