South Korean banks are refusing to follow the nation’s crypto exchanges into a “deposit rate war” as platforms scramble for market dominance.

Per Daehan Keumyoong Shinmun, banks think they have “no reason” to “become active” as leading crypto trading platforms try to outdo each other in a bid to win more customers.

South Korean Banks ‘Indifferent’ to Crypto Exchange Competition

Under the terms of the Virtual Asset User Protection Act, which came into force last month, crypto exchanges that offer crypto-fiat trading must store and manage their customers’ deposits in dedicated bank accounts.

The act also obliges exchanges to pay interest to their customers if they hold cash deposits. However, exchanges are free to adjust the level of the interest rates they offer their clients.

And this, in turn, has seen platforms try to win over more customers with ever-more competitive interest rates.

However, the media outlet reported that South Korea’s top banks “appear to be indifferent” to exchanges’ “deposit interest rate wars.”

An unnamed official at a South Korean banking group explained:

“Even if other businesses compete to sell products similar to bank accounts, there are inherent disadvantages, such as the fact that the Depositor Protection Act does not apply to them. In terms of brand awareness and trust in asset protection, banks still reign supreme.”

Interest rates on acquisition financing in S.Korea have dropped to the pre-pandemic level in the 5% range, paying the way for active M&A deals in the country. #bank_loans #interest_rates #Hyosung_Chemical #DIG_Airgas #DN_Solutions #Ecorbit https://t.co/pkc2XwbPw8

— The Korea Economic Daily (@kedglobal) August 15, 2024

Another banker claimed that the Cost of Funds Index, the benchmark lending rate for mortgage loans, has “recently been on a downward trend.”

And this fact, the banker claimed, meant that it would be “difficult” for commercial financial institutions to raise deposit interest rates in the short term.

Banks Keen to Work with Crypto Exchanges

However, another official warned banks that as fintech “becomes easier to access, some “investors’ funds” are moving to “places with more favorable conditions.”

The same expert claimed that banks “still have a solid position in long-term deposits.” However, the expert noted that “short-term investment funds that can be deposited and withdrawn at any time” could move to “other industries with much more favorable interest rates and limits.”

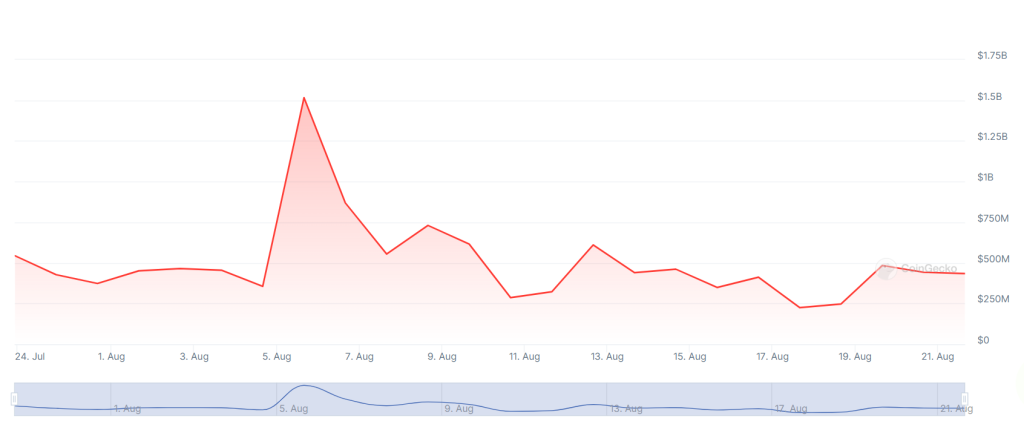

In late July, exchanges engaged in what some media outlets called “an unprecedented late-night scramble” over interest rates in “an effort to outdo each other.”

South Korea’s early trade data showed exports gaining momentum this month, suggesting global demand for semiconductors remains resilient https://t.co/NZejLZKE5K

— Bloomberg Markets (@markets) August 21, 2024

The “scramble” saw market leader Upbit announce a yearly interest rate of 1.3%. A mere 90 minutes later, its biggest rival Bithumb announced a 2% rate.

Upbit responded less than an hour later by cranking its own rate up to 2.1%, with Bithumb then raising its rate to 2.2%.

Another member of the “big four” fiat-trading crypto exchanges, Korbit, waded into the “war” shortly after, announcing a rate of 2.5%.

South Korean banks hike mortgage rates amid surging household debt https://t.co/bj4VPTZK6B

— Jeongmin Kim (@jeongminnkim) August 20, 2024

The final member of the “big four,” Coinone, has this week attempted to outdo all of its rivals.

Hanguk Kyungjae reported this week that the exchange is offering its clients an interest rate of 2.3%, in addition to doing away with withdrawal fees until September 19.

Despite their alleged indifference to competition in the crypto sector, exchange-related pressure is increasing on South Korean banks.

Reports have circulated this month, claiming that Kookmin (KB) Bank has convinced Bithumb to dump a long-standing partnership with rival NongHyup in favor of a KB deal.

Experts say KB wants to court younger customers, and thinks partnering with Bithumb will help it win new clients aged 20-39.

The post South Korean Banks ‘Won’t Follow Crypto Exchanges into Deposit Interest Rate War’ appeared first on Cryptonews.