Bitcoin’s historic November rallies may not materialize this year, as multiple signals indicate a prolonged consolidation rather than upward momentum.

The world’s largest crypto has spent two weeks trapped between $106,000 and $116,000, weighed down by persistent selling from long-term holders and muted institutional demand following October’s sharp liquidation event.

Meanwhile, dramatic shifts in global funding markets are adding complexity to the outlook.

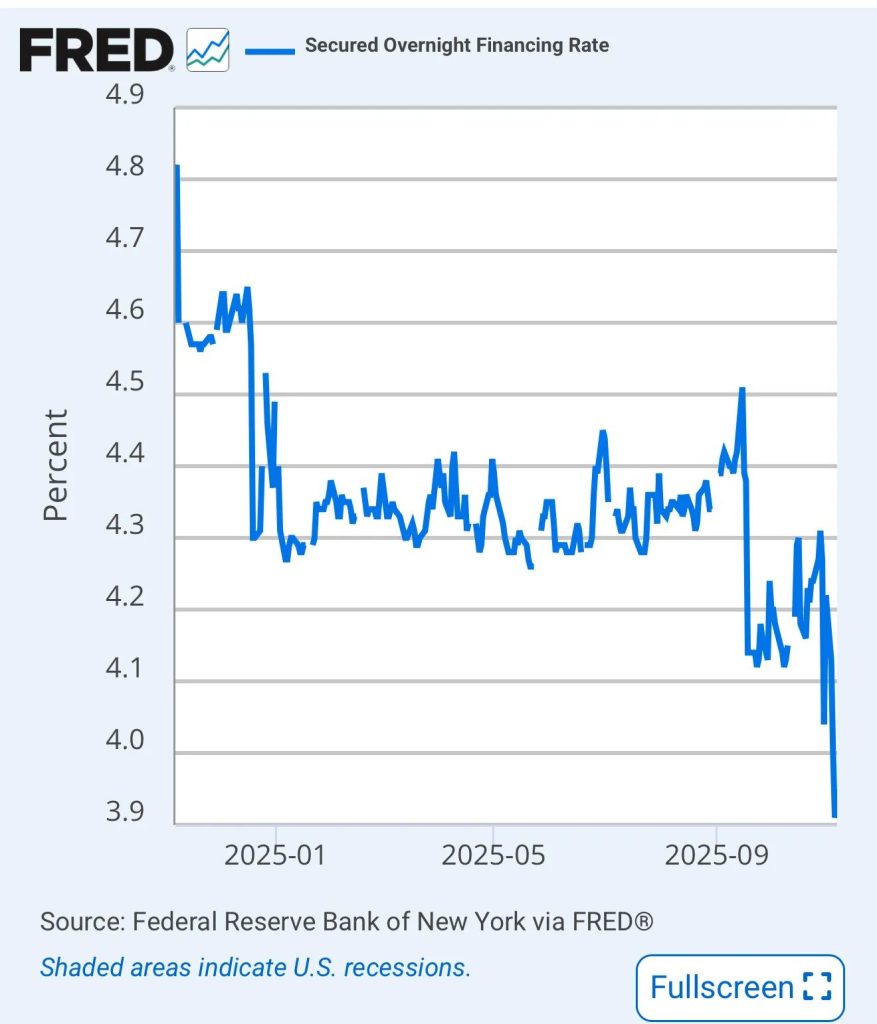

The Secured Overnight Financing Rate plummeted to 3.92% on November 6, its lowest level in two years, a collapse that financial analyst Shanaka Anslem warns “screams one word: panic.“

Persistent Distribution Weighs on Price Action

According to Bitfinex’s latest market analysis, Bitcoin briefly rallied to $116,500 on October 27 before retracing over 8.9% to revisit range lows.

The report reveals that long-term holders have accelerated distribution to 104,000 BTC per month, the sharpest selling wave since mid-July.

