Sony has taken Wall Street by surprise after its banking division, Sony Bank, filed an application with the U.S. Office of the Comptroller of the Currency (OCC) to establish a national crypto bank under its subsidiary “Connectia Trust.”

The move positions the Japanese tech giant to become one of the first major global corporations to issue a U.S. dollar–backed stablecoin through a federally regulated institution.

The application outlines plans to issue a U.S. dollar-pegged stablecoin, maintain the reserve assets backing it, and provide digital asset custody and management services.

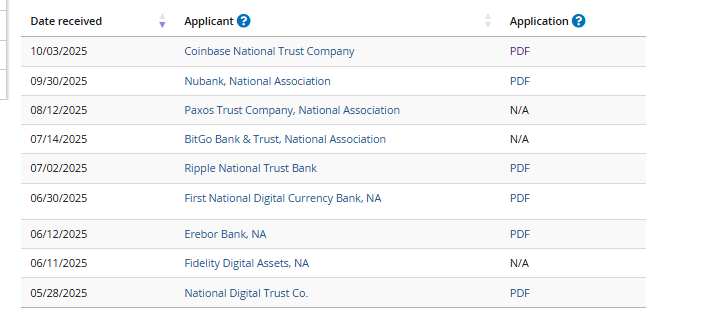

The filing places Sony alongside an elite list of firms, including Coinbase, Circle, Paxos, Stripe, and Ripple, currently awaiting OCC approval to operate as national digital banks.

If approved, Sony would become the first major global technology company to receive a U.S. bank charter specifically tied to stablecoin issuance.

The move shows how far stablecoins have evolved from a crypto niche to a mainstream financial instrument, particularly after the U.S. passed the GENIUS Act, a bill that established a unified federal framework for stablecoin issuers, requiring full backing by cash or Treasuries and ensuring token holder redemption rights.

Is the OCC Quietly Opening the Door to a New Era of Crypto Banking?

According to Sony’s filing, Connectia Trust plans to issue a USD-pegged stablecoin, hold corresponding reserves in cash or Treasuries, and provide digital asset custody and management services.

The company said these activities fall within the OCC’s previously approved scope of permissible national bank operations.

“During its initial phase, Trust Bank intends to engage in digital asset activities that the OCC has found permissible under existing national bank legal authorities,” Sony Bank wrote in its application.

“These include the issuance of dollar-pegged stablecoins and maintenance of corresponding reserve assets, non-fiduciary digital asset custody services, and fiduciary asset management for affiliates.”

So far, Anchorage Digital Bank remains the only crypto-native institution to secure a full de novo OCC charter, though it faced compliance challenges that led to a temporary cease-and-desist order in 2022, later lifted this August.

The OCC, an independent bureau of the U.S. Treasury, plays a crucial role here. It is the only regulator that can issue a national bank charter, allowing a firm to legally operate banking activities across all U.S. states under one license.

An OCC charter has become a prized gateway to legitimacy, granting crypto firms access to the Federal Reserve’s payment systems and establishing credibility with institutional partners.

The US Senate has confirmed former crypto exec Jonathan Gould as OCC chief in a 50–45 vote, naming him the first permanent head since 2020.#OCC #JonathanGould https://t.co/ipM7YhaG8B

— Cryptonews.com (@cryptonews) July 11, 2025

The OCC has received over 15 applications from fintech and crypto entities seeking trust charters, a sign of renewed regulatory openness under OCC chief Jonathan Gould, a former blockchain executive confirmed earlier this year.

Gould, who previously served as chief legal officer at Bitfury, has publicly emphasized that the OCC “does not impose blanket barriers” to banks engaged in digital asset activities.

His confirmation marked a policy shift: in May, the OCC issued new guidance explicitly allowing national banks to buy, sell, and custody cryptocurrencies on behalf of clients, provided they meet safety and risk management standards.

That change has transformed the OCC into a more crypto-friendly regulator under the Trump administration, following several years of hesitation.

The OCC clears the way for banks to handle customer-held crypto, buy and sell assets, and outsource custody services to third parties. #Banking #DigitalAssetshttps://t.co/SUIKNLycQD

— Cryptonews.com (@cryptonews) May 8, 2025

Notably, the agency recently approved Erebor Bank for conditional national status, showing a willingness to back digital-first institutions once again.

Could Sony’s Connectia Trust Redefine How Big Tech Enters Crypto Banking?

The regulation clarity has sparked a surge of new OCC applications from financial and tech firms hoping to capitalize on what has become one of crypto’s most lucrative markets.

The total stablecoin market capitalization now exceeds $300 billion, dominated by Tether (USDT) and Circle’s USD Coin (USDC), according to DefiLlama.

Forecasts suggest the market could drain $1 trillion from global banks by 2028, making Sony’s entry well-timed for a fast-growing segment of the digital economy.

If approved, Connectia Trust would join a new generation of federally chartered digital asset banks.

The implications go beyond finance. Sony Bank, already known for steady profits from mortgage lending and foreign currency operations, has been expanding aggressively into digital banking.

Earlier this year, it launched a next-generation banking system and the Sony Bank CONNECT app, designed to link its services with other Sony Group platforms and Web3 infrastructure.

Analysts believe the stablecoin initiative could lay the foundation for Sony’s broader ecosystem strategy.

Like JPM Coin, Connectia Trust’s tokens may initially operate as closed-loop settlement assets, used internally for treasury transfers, cross-border payments between subsidiaries, or digital transactions within Sony’s entertainment network.

That could mean stablecoin-powered payments across PlayStation, Sony Music, and Sony Pictures, or instant settlement between Sony’s international branches.

Such integration would give Sony an edge in programmable money applications, aligning its financial arm with its global entertainment and gaming businesses, a potential first for a consumer tech conglomerate.

Notably, Sony has been active for a while in the blockchain sector. In January, Sony Group launched Soneiun, an Ethereum layer-2 network built in partnership with Startale Group, extending its reach into decentralized infrastructure.

The company had first teased the project in 2023, and the chain now holds over $75.87M in total locked value.

The post Sony Shocks Wall Street: Tech Giant Seeks U.S. Bank License to Issue Its Own Stablecoin appeared first on Cryptonews.