Hyperliquid shattered revenue records in August with $106 million earned from perpetual futures trading, marking a 23% increase from July’s $86.6 million as the decentralized exchange captured 70% market share among DeFi perpetuals platforms.

The milestone came alongside $383 billion in monthly trading volume and an annualized revenue reaching $1.25 billion, according to DefiLlama.

Lean Team of 11 Employees Outperforms Financial Giants Through Automation

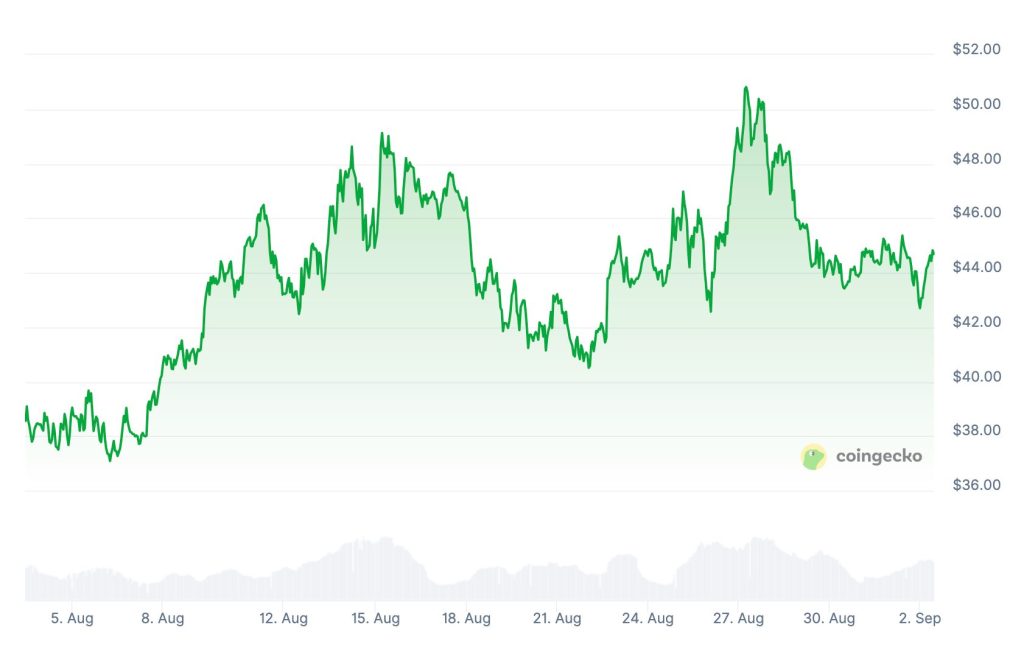

The platform’s HYPE token reached an all-time high of $51.12 on August 27, with gains of over 400% since April.

Recently, Arthur Hayes published his boldest prediction yet, forecasting that HYPE could surge 126x by 2028 as stablecoin adoption reaches $10 trillion and transforms the decentralized trading infrastructure.

Hyperliquid operates with just 11 employees while processing $330.8 billion annually, creating efficiency ratios that dwarf traditional payment giants.

PayPal employs 29,000 staff to handle $1.6 trillion yearly, while Visa uses 28,000 workers for $13 trillion in volume.

The exchange built its competitive advantage on HyperEVM, a custom Layer 1 blockchain that eliminates gas fees for trades while maintaining fully on-chain order books.

This technical architecture attracted traders from centralized platforms seeking high performance without traditional DeFi friction points.

Technical Innovation Drives 70% DeFi Perpetuals Market Capture

Hyperliquid’s dominance stems from solving core DeFi trading problems through purpose-built infrastructure that eliminates traditional pain points.

The platform’s HyperEVM blockchain processes trades without gas fees, maintaining complete on-chain transparency, while creating a hybrid model that combines the performance of CEXs with the benefits of DEXs.

The exchange outpaced Robinhood in trading volume for three consecutive months, generating over $28 million in weekly revenue while processing volumes that exceeded those of established centralized competitors, such as Bitstamp.

Trading activity reached $29 billion in 24-hour volume during market volatility periods, with $7.7 million in daily fees during peak periods.

DeFi Llama data reveals that the total value locked is climbing to $762.57 million from $230.48 million in April, while monthly DEX volume has exploded from $57.54 million in March to over $22 billion recently.

The platform’s cumulative perpetual futures volume has also reached $2.57 trillion.

Institutional adoption accelerated through strategic partnerships, including Anchorage Digital Bank custody services and Circle’s native USDC deployment.

The platform’s lean operational model relies heavily on automation and smart contracts to replace traditional finance departments.

Settlement, reconciliation, compliance checks, and customer operations are integrated directly into the infrastructure, enabling massive scale with minimal staffing requirements.

Arthur Hayes Projects 126x Returns as Stablecoin Revolution Unfolds

Former BitMEX CEO Arthur Hayes has published his most aggressive crypto prediction, forecasting that HYPE could achieve 126x returns by 2028, as Treasury Secretary Scott Bessent’s policies create the largest DeFi bull market in history.

Hayes’ thesis centers on capturing $34 trillion in global deposits through compliant stablecoin infrastructure.

The prediction assumes Hyperliquid will become the largest crypto trading venue as stablecoin supply reaches $10 trillion, with daily volumes matching Binance’s current $73 billion throughput.

@CryptoHayes says HYPE could surge 126x by 2028 as $10T stablecoin boom is set to reshape finance.#Hyperliquid #Stablecoinhttps://t.co/HhuG7nx0RE

— Cryptonews.com (@cryptonews) August 28, 2025

Hayes models the exchange, maintaining its 67% DeFi market share while expanding into broader crypto derivatives trading against centralized competitors.

Hayes nicknamed Treasury Secretary Scott Bessent “Buffalo Bill” for the anticipated dismantling of the Eurodollar banking system, projecting policies will force $10-13 trillion in foreign deposits into U.S. Treasury-backed stablecoins.

The strategy targets Global South retail deposits through WhatsApp and social media platforms equipped with crypto wallet functionality.

However, Polymarket odds for HYPE reaching $100 in 2025 have decreased to 24% from 35% in August, but are expected to increase with the anticipated Federal Reserve rate cuts.

Institutional investors, including Arthur Hayes, accumulated over 58,631 HYPE tokens worth $2.62 million, while 21Shares launched exchange-traded products on SIX Swiss Exchange.

Current HYPE metrics include $44.43 token price, $13 billion market capitalization, and $364.93 million daily volume.

The token trades just 12% below its previous peak, but remains bullish across technical indicators.

Looking forward, Hyperliquid’s future growth vectors include expanding beyond perpetuals into tokenized assets, deeper fintech integrations, and potential organizational scaling as the revenue trajectory attracts funding speculation.

The platform continues to operate like a payments powerhouse disguised as a startup, processing institutional-grade volumes while still upholding DeFi principles and transparency standards.

The post Hyperliquid Smashes Revenue Record with $106M in August, Dominates 70% of DeFi Perps Market appeared first on Cryptonews.