U.S. spot Solana exchange-traded funds logged another strong performance this week, recording $58 million in daily net inflows on Monday, their highest level since early November.

The latest figures extend Solana’s streak of 20 consecutive days of positive inflows, marking one of the most resilient ETF runs seen in the digital asset market this year.

the unbroken streak of daily inflows to the solana etf (topped off by a record day of inflows) is greatly under appreciated.

thank you for your attention to this matter https://t.co/8ItbDL85JO— raj

(@rajgokal) November 25, 2025

Solana ETFs Surge While Bitcoin and Ethereum Shed Billions in Monthly Outflows

According to data from SoSoValue, the inflows were led by Bitwise’s BSOL, which drew $39.5 million on the day, the third-largest single-day inflow since the products launched in late October.

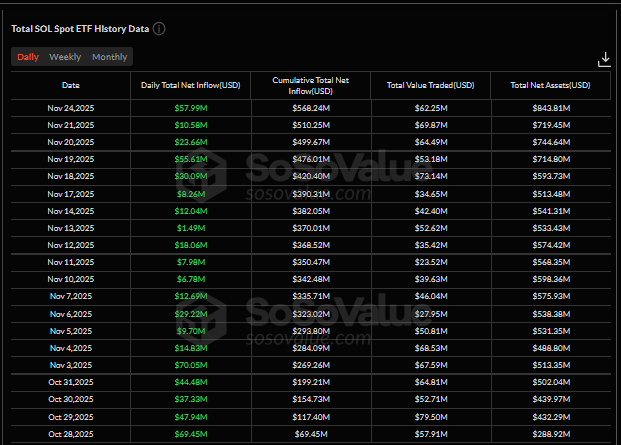

That pushed total net inflows for Solana ETFs to $568.24 million since debut, while combined net assets climbed to $843.81 million, equal to 1.09% of Solana’s market capitalization.

The sustained activity stands out sharply against the broader market backdrop, where both Bitcoin and Ethereum ETFs have faced weeks of heavy redemptions.

Bitcoin ETFs recorded a monthly outflow of $3.70 billion between November 3 and November 24, while Ethereum ETFs saw an outflow of $1.64 billion during the same period.

Solana remains the only major asset to post persistent inflows throughout November, attracting $369 million over the past three weeks as BTC and ETH funds continued to lose capital.

Analysts say recent flows point to a broader shift in how institutions are positioning themselves in the digital asset market.

Solana’s ETF has performed far better than early forecasts, which expected slower traction amid the recent downturn.

According to market researchers, the consistent inflows signal that Solana is increasingly being viewed as a “blue-chip” asset. They noted that this steady capital base could help provide support even as risk appetite across the crypto sector weakens.

Observers also noted the growing number of traditional finance firms choosing Solana for tokenization efforts. Projects such as xStocks, which brings U.S. equities and ETFs on-chain, were cited as examples of rising institutional activity.

Even so, analysts warned that ETF strength does not guarantee immediate price appreciation. SOL remains heavily influenced by broader market sentiment, and any sustained reaction in the token may take longer to materialize.

Solana ETFs Approach $1B AUM After Strong Weekly Inflows

Across individual issuers, Bitwise’s BSOL remains by far the dominant product, with $567.10 million in net assets.

Grayscale’s GSOL follows at $117.90 million, after taking in $4.66 million in new capital on Monday.

Fidelity’s FSOL and VanEck’s VSOL also recorded some of their highest single-day inflows to date, with $9.7 million and $3.1 million, respectively, while 21Shares’ TSOL and Canary’s SOLC continued to report positive but moderate activity.

Over the six-day window between November 17 and November 24, Solana ETFs added $177.93 million in new capital, rising from $390.31 million in cumulative inflows to $568.24 million.

Meanwhile, the total AUM of Solana ETFs is nearing a major milestone. With combined assets now above $870 million, the products are on track to reach $1 billion in the near term.

A new inflow catalyst is also approaching: Franklin Templeton’s Solana ETF, which has not yet launched, is expected to bring additional institutional demand once approved.

The flows contrast sharply with weakening market conditions. SOL remains down 30% in the past 30 days, and recent trading has shown declining volume and negative perpetual funding rates.

The token is trading around $137, down 1% on the day and 13% in the past two weeks.

In January 2025, JP Morgan originally forecasted that Solana ETFs could see between $3-6B in inflows within their first 6-12 months. The bank re-evaluated its position in October, changing its projections to ~$1.5B in the first year.

Technical indicators show that SOL is still locked in a broader corrective phase. Analysts tracking the asset’s Elliott Wave structure say the market may be moving through a deeper Wave C decline, with potential downside targets between $80 and $95 if current support levels fail.

The token is also trading below its 200-day EMA, a condition often associated with extended consolidation periods.

The post Solana ETF Inflows Hit Record $58M With Consecutive Weekly Gains — Here’s What Solana’s Founder Just Said appeared first on Cryptonews.