The South Korean crypto group is going through a tense Lunar New 12 months break, specialists are claiming, because the 12 months’s longest vacation coincides with a key time for Bitcoin (BTC) and altcoin markets.

Per Seoul Shinmun, South Korean crypto merchants are “troubled.” They’re involved by the truth that the vacation “overlaps with the US Federal Reserve’s upcoming base charge choice,” the outlet wrote.

South Korean Crypto Neighborhood: Time to HODL, Promote, or Purchase?

As such, the outlet reported, home merchants are not sure if they need to maintain, pre-emptively promote, and even purchase cash in the course of the vacation.

This 12 months, Lunar New 12 months falls on January 29. However in South Korea – as the times previous to and following New 12 months’s Day are additionally public holidays – most companies are additionally giving their staff the time without work on Monday (27) and Friday (31).

That signifies that, together with the 2 weekends, most staff have 9 days off this 12 months. However whereas the South Korean inventory market can be inactive in the course of the holidays, the 24/7 nature of crypto means no such slowdown is anticipated within the coin markets.

The media outlet mentioned Upbit crypto trade information reveals home Bitcoin and Ethereum (ETH) costs trended upward “in the course of the Lunar New 12 months vacation for the previous three years.”

Korea began the Lunar New 12 months vacation with scattered rain and snow flurries on Monday, though most areas have seen only some snowflakes.

https://t.co/DxMw9syGcV— The Korea JoongAng Each day (@JoongAngDaily) January 27, 2025

Vacation Uncertainty for Merchants

Kim (first title withheld) is a Seoul-based crypto dealer. He advised Cryptonews.com that the vacation interval would possible be filled with “uncertainty” this 12 months. Kim mentioned:

“It will likely be a little bit of a nail-biting time if the Fed or US President Donald Trump make bulletins. In that case, the South Korean market will in all probability reply quick. However merchants are all the time prepared for volatility within the markets. We simply have to remain alert. That’s the character of buying and selling crypto.”

The vacation interval, nevertheless, has additionally seen vital drops. These have included situations of day-on-day drops of as much as 5%.

For South Korean merchants, nearly every part will hinge on occasions within the USA, the media outlet reported.

Home regulators and politicians are unlikely to make any main bulletins in the course of the holidays.

So occasions in Washington will possible be the driving power behind any worth actions on home platforms.

Seoul Shinmun famous that “for the reason that election of Trump,” curiosity “in cryptocurrency funding has elevated in South Korea.”

The Fed is broadly anticipated to freeze its present benchmark rate of interest of 4.25-4.50% on the Federal Open Market Committee assembly, which kicks off on January 28.

South Korea is present process an unprecedented political disaster with impeached President Yoon going through one authorized continuing that might oust him from workplace and one other that brings a doable dying penalty. Right here's what to know. https://t.co/jKB92C62QD

— Bloomberg Politics (@bpolitics) January 27, 2025

Consultants Converse

The crypto providers supplier Matrixport advised the identical media outlet:

“Prior to now 12 years, Bitcoin has risen 11 occasions in the course of the Lunar New 12 months vacation interval. Adverse components such because the Fed’s hawkish stance are placing downward stress on the markets. However constructive components, like expectations a couple of forthcoming strategic Bitcoin reserve within the US, are supporting BTC costs. So there’s a excessive chance of a rise within the days following the Lunar New 12 months vacation.”

An unnamed home crypto trade worker advised Seoul Shinmun:

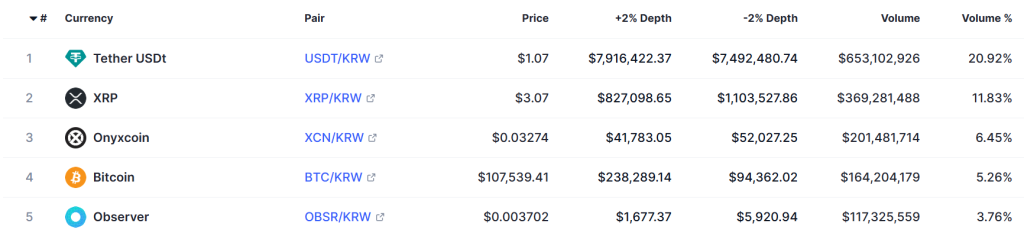

“Since Trump’s election, market liquidity has elevated quickly. And South Korean buying and selling volumes right here have elevated to a degree surpassing that of the inventory market. The crypto market operates 24 hours a day and is extremely risky. So individuals can be clever to take a cautious method.”

The publish South Korean Crypto Traders Face ‘Nail-biting’ Lunar New 12 months Conundrum appeared first on Cryptonews.