Historical past has at all times had its moments of gold rush. That one momentary discovery of a commodity or scarce useful resource, spurring a brand new wave of generational wealth.

Enter the Industrial Revolution and, with it, the trendy tackle asset lessons for wealth multiplication. Anybody might have partaken in these wealth booms. Nevertheless, the lack of knowledge and a basic sense of inaccessibility to international monetary markets one way or the other saved the overwhelming majority of individuals from investing on this planet’s pure wealth.

The nice factor is historical past repeats itself.

The brand new gold rush is already upon us. And this time, the world has blockchain.

Tokenizing the Industrial Revolution

Because the first industrial revolution, oil has performed a pivotal function in international financial progress, powering industries and influencing geopolitical landscapes. There are a lot of avenues to spend money on oil markets right now, however not essentially in your complete worth chain of the commodity. There’s a entire world devoted to black gold, from extraction to processing to distribution and consumption.

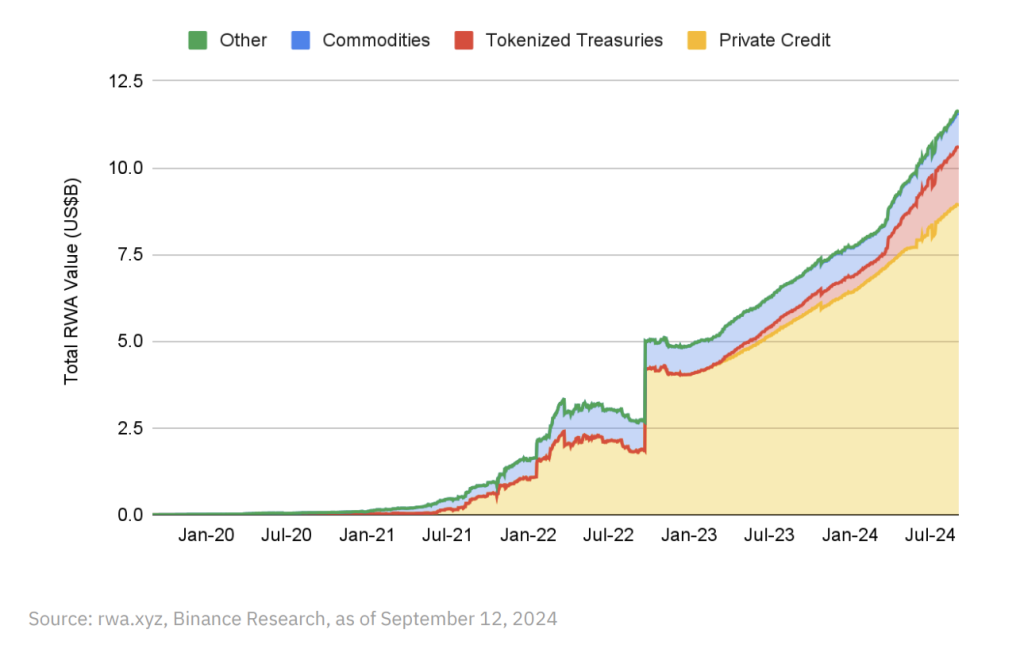

Fortunately, the arrival of knowledge and decentralization allows democratized entry to how we personal, commerce, and worth the sector. Notably, the tokenized real-world property (RWAs) market has surpassed $12 billion, indicating rising investor confidence in such digital representations. A basic case of the outdated economic system assembly the digital future – or most likely outdated cash assembly the brand new wave of retail and institutional traders.

Possession has been one of the crucial intriguing points of tokenizing oil: how precisely can one stake a declare within the worth streams of such a fancy business? That is the place tokenization comes into play. In contrast to conventional investments in oil, which could contain important capital funding or advanced contracts, tokenized oil supplies fractional possession by digital tokens on a blockchain. Every token usually represents a selected, measurable quantity of oil – whether or not in barrels, liters, or one other standardized unit – saved in licensed areas or held as reserves by trusted custodians.

