Russia’s largest lender, Sberbank, is expanding its push into digital finance as it tests decentralized finance (DeFi) tools and rolls out investment products linked to cryptocurrencies.

Key Takeaways:

- Sberbank is testing DeFi tools and offering regulated crypto-linked investments.

- The bank is working with regulators to integrate crypto into banking infrastructure.

- Issuance of crypto-linked products has reached 1.5 billion rubles.

Speaking at the “FI Day. AI & Blockchain” conference in Moscow, senior Sberbank executives outlined a strategy focused on digital financial assets, blockchain infrastructure, and regulated access to crypto-linked investments.

The bank is also working on integrating with public blockchains, a notable step for a systemically important institution in Russia’s tightly controlled financial system.

Sberbank in Talks With Russian Regulators on Regulated Crypto Access

Anatoly Popov, deputy chairman of Sberbank’s management board, said the lender is already in active dialogue with the Bank of Russia and Rosfinmonitoring on how crypto-related services could fit within a regulated framework.

The goal, he said, is to allow qualified investors to access digital assets using familiar banking infrastructure, while ensuring investor protection and financial stability.

Sberbank has already begun testing DeFi instruments and expects traditional banking and decentralized finance to converge over time.

Within current regulations, the bank offers structured bonds and digital financial assets (DFAs) whose returns are tied to cryptocurrencies such as Bitcoin and Ether, as well as baskets of multiple digital assets.

These products allow clients to gain exposure to crypto markets without holding tokens directly.

JUST IN: RUSSIAN STATE OWNED BANK SBERBANK JUST SAID THEY ARE WORKING ON #BITCOIN AND CRYPTO SERVICES

GLOBAL FLOODGATES ARE OPENING. BULLISHpic.twitter.com/UcNjYkoKuu

— The Bitcoin Historian (@pete_rizzo_) December 16, 2025

The bank has also issued digital asset funds tracking indices linked to Bitcoin and Ether, along with a broader crypto infrastructure portfolio that includes assets such as Solana, Tron, Avalanche, and BNB.

In addition, Sberbank has launched several structured bonds, both on exchanges and over the counter, with yields linked to Bitcoin and Ether indices.

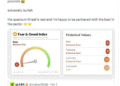

The total volume of these crypto-linked instruments has reached about 1.5 billion rubles, which Popov described as a strong result for a nascent market.

While Sberbank does not view cryptocurrencies as a speculative investment for its own balance sheet, it has signaled readiness to act as a liquidity provider and market maker on regulated platforms once clear rules are in place.

The bank estimates that crypto adoption among Russians remains high, with the central bank projecting digital asset holdings in domestic wallets could reach hundreds of billions of rubles by early 2025.

Sberbank is Building its Own Blockchain

Alongside crypto-linked products, Sberbank is continuing to build its own blockchain platform for issuing and managing digital financial assets.

The platform, developed internally, supports smart contracts and tokenization tools for corporate clients and has already been used to issue digital assets linked to commodities and cryptocurrency indices.

Looking ahead, Sberbank sees stablecoins, tokenized assets, and greater interoperability between private and public blockchains as key trends.

Executives said the bank is particularly interested in public networks with mature smart contract ecosystems, such as Ethereum, though broader integration will depend on regulatory clarity.

In March, Sberbank launched a blockchain technology-powered token that tracks global cocoa prices.

The post Russia’s Sberbank Tests DeFi Tools, Offers Crypto Investment Products appeared first on Cryptonews.