Bitcoin has entered one of its most severe short-term capitulation phases of this cycle, with fresh on-chain data revealing that short-term holders are now realizing losses at levels historically seen only near major market turning points.

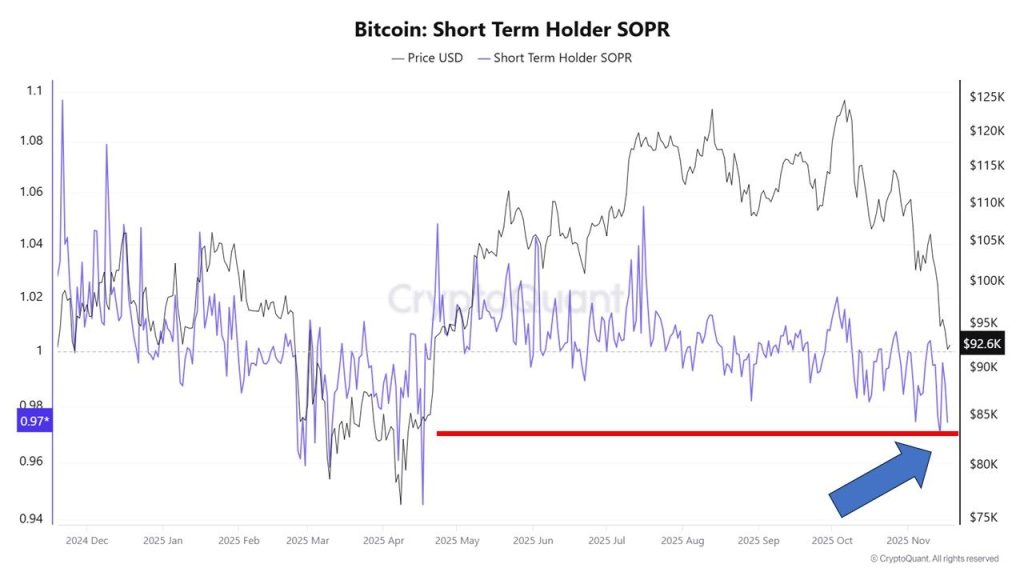

According to analysis from CryptoQuant, the Short-Term Holder Spent Output Profit Ratio has fallen to extremely depressed levels around 0.97.

This means recent buyers are selling coins at a clear loss, while the transfer of 65,200 BTC to exchanges confirms that fear-driven panic is actively translating into realized losses.

This capitulation structure is reinforced by STH-MVRV dropping far below 1.0, placing nearly all recent buyers underwater in one of the weakest profitability zones on record.

The conditions that typically precede cyclical recoveries are now gradually aligning, though volatility may persist as weak hands continue their exodus from the market.

This insight came as ETFs are also bleeding, with BlackRock’s iShares Bitcoin Trust (IBIT) recording its largest single-day outflow since launch, as investors withdrew $523 million yesterday.

Whale Flight Leaves Retail Traders Exposed to Elevated Risk

CryptoQuant CEO Ki Young Ju highlighted structural weakness across Bitcoin’s futures market, noting that average order size shows futures whales have left while retail now dominates trading activity.

Inflows from spot to futures exchanges have collapsed, ending the season when whales posted BTC as collateral for long positions.

The estimated leverage ratio remains high even as Binance’s deposit cost basis sits at $57,000, meaning traders have already captured large gains from ETF and institutional flows.

Open interest still exceeds last year’s levels, yet aggregated funding rates remain neutral rather than fearful, suggesting complacency persists despite deteriorating conditions.

Coinbase Premium has fallen to a nine-month low, likely driven by ETF-related institutional selling that has produced three consecutive weeks of net negative flows.

Strategy’s mNAV stands at 1.23 while near-term capital raising appears difficult, compounding pressure on institutional demand channels.

Mixed Signals Emerge as Miners Complete Balance Sheet Adjustments

While Bitcoin has declined 21% from its recent peak of $119,771 to current levels around $91,869, miner behavior reveals strategic positioning rather than panic.

According to a CryptoQuant analyst, miners distributed coins on only 11 days versus 19 accumulation days over the past 30-day window, with volumes nearly balanced at 6,048 BTC sold against 6,467 BTC accumulated.

The most significant shift occurred in the last seven days, when Bitcoin saw a net accumulation of 777 BTC despite trading 12.6% lower than 30 days prior.

The 30-day net position has flipped back to positive territory at +419 BTC as of November 17th, suggesting vulnerable miners have completed necessary liquidations and are no longer a primary source of selling pressure.

Speaking with Cryptonews, Farzam Ehsani, Co-founder and CEO of VALR, warned that “to confirm the end of the rally, the market must fall below the $92,000 zone, which will be the final signal of a break in the structure.”

He added that “a breakout above $105,000 is necessary to return to a confident growth pattern,” emphasizing that selling on rebounds will remain the dominant strategy until clear resistance levels are breached.

Bitcoin’s realized cap growth has stalled for three days, while market cap is growing more slowly than realized cap, indicating sustained selling pressure.

The PnL Index flipped short on November 8th as whales take profits, with cycle theory suggesting a potential bottom around $56,000 near the realized price.

Despite current weakness, Ehsani noted that negative trends by mid-November have not eliminated positive expectations for December.

“A classic Santa Claus rally is possible if economic releases align and Fed communication softens,” he stated, suggesting Bitcoin may return to the $111,000–$116,000 range by year-end if ETF demand remains strong and macro conditions improve.

The Crypto Sentiment Index registered a value of 10 over the weekend, echoing lows from late February, while the Bitcoin Fear and Greed Index currently sits at 15, indicating extreme fear among market participants.

The post Paper Hands Exit Bitcoin as Fear Takes Hold – Volatility May Persist, Analyst Warns appeared first on Cryptonews.