Key Takeaways:

- Prediction markets like Polymarket are becoming a major crypto narrative in 2026, driven by high win rates and visible profits.

- Accounts with near-perfect performance are often powered by automation, not market prediction.

- Bots exploit short-term pricing inefficiencies, especially during high volatility, rather than guessing outcomes.

- Tools like Clawdbot lower the barrier to automation but introduce new risks, including technical failures and loss of control over funds.

- Automation can create an edge, but it does not replace market understanding, risk management, or long-term sustainability.

Prediction markets, led by Polymarket, are becoming one of the key crypto narratives in 2026. People are watching other users post impressive win rates and make serious money every day. Naturally, they want the same. But is it really that simple?

At its core, prediction markets are straightforward. You place a bet on an outcome and wait to see how it plays out. Some markets focus on big macro questions, like whether interest rates will be cut or raised. Others are much narrower. During the Monad (MON) token launch, for example, there was a market where users could bet on how much money the ICO would raise.

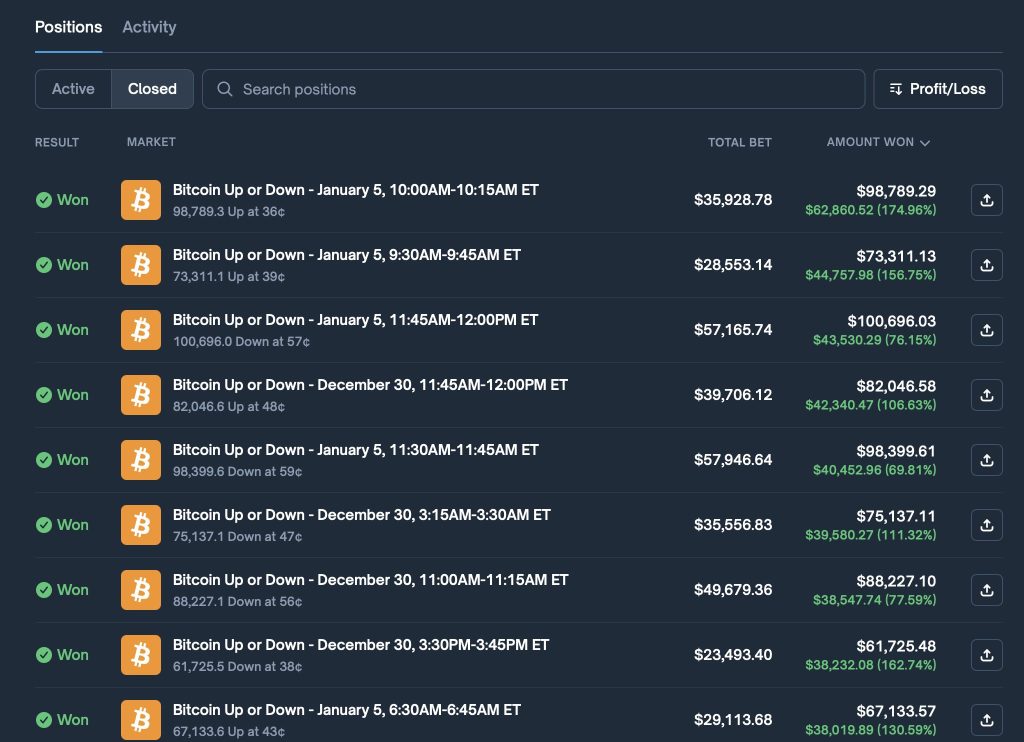

One Polymarket user, known as Account88888, took a very different approach. Instead of long-term narratives, they focused on 15-minute Bitcoin price markets, simply betting on whether BTC would go up or down. In one example, the user placed $35,928.78 and walked away with $62,860.52, a return of 174.96%.

Account88888’s win rate sits close to 100%. That immediately raised questions among experienced Polymarket users. Is this really a human trader? Or is something else going on? The most likely explanation is automation.

On X, bots promising “hands-off” trading are everywhere.

‘Instead I learned they do not think at all. They calculate’

A Polymarket trader known as Marlow says he has been tracking similar accounts for a while, including Account88888. At first, the strategy looked strange. On the surface, it seemed like the kind of approach that should lose money, not generate consistent profits.

“Account88888. 99% win-rate. Over 11,000 trades. The script surfaced in minutes,” Marlow wrote.

