Democratic Senators Elizabeth Warren and Richard Blumenthal launched a direct challenge against Meta’s CEO Mark Zuckerberg, sending a formal letter on Wednesday demanding comprehensive disclosure about the tech company’s revived interest in stablecoin payment systems.

The timing of this congressional inquiry proves particularly significant, as the Senate prepares to vote on upcoming stablecoin regulation legislation.

The lawmakers argue that, given Meta’s enormous market influence, it has become imperative for both Congress and the American public to gain complete transparency regarding the company’s cryptocurrency ambitions.

Why Warren Calls Meta’s Stablecoin a ‘Monopolistic Threat’ to the US Economy

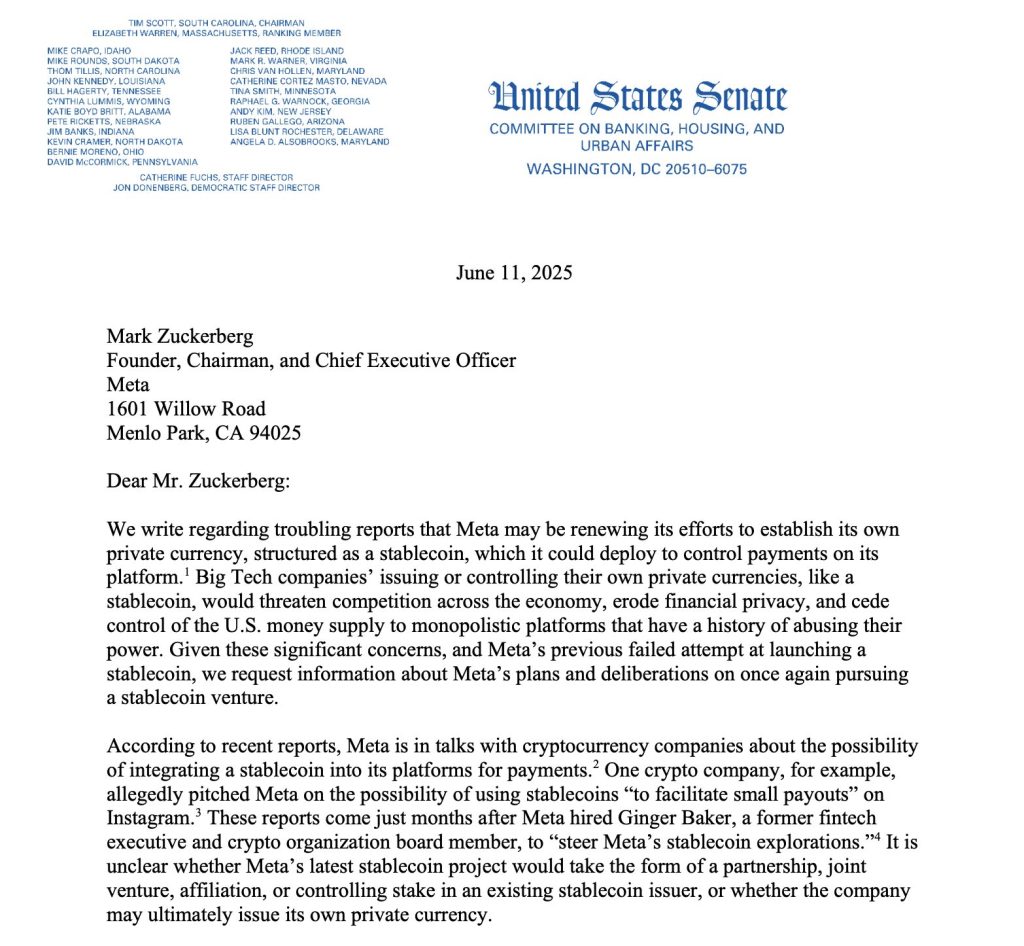

In their June 12 correspondence, the senators articulated their concerns about the broader implications of technology giants entering the digital currency space.

