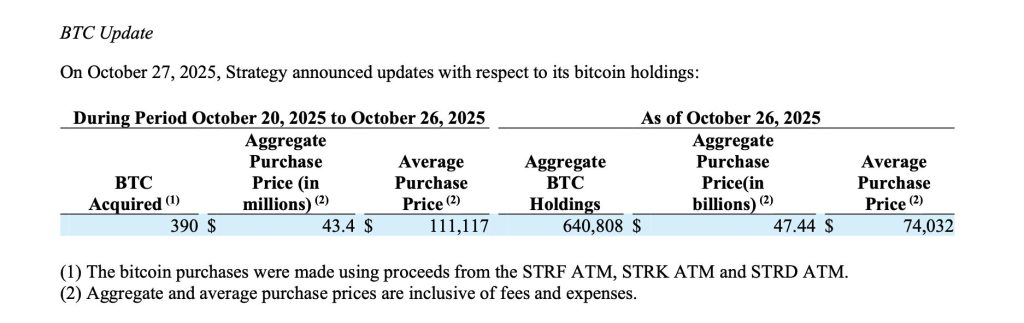

Strategy, the business intelligence firm led by Bitcoin advocate Michael Saylor, has once again expanded its Bitcoin treasury. According to a filing released on October 27, the company acquired an additional 390 BTC between October 20 and October 26, spending $43.4 million at an average price of $111,117 per Bitcoin.

Strategy has acquired 390 BTC for ~$43.4 million at ~$111,053 per bitcoin and has achieved BTC Yield of 26.0% YTD 2025. As of 10/26/2025, we hodl 640,808 $BTC acquired for ~$47.44 billion at ~$74,032 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/1d4Pmv8ub2

— Michael Saylor (@saylor) October 27, 2025

This latest purchase brings Strategy’s total holdings to 640,808 BTC, acquired at an aggregate purchase price of $47.44 billion. The company’s average purchase price now stands at $74,032 per Bitcoin, inclusive of fees and expenses.

Strategic Use of ATM Programs

The filing revealed that the latest Bitcoin purchases were funded through proceeds from several of Strategy’s At-The-Market (ATM) equity programs. Specifically, the company issued preferred shares under its STRF, STRK, and STRDATM programs, raising a combined total of $43.4 million during the same period.

Strategy has leaned heavily on its ATM offerings to generate capital for Bitcoin acquisitions without taking on additional debt. The programs collectively provide the company access to more than $46 billion in potential issuance capacity, giving it flexibility to continue adding Bitcoin as market conditions evolve.

This approach aligns with Saylor’s long-term thesis: using equity capital to accumulate Bitcoin as a superior store of value. By issuing stock instead of borrowing, Strategy minimizes balance-sheet risk while deepening its exposure to the world’s largest digital asset.

Saylor’s Conviction in Bitcoin Remains Unshaken

Despite market volatility, Michael Saylor’s conviction in Bitcoin remains steadfast. The billionaire founder and executive chairman has repeatedly described Bitcoin as “digital property” and “the ultimate treasury reserve asset.”

Strategy’s consistent accumulation strategy has made it the largest corporate holder of Bitcoin globally, far surpassing entities such as Tesla and Marathon Digital. The firm’s holdings now represent more than 3% of Bitcoin’s total circulating supply, further cementing its position as a proxy for institutional Bitcoin exposure on Wall Street.

Bitcoin-as-a-Service Vision

Beyond holding Bitcoin, Strategy continues to advance its vision of “Bitcoin-as-a-Service”, providing software, analytics, and capital markets infrastructure to other institutions exploring digital assets.

By combining traditional capital-raising mechanisms with blockchain-native investment principles, Saylor’s company has built a hybrid model that bridges corporate finance and decentralized value storage.

As Bitcoin’s next halving cycle approaches in 2026, Strategy’s latest purchase reinforces its long-term belief: that Bitcoin will outlast inflation, outperform traditional assets, and remain the cornerstone of a new global financial paradigm.

With 640,808 BTC now in reserve, Strategy shows no signs of slowing — only scaling.

Michael Saylor Escapes Multi-Billion Tax Bomb

Strategy has also recently announced it no longer expects to face a multi-billion tax liability tied to unrealized crypto gains after new guidance from the IRS and Treasury.

The 71-page update says companies don’t have to include unrealized Bitcoin gains or losses in the 15% Corporate Alternative Minimum Tax (CAMT) calculation.

This saves Strategy from billions in potential payments and eases fears that long-term Bitcoin treasuries would be penalized for appreciation.

The post Michael Saylor’s Strategy Buys 390 BTC, Boosting Treasury to 640K BTC appeared first on Cryptonews.

![[LIVE] Altcoin Season Price Watch, October 27 – Trending Altcoins Lag as Liquidity Clings to BTC](https://cryptomediaclub.com/wp-content/uploads/2025/10/empty-cryptonews-8-75x75.jpg)