Michael Saylor moved quickly on Friday to stamp out fresh speculation that his Bitcoin acquisition vehicle, Strategy, had quietly sold tens of thousands of coins during this week’s market downturn.

The executive chair called the claims “false” and insisted the company is still accumulating Bitcoin despite a volatile stretch that pushed BTC below $95,000 for the first time in six months.

DID SAYLOR SELL $4 BILLION TODAY?

No. Strategy has been moving billions of dollars of BTC in the past 2 weeks as part of what appears to be a change in custodians for some of their Bitcoin.

Our research team wrote a deep-dive on Strategy’s recent movements and activity, to help… https://t.co/1pvycnF3ZX— Arkham (@arkham) November 14, 2025

The rumors exploded after crypto analytics platform Arkham flagged what it described as a drop in Strategy’s Bitcoin holdings from 484,000 BTC to 437,000 BTC, a difference of roughly 47,000 BTC worth about $4.6 billion at the time.

The report circulated just as Bitcoin slipped more than 4% in under 24 hours, falling from above $100,000 to below $95,000. Saylor dismissed the speculation in a post on X, writing that there was “no truth” to suggestions the firm had reduced its position.

We are ₿uying.pic.twitter.com/6g11E9G6pO

— Michael Saylor (@saylor) November 14, 2025

Saylor Rejects Sell-Off Rumors, Confirms Strategy Added 487 BTC This Week

Speaking later on CNBC, he doubled down, saying Strategy was not only not selling but was accelerating its purchases. “We are buying,” Saylor said. “We’ll report our next buys on Monday morning.”

He added that the current price action had not shaken the firm’s strategy. “If you’re going to be a Bitcoin investor, you need a four-year time horizon, and you need to be prepared to handle volatility.”

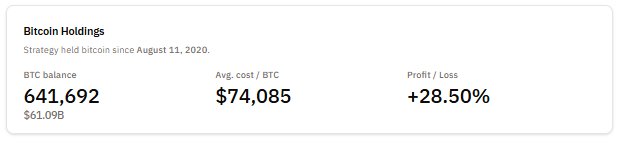

Internal data from Strategy appeared to support his comments. The company’s dashboard showed total Bitcoin holdings of 641,692 BTC as of Monday, matching its previous disclosure, and its SEC filings confirmed continued accumulation throughout early November.

The sudden movement of coins earlier in the day added fresh uncertainty to already fragile crypto markets.

Strategy(@Strategy) moved 58,915 $BTC($5.77B) to new wallets today, likely for custody purposes.https://t.co/FgZG2ZWlVi pic.twitter.com/fimqXsgLH0

— Lookonchain (@lookonchain) November 14, 2025

On-chain analysts reported that Strategy transferred more than 58,000 BTC to new wallets, a shift that triggered algorithmic trading activity and accelerated the sell-off.

Although analysts later attributed the transfers to custody restructuring rather than liquidation, the clarification did little to ease broader concerns.

MSTR Drops to One-Year Low as Investors Reassess Bitcoin Proxy Premium

Market pressure quickly spread to Strategy’s financial footing. Shares of its Nasdaq-listed stock, MSTR, fell below $200 in pre-market trading on Friday, its lowest level since October 2024.

The company’s Net Asset Value multiple briefly slipped below 1 for the first time, indicating that investors were valuing the firm at less than the worth of its Bitcoin holdings.

The multiple has since recovered to 1.09, but the shift marks a break from years in which Strategy consistently traded at a premium.

That reversal reflects cooler investor expectations. According to K33 Research, Strategy’s equity premium has contracted by $79.2 billion since November 2024.

$79.2bn reduction in MSTR's equity premiums relative to its BTC holdings since November 20, 2024.

With $31.1bn raised through dilution over this period, roughly $48.1bn of the implied demand for BTC via MSTR never translated into spot purchases. pic.twitter.com/14sf9dL4tl— Vetle Lunde (@VetleLunde) November 14, 2025

While the company raised over $31 billion through share issuance during that period, analysts estimate nearly $48 billion of implied Bitcoin demand never translated into actual BTC purchases.

Some market watchers say investors are no longer using MSTR as a straightforward proxy for Bitcoin exposure.

Others dismissed liquidation fears. Analyst Willy Woo said Strategy is unlikely to face pressure to sell before 2027 as long as MSTR trades above $183.19, a threshold linked to the company’s debt structure. He noted that only a weak 2028 Bitcoin cycle could force partial sales.

MSTR liquidation in the next bear market? I doubt it,

Here's their debt, the date the debt is due and the price MSTR stock needs to exceed to prevent partial liquidation of their BTC treasury to pay the debt. Equivalent BTC price assumes mNAV 1.0 pic.twitter.com/AzVgecI7i2— Willy Woo (@woonomic) November 4, 2025

The dispute comes amid wider turbulence across digital assets and U.S. markets. Bitcoin briefly jumped above $106,000 after lawmakers ended a record 43-day government shutdown, but the rally faded as expectations for a December Federal Reserve rate cut diminished.

Despite the volatility, Strategy remains the largest corporate holder of Bitcoin; however, its market share has fallen from 75% to 60% as more firms add BTC to their treasuries.

The post Michael Saylor Slams 47,000 BTC Sale Rumor, Teases “Pleasantly Surprising” New Buys appeared first on Cryptonews.