“Unless ETF inflows or new spot demand returns to absorb ongoing distribution, BTC is likely to remain range-bound, with a risk bias toward retesting the $106,000–$107,000 zone,” Bitfinex analysts wrote in their November 3 report.

The firm warned that “a sustained break below this level could open the path to $100,000 per BTC.“

Options markets also add to the mounting uncertainty, with implied volatility compressing steadily since the October 10 liquidation event.

The Put/Call volume ratio has oscillated between extremes as traders alternate between chasing rallies and adopting defensive positions, indicating what Bitfinex described as “a broad lack of directional conviction.“

Fed Ends Balance Sheet Runoff Amid Liquidity Concerns

The Federal Reserve formally ended its balance sheet runoff and cut interest rates by 25 basis points to 3.75-4% on October 29.

Fed Chair Jerome Powell acknowledged that “signs have clearly emerged that we have reached that standard in money markets” regarding adequate reserve levels.

Beginning December 1, the Fed will roll over all maturing Treasury securities while reinvesting the proceeds from mortgage-backed securities into Treasury bills, effectively restoring $25-35 billion in monthly liquidity.

Powell described the cut as “risk management” amid weakening hiring and wages but stressed that future decisions are “not on a pre-set course.“

Fidelity’s Jurrien Timmer noted that “the Fed’s reverse repo facility (RRP) is now depleted and the Treasury’s cash balance (TGA) has grown to $1 trillion.”

He described this as “a robust cache of ‘fiscal QE’ waiting to be deployed.“

With last week’s rate cut also comes the end of the Fed’s balance sheet reduction (QT). The Fed’s reverse repo facility (RRP) is now depleted and the Treasury’s cash balance (TGA) has grown to $1 trillion. That’s a robust cache of “fiscal QE” waiting to be deployed. I’m not… pic.twitter.com/pZlNfhTW2t

— Jurrien Timmer (@TimmerFidelity) November 7, 2025

Deep Division Over December Rate Cut

Earlier today, the Wall Street Journal’s Nick Timiraos reported that Federal Reserve officials are “fractured over which poses the greater threat—persistent inflation or a sluggish labor market.”

Kansas City Fed President Jeff Schmid dissented against October’s cut, while Cleveland’s Beth Hammack and Dallas’s Lorie Logan publicly opposed further reductions.

Powell acknowledged these divisions, stating, “people just have different risk tolerances, so that leads you to people with disparate views.”

Timiraos noted that Powell “pushed back so bluntly against expectations” of a December cut “to manage a committee riven by seemingly unbridgeable differences.“

Fed officials are fracturing over a December rate cut after inflation-focused hawks pushed for a pause after last month's rate reduction.

Officials are divided on three questions that come down to judgment calls: Will tariff-driven cost increases truly be a one-off? Does weak…— Nick Timiraos (@NickTimiraos) November 12, 2025

San Francisco Fed President Mary Daly made the dovish case, warning that the economy risks “losing jobs and growth in the process” of fighting inflation.

She argued that slowing wage growth indicates falling labor demand rather than supply constraints.

Mixed Economic Signals Cloud Outlook

Bitfinex’s report detailed deteriorating labor conditions, noting that year-over-year wage growth cooled from 4.7% in early 2023 to 3.7% by August.

The Conference Board’s Consumer Confidence Index fell to 94.6 in October from 95.6 in September.

Treasury yields have declined substantially since summer, with 10-year notes dropping 51 basis points from 4.5% in June to 4% by late October.

Bitfinex analysts noted this “reflects a mix of shifting expectations, including prospects of rate cuts, softer economic growth, and rising safe-haven demand.“

Bitcoin remains caught between conflicting forces as traditional November strength clashes with 2025’s unique macroeconomic backdrop.

Without sustained institutional demand, analysts expect continued range-bound trading through the end of the month.

The post Forget “Moonvember” — Analysts Say Bitcoin Could Trade Sideways This Month appeared first on Cryptonews.