A Bitcoin wallet linked to Chinese mining pool LuBian has awakened after more than three years of dormancy, transferring nearly $1.3 billion worth of BTC just 24 hours after the U.S. Department of Justice (DOJ) announced one of the largest crypto forfeiture cases in history, which the firm was allegedly linked to.

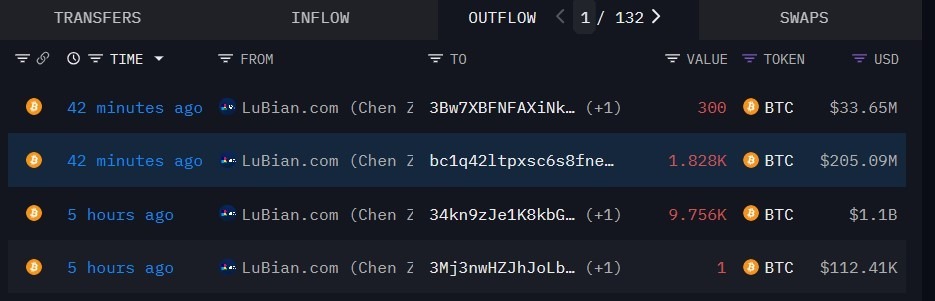

Blockchain analytics firms Lookonchain and Arkham Intelligence tracked the movement of 9,757 BTC, which is worth around $1.1 billion, to several new addresses. Hours later, an additional 2,129 BTC (about $238 million) was transferred, bringing the total to 11,886 BTC, now valued at over $1.3 billion.

However, the timing has sparked curiosity about whether the move was a precautionary reaction to the DOJ’s crackdown or a long-planned reallocation.

Blockchain analysts note that similar awakenings often occur after major enforcement actions, as large holders attempt to reorganize funds, enhance privacy, or preempt potential freezes.

However, some market observers caution against reading too much into the timing, pointing to recent activity among Bitcoin mining firms adjusting their treasuries amid volatile markets.

- MARA Holdings purchased 400 BTC (about $46 million) on Oct. 13, increasing its reserves to 53,250 BTC (worth over $6 billion).

- Riot Platforms produced 445 BTC in September and sold 465 BTC for around $52.6 million, maintaining a 19,287 BTC treasury.

- Bitfarms sold 1,052 BTC in Q2 for about $95,500 each, retaining 1,402 BTC by mid-August.

These data points show a divergence in miner strategy, with some accumulating amid price dips, while others liquidate to fund growth and operations.

Whether defensive or strategic, LuBian’s reemergence and a $1.3 billion Bitcoin shuffle right after a major DOJ announcement have set off one of crypto’s most compelling mysteries of the month.

The Curious Coincidence Between DOJ’s Case and LuBian’s $1.3B Move

The timing of this move has sparked speculation across the crypto community, coming less than 24 hours after U.S. prosecutors unsealed an indictment against Prince Holding Group, a Cambodia-based conglomerate accused of orchestrating an international crypto fraud and money laundering network.

@USTreasury has moved to make its largest-ever cryptocurrency seizure, targeting $12B in #Bitcoin from a global "pig butchering" scam. #US #PigButcheringhttps://t.co/6JpciJNrod

— Cryptonews.com (@cryptonews) October 14, 2025

The DOJ’s complaint seeks to forfeit around $14.4 billion in Bitcoin, allegedly tied to schemes run by the group’s founder, Chen Zhi.

Court filings allege that Zhi and his associates laundered illicit proceeds through large-scale mining operations, including Warp Data in Laos, its Texas-based subsidiary, and LuBian in China, which ranked as the sixth-largest Bitcoin mining pool in 2020.

According to the DOJ, these companies “produced large sums of clean Bitcoin dissociated from criminal proceeds.”

Adding to the intrigue, Arkham Intelligence previously reported that LuBian had been hacked for 127,426 BTC in 2020 (worth about $3.5 billion at the time). Arkham’s September report noted that 11,886 BTC had been moved to recovery wallets, which is the exact same amount that just became active this week.

A massive Bitcoin theft from 2020 has surfaced nearly four years later, and it's now being called the largest crypto heist ever uncovered. #Bitcoin #Hackhttps://t.co/5Qq5HqbUMn

— Cryptonews.com (@cryptonews) August 3, 2025

The reactivation of those funds, following years of silence and within hours of the DOJ’s major Bitcoin seizure, has raised questions about whether the two events are connected or coincidental.

If the DOJ succeeds in its forfeiture claims, it could mark one of the biggest additions to the U.S. government’s Bitcoin holdings to date, further strengthening its role as a leader in the crypto space.

These developments come amid Washington’s formal establishment of the Strategic Bitcoin Reserve (SBR), a controversial initiative seeking to convert seized assets into a sovereign digital reserve, thereby showing how the crypto crackdown is evolving into crypto custody at the highest levels of government.

Crypto Crackdown to Crypto Reserve: Inside the U.S. Government’s Growing Bitcoin Power

What began as a crackdown on illicit cryptocurrency activity has quietly evolved into one of the largest sovereign Bitcoin holdings in the world.

In March, President Donald Trump signed an executive order establishing the Strategic Bitcoin Reserve (SBR), a move that effectively formalizes the United States’ role as a major player in the digital asset economy.

The reserve is designed to hold Bitcoin and other cryptocurrencies seized in criminal and civil cases, a departure from the long-standing policy of auctioning off confiscated coins.

By August, Treasury Secretary Scott Bessent estimated that the federal government already controls between $15 billion and $20 billion worth of forfeited Bitcoin. Current data suggests that the United States now holds roughly 197,354 BTC, valued at around $22.45 billion, placing it at the top of the global leaderboard of government Bitcoin holders.

China follows closely with an estimated 190,000 BTC, while the United Kingdom, Ukraine, and the United Arab Emirates round out the top five sovereign holders.

In September, Congress advanced a bill requiring the Treasury Department to deliver a detailed report on the Strategic Bitcoin Reserve within 90 days of enactment.

The report will assess the feasibility, security, and accounting of a government-managed Bitcoin stockpile built primarily from seized cryptocurrencies.

Senator Cynthia Lummis, one of the bill’s strongest supporters, has said the reserve will allow the United States to “secure its debts with a hard asset” and ensure transparency through on-chain audits.

Add this to the reasons why a Strategic Bitcoin Reserve is the wisest thing we can do to shore up USD. It secures our debt with a hard asset + we can audit it to prove reserves at any time.

Given its scarcity, we can also use it in 20+ yrs to retire a meaningful % of US debt. https://t.co/9sI5eUxzCP— Cynthia Lummis

(@CynthiaMLummis) October 14, 2025

Industry figures, including Galaxy Digital’s Alex Thorn, have suggested the reserve could be formally operational before the end of 2025.

Meanwhile, the global conversation around sovereign Bitcoin reserves is gaining momentum.

Nations such as Bhutan, El Salvador, and Kyrgyzstan have either established or advanced plans for state-backed crypto reserves.

The post LuBian Wallet Breaks 3-Year Silence with $1.3B Bitcoin Move, Just One Day After DOJ Crackdown – Coincidence? appeared first on Cryptonews.