“Big Tech companies’ issuing or controlling their own private currencies, like a stablecoin, would threaten competition across the economy, erode financial privacy, and cede control of the U.S. money supply to monopolistic platforms that have a history of abusing their power,” the senators wrote.

Zuckerberg has been given a five-day deadline until June 17 to provide detailed responses to eight specific inquiries about Meta’s stablecoin strategy.

These questions encompass which external companies Meta has engaged for consultation and whether the corporation is actively considering developing its own stablecoin.

The senators are also seeking information about Meta’s lobbying activities regarding cryptocurrency legislation and the company’s stance on potential amendments that would prevent “Big Tech” firms from controlling stablecoin issuers.

Warren and Blumenthal referenced Meta’s previous ventures into digital currency through the Libra and Diem projects, which debuted in 2019.

These initiatives ultimately failed due to overwhelming regulatory pressure and opposition from both political parties, leading to the sale of all related assets by 2022.

Will the GENIUS Act Hand Stablecoin Control to Big Tech? Senate Vote Sparks Fury

The letter also highlights concerns about potential regulatory exceptions that could benefit Meta.

The senators worry about President Donald Trump potentially granting the company a waiver under the GENIUS Act, which could allow Meta to circumvent regulations other stablecoin issuers must follow.

#DontMessWithMedicaid

(The Genius Act Page 2 of 2)

The bill also includes a giant carve-out to ensure Musk’s social media platform X, formerly Twitter, would not be covered by even modest restrictions,

thereby “gifting the President’s closest Big Tech ally a competitive…— Harold Katlin (@HaroldKatl3281) June 9, 2025

The lawmakers warned about privacy implications if Meta were to control its stablecoin infrastructure.

“If Meta controlled its own stablecoin, the company could further pry into consumers’ transactions and commercial activity,” the senators wrote.

This congressional investigation stems from a May 8 report revealing that Meta has been discussing incorporating stablecoins into its platform ecosystem with various cryptocurrency companies, including Instagram, Facebook, and WhatsApp.

At the time of initial reporting, it remained uncertain whether Meta intended to partner with established stablecoin providers like Tether or Circle or planned to develop its own proprietary solution.

Meta Says ‘No Stablecoin’ — But Senators Found Evidence of Secret Crypto Talks

Meta communications director Andy Stone responded to the May reports by confirming that the Diem project had been permanently discontinued, stating that Diem is “dead” and that there was “no Meta stablecoin.”

To be clear: as Mark said (and as the story notes), Diem is “dead.” There is no Meta stablecoin. https://t.co/U1DN2VXM9Q

— Andy Stone (@andymstone) May 8, 2025

However, subsequent reporting by Fortune suggested that Meta was actively negotiating with multiple cryptocurrency firms regarding stablecoin payment integration.

Drawing from available information, Meta’s primary interest lies in the practical advantages of stablecoins over traditional fiat currencies, particularly regarding cost-effective international transfers and cross-border payments.

Circle’s Senior Director of Business Development Matt Cavin, who previously held an executive position at Web3 gaming company Immutable until March, is reportedly spearheading the discussions.

"We are crossing the chasm from early adopters to mainstream acceptance (of stablecoins)." – @jerallaire, co-founder of @circle

"The laws and regulations of a publicly traded company matter in terms of trust, transparency, compliance, and governance."

"We're a market-neutral… pic.twitter.com/UaBmq51WV1— TBPN (@tbpn) June 6, 2025

Additionally, Ginger Baker, whom Meta recruited as Vice President of Product in January, is said to be contributing to the stablecoin initiative.

Baker brings significant cryptocurrency expertise, having served on the board of the Stellar Development Foundation and previously working as a senior director of products at Ripple.

The post Senators Warren and Blumenthal Go to War Against Meta’s New Stablecoin Scheme, Calling it a ‘Threat’ appeared first on Cryptonews.