When somebody buys an oil-backed token, they personal a fractional stake in bodily oil, recorded securely on a blockchain. This digital ledger supplies clear, immutable proof of possession with out the necessity for intermediaries, enabling a streamlined means to purchase, promote, or maintain oil-based property with out dealing with the commodity bodily. In contrast to conventional oil investments, which frequently require important capital, advanced mechanisms, and insider information, tokenized oil democratizes entry to a market beforehand unique to main gamers. Blockchain additional enhances this by providing real-time asset monitoring, giving traders an accountable view of their holdings.

Furthermore, good contracts can automate key points of this possession. For instance, if the token represents oil that’s leased out or utilized in some capability, any returns generated may be distributed again to token holders mechanically. This setup permits for a fluid, clear, and extra direct funding course of, providing traders the prospect to carry a precious tangible commodity with out the standard logistical and authorized complexities tied to grease possession. In keeping with a report by PwC, blockchain know-how can considerably cut back operational prices in commodity buying and selling, making tokenized oil a extra environment friendly funding automobile.

The Attraction of Tokenizing Commodities

The tokenization of commodities affords quite a few benefits, making it an interesting choice for merchants, traders, and producers. One key profit is the steadiness that comes from real-world asset backing. Conventional traders typically discover the crypto area intimidating on account of its infamous volatility—Bitcoin, as an illustration, skilled dramatic value swings, from practically $69,000 in November 2021 to $16,000 only a yr later, and now, effectively inside attain of the hallowed six-figure mark.

In distinction, oil, a commodity with a world market dimension of $2.7 trillion as of 2022, tends to observe extra predictable provide and demand dynamics. Oil-backed cryptocurrencies, by tying token values instantly to grease, present a technique to interact with digital property with out the heightened dangers related to speculative cash.

Tokenized oil additionally serves as a hedge towards inflation and market volatility. Commodities like oil have lengthy been used to protect worth throughout inflationary intervals, and inflation in lots of main economies not too long ago reached multi-decade highs. By bringing this stability into the digital asset area, oil-backed cryptocurrencies supply an inflation-resistant funding choice. In contrast to conventional digital tokens that usually react to market sentiment, oil-backed tokens are anchored in bodily sources, making them extra secure and enticing to cautious traders.

Lastly, tokenized oil bridges the hole between conventional finance and digital property. For traders cautious of speculative cryptocurrencies, the tangible backing of oil supplies reassurance. By combining the reliability of a bodily commodity with the innovation of blockchain, oil-backed tokens entice a extra numerous group of traders, together with these from conventional finance sectors. This distinctive integration has the potential to stability the digital asset market, positioning tokenized oil as a center floor between high-risk digital property and the steadiness of bodily commodities.

You may also like What Reforms Can We Anticipate from Paul Atkins on the SEC?

A New Period for Tokenized Property

Some estimates recommend that Tokenized Actual-World Property (RWAs) might open up a $30 trillion market alternative within the coming years. With a brand new administration prioritizing pro-energy independence insurance policies and a extra crypto-friendly Congress anticipated to take workplace, there’s a renewed sense of optimism inside the digital asset area. These developments are prone to create an surroundings that helps RWA tasks, together with oil-backed cryptocurrencies, providing inflation-resistant choices grounded in tangible sources inside the digital economic system.

The expansion potential for tokenized property is big. Trade leaders like McKinsey predict the RWA market might attain anyplace from $2 trillion to an astounding $4 trillion by 2030. With the present market at roughly $185 billion, this sector is on the verge of transformative progress as conventional and digital finance start to align beneath favorable regulation.

As demand rises for safe and modern investments, oil-backed crypto affords an thrilling new frontier. By combining the steadiness of a tangible commodity with the transparency and accessibility of blockchain, tokenized oil might paved the way into a brand new period of accessible, diversified investments, offering each seasoned and new traders with a secure basis within the evolving crypto panorama.

Disclaimer: The opinions on this article are the author’s personal and don’t essentially symbolize the views of Cryptonews.com. This text is supposed to supply a broad perspective on its matter and shouldn’t be taken as skilled recommendation.

The put up Opinion: Is Tokenized Oil the Subsequent Massive Factor in Investing? appeared first on Cryptonews.