The key point is that the bot is not trying to predict the market. It is mechanically extracting arbitrage from pricing inefficiencies on Polymarket.

Every Polymarket market works the same way. There are only two outcomes. When the market settles, the winning side pays $1, the losing side pays nothing. Prices before settlement simply reflect how likely each outcome looks at that moment. They don’t change the final payout.

This creates an opportunity during periods of high volatility. If both opposing outcomes are temporarily underpriced and their combined cost drops below $1, an arbitrage appears. You are effectively buying a guaranteed $1 payout for less than its face value.

In volatile moments, traders rush to hedge against different scenarios at the same time. Demand becomes distorted. Prices on both sides get pushed down. In some cases, the “UP” and “DOWN” contracts on the same market might trade at, for example, $0.30 and $0.35 combined, still below $1, even though one of them must pay out $1 at settlement.

The bot simply buys both sides, waits for the market to resolve, and collects the difference. Over and over again. Thousands of times. It profits from mathematical certainty created by temporary imbalances in supply and demand.

Marlow explains it plainly:

The bot buys both. Waits fifteen minutes. Collects $1. Keeps six cents. Repeats. It does not care about direction. Does not read charts. Does not react to news. It farms the spread between panic pricing and mathematical certainty. My scanner keeps finding more of these. Different strategies, but the same signature. Execution patterns too clean and too fast for human hands. I built this tool expecting to learn how the best traders think. Instead I learned they do not think at all. They calculate.

‘Automation Is a Heavy Advantage in 2026’: Clawdbot (Now Moltbot) Enters Polymarket

As stories like this spread, ads started appearing on X promoting bots that promise to trade on Polymarket or other prediction markets on your behalf. At the same time, interest in AI agents has continued to grow, even though the space was already crowded.

Developed by Peter Steinberger, Clawdbot, now rebranded as Moltbot, promises to make working with AI agents far more seamless.

In simple terms, Clawdbot is a locally running AI agent that connects a large language model with real actions on a user’s computer. It can run terminal commands, read and write files, install software, browse the web, and send messages through messengers.

Users interact with Clawdbot through familiar chat apps like Telegram, WhatsApp, or iMessage. Behind the scenes, the agent decides which tools to use and which actions to take, based on context, instructions, memory, and available capabilities. In practice, it functions like a constantly running personal service that receives text commands and executes them directly on the system where it is installed.

Clawdbot has now made its way to Polymarket as well.

A trader known as Xmaeth on X, who has around 33,000 followers, shared how they set up Clawdbot to trade on Polymarket. This post has already reached 1.6 million views. The trader gave the agent $100 and API access to the Polymarket account, instructing it to trade 15-minute BTC markets with conservative risk management. According to Xmaeth, the balance grew to $347 overnight.

Xmaeth conclusion was simple:

Automation is a heavy advantage in 2026. Save it to re-read later.

Automation Isn’t Magic on Polymarket

The rise of Clawdbot and similar tools does not mean prediction markets have turned into a one-click money machine. These agents require technical setup, trust in the code, and full access to funds. Results are often shown over short time frames, with little evidence of long-term stability.

The risks are real, especially when larger amounts of capital are involved. One wrong trade, one bug, and losses can escalate quickly.

Automation also increases competition. As more bots enter the market, obvious inefficiencies get exploited faster, leaving less profit for late participants.

Polymarket’s example shows that profit in crypto can still come from many paths. Algorithmic arbitrage is one. Manual strategies and market structure analysis are others. But as always, it’s not the bot itself that creates an edge. It’s an understanding of how the market works. Without that, neither automation nor AI offers a sustainable advantage.

Another open question is how Polymarket, and prediction markets more broadly, will respond. On one hand, bots attract attention and users chase “easy money.” On the other hand, regulators are unlikely to look kindly on fully automated extraction strategies, especially given Polymarket’s existing regulatory challenges.

Whether these bots remain effective over time is still unclear. What is clear is that as their numbers grow, so will cases of abuse, scams, and unpleasant outcomes.

That leads to the biggest question of all. If this really works at scale, do Polymarket, Clawdbot, and similar tools change how we think about work, income, and markets? Do we move toward a world where money can be generated automatically, at scale? Or does that vision collapse under regulation, competition, and reality?

For now, the questions are piling up faster than the answers.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

The post Is Clawdbot Creating a ‘99% Win-Rate’ on Polymarket? appeared first on Cryptonews.