Crypto holds transformative potential as a global financial infrastructure beyond traditional banks. However, for many users, the lack of privacy and security measures remains a major barrier. Users and institutions accustomed to traditional finance’s robust privacy protections often view crypto’s transparency cautiously. Without the level of confidentiality and preservation of digital identities they expect, high-net-worth individuals and enterprises leveraging existing privacy frameworks have been slower to fully embrace on-chain financial opportunities.

If crypto wants to attract these two specific groups, it needs to integrate privacy as a mandatory feature, ensuring that users’ financial activities are protected from unwanted visibility and misuse. Many enterprises, banks, investors, retail audiences, and more, depend on elements of privacy in their everyday lives. Without this option, crypto will hold itself back from establishing long-term mainstream adoption.

Crypto transactions on public blockchains are currently visible to anyone, exposing enterprises to unique risks:

- Economic disadvantage: Without privacy, traders risk being front-run or copied, which can lead to lost profits.

- Operational exposure: Lack of discretion can reveal a business’s financial activities, compromising its competitive edge.

- Criminal activity: Publicly visible wallets make users vulnerable to hacking and, in some cases, physical threats.

The decentralized nature of crypto should not mean sacrificing security. Privacy protections can empower institutions to benefit from transparency without compromising personal or operational security. Currently, traditional banking manages these risks through well-established privacy protocols. Integrating privacy into crypto transactions enables high-net-worth individuals and enterprises to transact without publicizing sensitive details, creating a safer environment in which to participate in on-chain activities.

The Appeal of Privacy for Enterprise Adoption

Firms like Stripe and Visa are increasingly betting on the future of decentralized finance (DeFi) by adopting stablecoins for intermediary-free transactions. However, scaling this requires solving a critical challenge: privacy. Traditional financial institutions operate on a foundation of discretion, where sensitive transaction details are hidden from public view. Without privacy solutions, enterprises may be hesitant to embrace blockchain-based frameworks due to concerns over data exposure, market manipulation, and security risks.

To truly unlock the potential of intermediary-free financial systems, privacy must be integrated to protect institutions and high-net-worth users while maintaining the decentralized and transparent core of blockchain technology. This balance will allow firms like Stripe and Visa, among others, to offer secure, anonymous transactions, enabling their customers and businesses to engage confidently with various DeFi protocols and the broader crypto market. By addressing privacy, these enterprises can drive wider adoption of stablecoins and foster an environment where DeFi can thrive.

Three Approaches to Privacy

Three privacy approaches currently exist in crypto, each with unique strengths and limitations:

- Centralized exchanges: Centralized exchanges offer privacy by pooling user funds, creating some transactional obscurity. However, this model is restrictive, locking users into a single platform and undermining the composability central to DeFi. Recognizing these limitations, even large exchanges like Coinbase and Kraken are now working on Layer 2 solutions that prioritize on-chain privacy, signaling a shift toward a more decentralized approach.

- Fully homomorphic encryption (FHE): While promising, fully homomorphic encryption, recently co-authored by Circle, remains limited by current processing power. FHE is computationally intensive, making it impractical for widespread crypto adoption in the near term. Although theoretically sound, its complexity and performance limitations mean it is unlikely to play a major role in near-future privacy solutions.

- Smart contract privacy: Smart contract privacy brings users closer to true on-chain privacy. Transactions remain verifiable but are obfuscated, preserving both privacy and trust. This model offers significant advantages for enterprises, allowing them to maintain confidentiality similar to Web 2 finance while benefiting from the transparency and composability of DeFi.

The most practical solution currently is smart contract privacy, as it would allow enterprises and high-net-worth users to conduct private transactions while maintaining verifiability and trust. This method is particularly advantageous for enterprises, as it combines the privacy of Web 2 finance with the added benefits of DeFi. Conclusively, smart contract privacy opens up yield opportunities for both parties to earn on idle assets while keeping funds within a private Layer 2 environment.

Balancing Privacy and Compliance

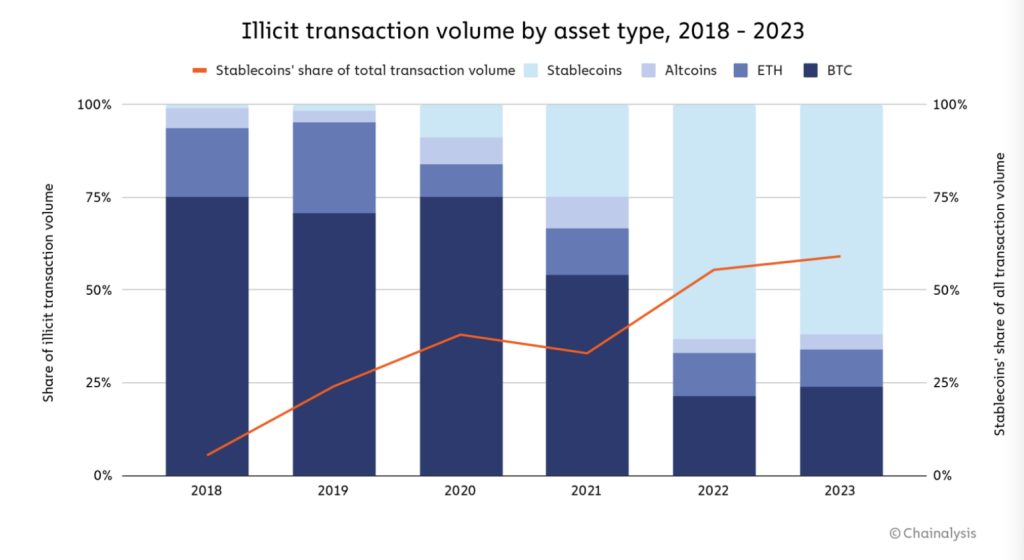

Privacy in crypto is not a singular issue pertaining to the act of concealing illicit activity; it’s about maintaining the right to financial discretion. Blockchain technology can integrate compliance features directly into private transaction protocols, ensuring regulatory standards without forfeiting user privacy. Authorities can access transaction links for auditing purposes and limit the utility of privacy for criminal activity while still keeping identities protected.

For instance, when users access their favorite platform to stake ETH, they should have the option of using a private wallet directly within that interface. This principle applies equally when accruing yields, which is similar to traditional banking practices where deposit amounts and earnings remain confidential. The more projects and platforms that provide such opportunities, the greater the incentive for institutions to engage with these products.

Conclusion

As crypto continues to grow, high-net-worth individuals and enterprises leveraging existing privacy frameworks will expect strong privacy. In either case, privacy tools that meet regulatory standards without sacrificing user protection would be game-changing for the industry.

On-chain privacy safeguards could transform the DeFi sector and encourage mainstream institutional users looking to enter the space with more confidence. Privacy protections for identities, transactions, and strategies will serve as a cornerstone for Web 3 expansion, where promises of secure, compliant, and decentralized financial opportunity are feasible for new enterprises interested in breaking out of Web 2.

Disclaimer: The opinions in this article are the writer’s own and do not necessarily represent the views of Cryptonews.com. This article is meant to provide a broad perspective on its topic and should not be taken as professional advice.

The post Lack of Privacy in Crypto Is Holding Back Institutional and Mainstream Adoption appeared first on Cryptonews.