As Bitcoin briefly hits $93,000, Hyla’s move underscores rising interest in crypto’s transformative potential. Hyla Fund Management is launching a $30 million fund to support Latin America’s growing cryptocurrency sector, aiming to enhance financial access and remittance solutions in the region.

Led by CEO Paola Origel, the fund seeks to identify high-potential projects, capitalizing on the region’s digital finance needs.

Hyla Fund Targets Latin America’s Crypto Potential with $30M Fund

Hyla Fund Management, led by CEO Paola Origel, is set to launch a $30 million cryptocurrency investment fund in January 2025, aimed at fueling Latin America’s burgeoning digital asset market.

Originally from Mexico, Origel sees vast potential in the region, particularly for improving financial access and remittance solutions in underserved communities.

The fund seeks to become the “Goldman Sachs for digital assets” by identifying promising cryptocurrency projects that could revolutionize both regional and global markets.

EXCLUSIVE: Paola Origel, CEO of Hyla Fund Management, sat down with CoinDesk to discuss the firm's new LatAm crypto fund and its big ambitions to become the "Goldman Sachs for digital assets." @tom_carreras reportshttps://t.co/EB8m2383Wf

— CoinDesk (@CoinDesk) November 13, 2024

With the Latin American crypto sector gaining traction, Hyla Fund is not just focusing on established cryptocurrencies but is keen on discovering emerging “unicorns” that could transform the digital finance landscape.

“We’re investing in teams that understand the unique needs of this region and have the potential to set global standards,” said Origel in a statement.

Hyla’s investment strategy involves backing local crypto projects and supporting strong management teams that can scale effectively. By increasing demand for Bitcoin and other digital assets in the region, Hyla could contribute to broader adoption and bolster price stability in Latin America.

- Investment Focus: Local crypto projects with regional impact potential

- Leadership: CEO Paola Origel aims to turn Hyla into a digital asset powerhouse

- Launch Date: January 2025, with $30M in initial funding

Trump’s Crypto-Friendly Policies Drive Bitcoin Near $93,000

In parallel, Bitcoin has been on a bullish run, briefly hitting $93,000, a record high fueled by President-elect Donald Trump’s pro-crypto stance.

Trump has promised a regulatory framework conducive to crypto and plans to make the U.S. a global leader in digital assets.

Anticipation of potential Federal Reserve rate cuts has also contributed to Bitcoin’s rise, with many analysts predicting it could soon hit the $100,000 mark.

Bitcoin briefly spiked above $93,000 as expectations of further Federal Reserve rate cuts added to the impetus from President-elect Donald Trump’s pro-crypto stance https://t.co/FPNvo2jHfE

— Bloomberg Crypto (@crypto) November 13, 2024

A tweet from @crypto noted, “Bitcoin’s new all-time high of $93,000 shows the growing confidence in Trump’s crypto policies.” However, Bitcoin’s rally was short-lived, and by mid-morning, it had settled to $89,974 in Singapore trading.

Some analysts warn that despite the optimistic outlook, profit-taking could lead to near-term volatility as markets adjust to evolving policy expectations.

- Record High: Bitcoin briefly touched $93,000 on Trump’s crypto-friendly promises

- Current Price: Stabilized around $89,974 after profit-taking

- Outlook: Analysts eye $100,000, but volatility remains likely

Metaplanet Increases Bitcoin Holdings Amid Stock Decline

Japan’s Metaplanet, a major corporate player in Bitcoin investment, recently boosted its holdings to approximately 1,000 BTC, valued at $28 million. Similar to U.S.-based MicroStrategy, Metaplanet raised capital through loans, bond offerings, and equity sales to expand its Bitcoin reserves.

However, following this announcement, Metaplanet’s stock dropped by 9.1%, attributed to a $2.1 million net loss in the first three quarters of 2024, primarily due to rising expenses in its hospitality division.

JUST IN:

Japanese public company Metaplanet gained $28 million in unrealised profit on their #Bitcoin holdings.

The Bitcoin effectpic.twitter.com/Th12FulWeS

— Bitcoin Magazine (@BitcoinMagazine) November 13, 2024

Bitcoin Magazine tweeted, “Metaplanet’s commitment to Bitcoin highlights growing corporate interest in crypto as a treasury asset.”

The company’s decision to increase its Bitcoin holdings could signal continued institutional confidence in Bitcoin, potentially supporting market demand and stability.

