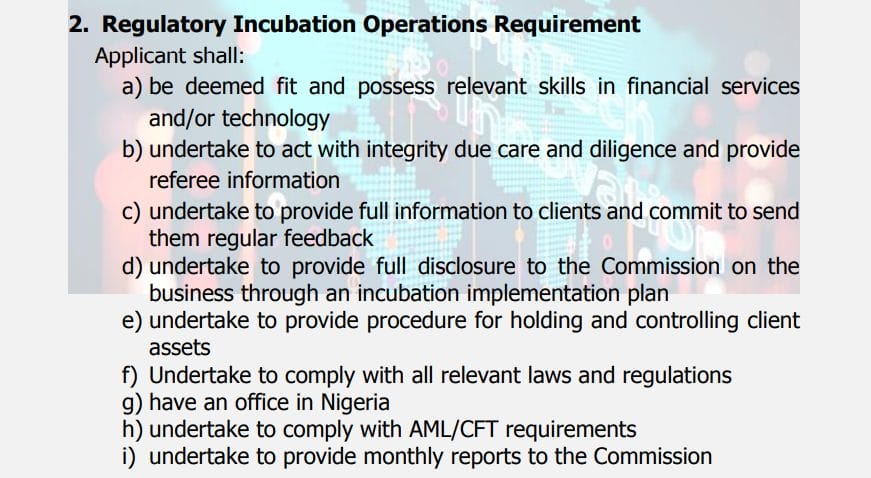

Nigeria’s Securities and Exchange Commission (SEC) mandated on June 21 that all Virtual Asset Service Providers (VASPs), including cryptocurrency companies, establish offices in Nigeria as part of eligibility requirements under its Accelerated Regulatory Incubation Programme (ARIP).

This initiative is expected to expedite the registration and onboarding of VASPs ahead of the forthcoming Digital Assets Rules, focusing on compliance and investor protection.

The requirement also states that applicants must report customer complaints and emergent risks and be subject to SEC inspections, audits, and monitoring.

Nigeria’s SEC Implements Accelerated Regulatory Incubation Program (ARIP) for VASPs

While regulations governing digital asset issuance, offering platforms, exchanges, and custody are being amended, VASPs are temporarily mandated to operate under the ARIP framework.

In addition to establishing a physical office, the CEO or managing director of these entities must reside locally.

They must also commit to operational readiness with live customer support and express readiness to apply for full registration as soon as the necessary rules are established. Products or services should address specific industry challenges or offer significant consumer benefits, ensuring investor safety.

The framework applies to entities conducting business in Nigeria or offering services to Nigerian consumers, encompassing platforms facilitating the offering, trading, exchange, custody, and transfer of digital assets.

The SEC intends to use ARIP to fast-track the onboarding of entities that have submitted applications or intend to register with the Commission. Qualified entities under ARIP can receive approval in principle from the SEC, pending the full implementation of the Digital Assets Rules.

Nigeria Introduces Strict Regulations for VASPs Under Regulatory Incubation

VASPs under regulatory incubation face specific restrictions, including prohibitions on guaranteeing financial returns in promotions and caps on client onboarding. The incubation period is limited to one year, after which firms must either seek full registration or cease operations if eligibility criteria are unmet.

The SEC retains the discretion to terminate participation in the incubation process if firms fail to maintain eligibility, breach conditions, deviate from implementation plans, or neglect to apply for registration or submit a discontinuation notice within the stipulated time frame.

According to the SEC, applicants must submit detailed implementation plans outlining business models, objectives, risk management frameworks, and communication strategies. These plans must include strategies for concluding the incubation period, whether through successful registration or an exit strategy.

Application requirements include submitting a sworn statement confirming no fraud convictions, an operational plan, a business model with a clear value proposition, and provisions for investor protection.

Additionally, applicants must pay a processing fee of 2 million naira ($1,277) and provide evidence of the required shareholder funds.

Also, ARIP participants must submit weekly and monthly trading statistics, quarterly financials, compliance reports, and incident reports. The SEC has stipulated that failure to comply with ARIP requirements could lead to penalties starting at 5 million naira ($3,194) and increasing daily for continued non-compliance.

Unregistered commercial VASPs face penalties starting at 20 million naira ($12,776), while other digital investment platforms, such as crypto brokers and advisers, may be fined at least 10 million naira ($6,388).

In March, Nigeria’s SEC proposed amendments to rules governing platforms offering crypto services, including a proposed increase in the registration fee for crypto exchanges from 30 million naira ($18,620) to 150 million naira ($93,000).

The post Nigeria’s SEC Mandates VASPs to Establish Local Offices for Framework Program Eligibility appeared first on Cryptonews.