Hyperscale Data launched a $100 million Bitcoin treasury strategy while pivoting to AI and digital assets.

According to a recent announcement, the Las Vegas-based company will fund the initiative through Montana data center asset sales and equity offerings.

Meanwhile, Hyperscale plans to expand its Michigan campus from 30 MW to potentially 340 MW for AI and cloud computing operations.

The move positions Bitcoin as a primary treasury reserve, as the company already holds $1.33 million in digital assets, representing 11.9% of its market capitalization, through its mining operations.

BREAKING:

HYPERSCALE DATA JUST LAUNCHED ITS BITCOIN TREASURY WITH $100 MILLION! pic.twitter.com/7eSaWaDDdt— Coinvo (@ByCoinvo) September 15, 2025

Treasury Strategy Built on Mining Foundation

Hyperscale’s subsidiary Sentinum has operated a Bitcoin mining business for years, creating what CEO William B. Horne called “a foundation of operational expertise in digital assets” that supports the MicroStrategy-style treasury approach.

The company currently holds 11.1159 Bitcoin, worth approximately $1.23 million as of September 8, all of which was earned through mining rather than market purchases.

Previous announcements revealed an aggressive accumulation timeline, including a September 2 plan to add $20 million in Bitcoin and September 5 reports showing holdings reaching 8.1% of market capitalization.

Hyperscale will fund the $100 million program through proceeds from selling Montana data center land leases and power contracts, combined with its at-the-market equity offering.

The company announced plans to divest two 10 MW Montana properties to concentrate resources on its Michigan flagship campus.

Sentinum built and operates a fully functional data center on a single Montana property, having conducted crypto mining operations since acquiring the lease and power agreements in February 2023.

The strategic focus shift allows Hyperscale to direct capital and management attention toward Michigan, where the company expects substantially higher long-term asset values.

“This marks a pivotal moment in Hyperscale Data’s evolution,” Horne stated, explaining the company is “building a company anchored in two of the most dynamic forces of our era: artificial intelligence and digital assets.”

Notably, the Michigan facility expansion represents a parallel growth strategy, with the current 30 MW capacity advancing to 70 MW over 20 months through the use of natural gas infrastructure, which enables on-site generation.

The ultimate expansion goal is 340 MW capacity. However, it is subject to utility agreements, regulatory approvals, and appropriate funding for enterprise AI and cloud clients deploying GPU-based systems.

Hyperscale maintains transparency through weekly crypto holdings reports, with recent disclosures showing $101,123.70 in XRP purchases through 33,120 tokens at $3.0533 average price.

Hyperscale Data Subsidiary Ault Capital Group to Purchase Up to $10 Million of XRP for Expansion of its Financial Services Business $GPUS.

Read more https://t.co/CUpWnZVV5q pic.twitter.com/YyQcpdSWyD— Hyperscale Data, Inc. (@hyperscaledata) May 28, 2025

Corporate Bitcoin Race Enters Competitive Phase

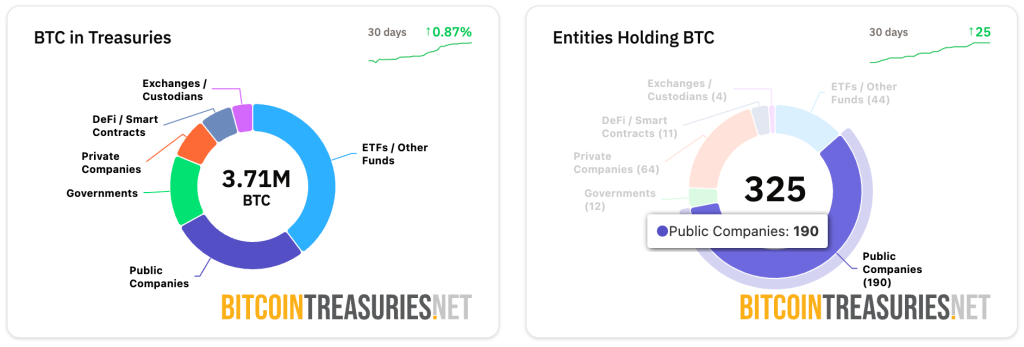

Hyperscale’s treasury strategy emerges as corporate Bitcoin adoption reaches over 1 million BTC worth $116 billion across 190 entities, yet faces what Coinbase Research describes as the end of the “easy money” era.

Recent moves have shown intensifying competition, with the Chinese firm CPOP launching a similar $33 million Bitcoin treasury that sparked a 56% stock surge before retreating.

UK-based Smarter Web, holding over £200 million in crypto reserves, is also actively seeking acquisition targets to purchase Bitcoin holdings at discount prices as some treasury companies now trade below their Bitcoin asset values.

UK's largest Bitcoin treasury, Smarter Web, eyes distressed competitor acquisitions for discount Bitcoin despite 73% share price drop.#Bitcoin #UKhttps://t.co/F0G0RcXNBv

— Cryptonews.com (@cryptonews) September 12, 2025

The corporate treasury movement has shifted from guaranteed premiums for early adopters to execution-dependent success as market saturation challenges new entrants.

Industry analysts warn that rising interest rates expose structural vulnerabilities in debt-financed Bitcoin strategies, with most participants potentially unable to survive credit cycles.

Unlike historical wealth-building through leveraged real estate that generated rental income, Bitcoin produces no cash flow, forcing companies to rely on operational performance or asset appreciation to service acquisition debt.

Notably, Hyperscale’s dual approach of combining AI infrastructure development with Bitcoin treasury management may position it differently, potentially benefiting from multiple growth catalysts.

However, the strategy also exposes the company to volatility from both cryptocurrency price cycles and capital-intensive data center buildouts in an environment where Capital Group quietly generated $5 billion from Bitcoin treasury investments.

The company’s planned divestiture of its subsidiary, Ault Capital Group, in Q1 2026 will position Hyperscale as a focused data center operator and digital asset holder once the separation is complete.

The post Hyperscale Data Announces $100M Bitcoin Treasury as Company Pivots to AI and Digital Assets appeared first on Cryptonews.