- Investment Growth: Metaplanet now holds 1,000 BTC, worth $28M

- Stock Impact: Shares fell 9.1% amid operational losses

- Market Insight: Corporate interest in Bitcoin as a treasury asset continues

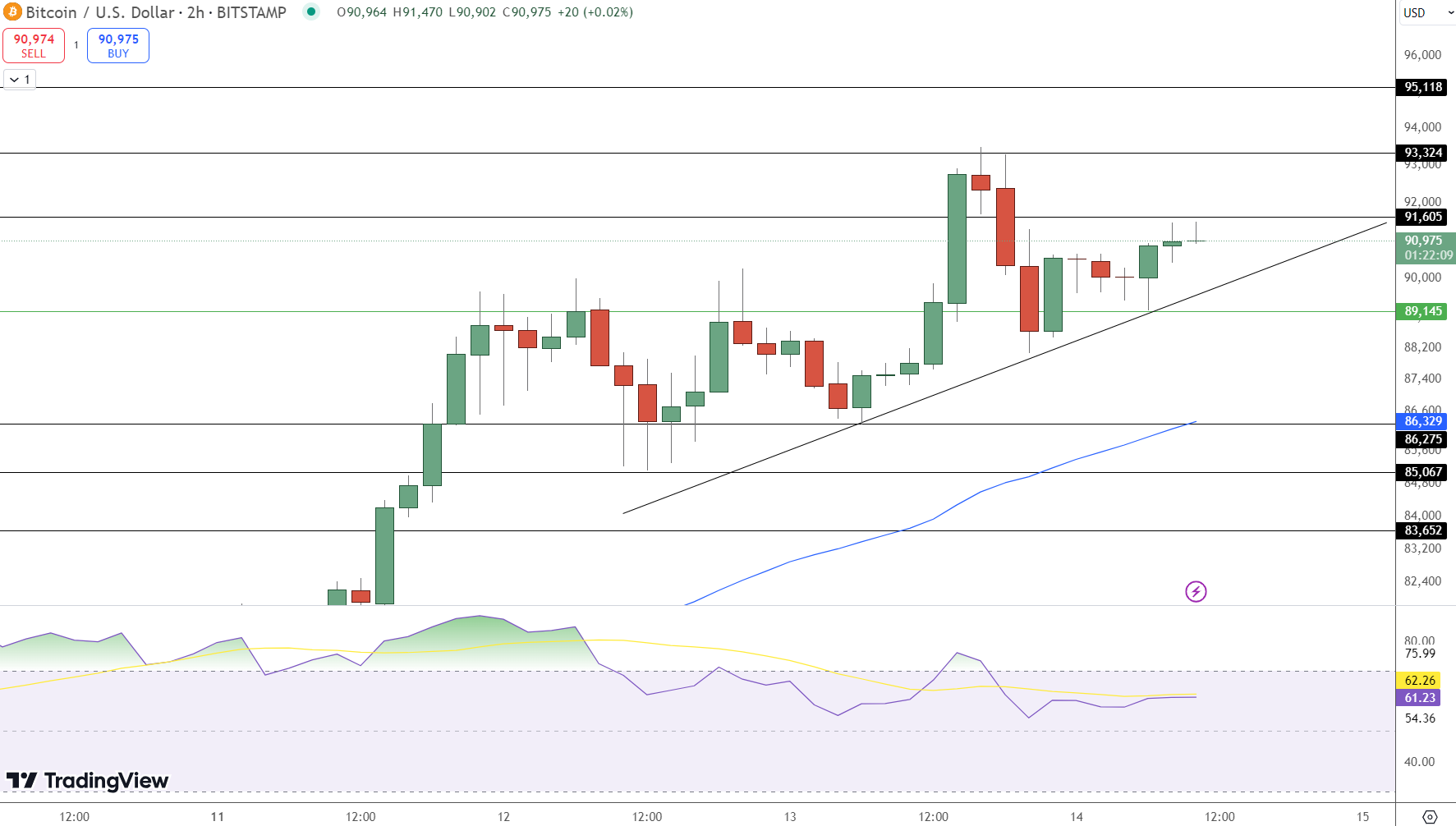

Bitcoin Holds Above $91,500; Key Levels to Watch Amid Uptrend Support

Bitcoin’s price action remains buoyed by an ascending trendline, signaling bullish momentum as long as it holds above the pivot level at $89,150. Immediate resistance at $91,600 is proving a challenging barrier, capping gains for now.

Should Bitcoin break above this level, it could target higher resistances around $93,325 and $95,120.

On the downside, the immediate support at $89,150 remains crucial, with further supports at $86,550 and $85,070 if a pullback occurs. The RSI, currently at 63, indicates moderate bullish strength, though caution is advised near resistance levels.

Key Insights:

- Uptrend Support: Ascending trendline shows buying interest above the $89,150 pivot.

- Resistance Barrier: $91,600 limits immediate upward potential.

- RSI Level: RSI at 63 points to moderate bullish momentum.

Key Insights:

- Support Level: Upward channel support around $89,000.

- Immediate Resistance: Key resistance at $91,280 and $93,320.

- Technical Indicator: RSI at 59 shows moderate bullish momentum.

–

You might also like Bitcoin Price Prediction 2024 – 2034

Flockerz ($FLOCK) Nears Presale Goal with Just Hours Left Before Price Increase

Flockerz ($FLOCK) continues to capture attention in the meme coin space, nearing its presale target with $1,768,860.5 raised out of $1,842,124. Investors have less than a day to purchase $FLOCK at the current price of $0.0060049 before it increases, leaving a limited window for early participation.

This project stands out with its decentralized autonomous organization (DAO), Flocktopia, which allows $FLOCK holders to influence the project’s governance and direction. Through this “Vote-to-Earn” model, the community has a say in decision-making, aligning interests for potential token growth.

The project offers long-term incentives, with staking rewards up to 7,888%, designed to foster community engagement and boost token scarcity. Anticipated listings on major exchanges and endorsements from influencers further highlight Flockerz’s ambition to secure a notable position in Web3.

Investors can secure $FLOCK using ETH, BNB, USDT, or a bank card on the official presale website. Don’t miss the opportunity to join before the next price increase.

Visit the Flockerz Presale Website.

The post Hyla Fund’s $30M Bet on Latin America’s Crypto Future with Bitcoin Nears $93,000 appeared first on Cryptonews.