Liquidity within the cryptocurrency market has surged, with the entire market capitalization of stablecoins not too long ago surpassing $200 billion. This improve has traditionally preceded value rallies.

When the liquidity impulse grows, a rally often follows.

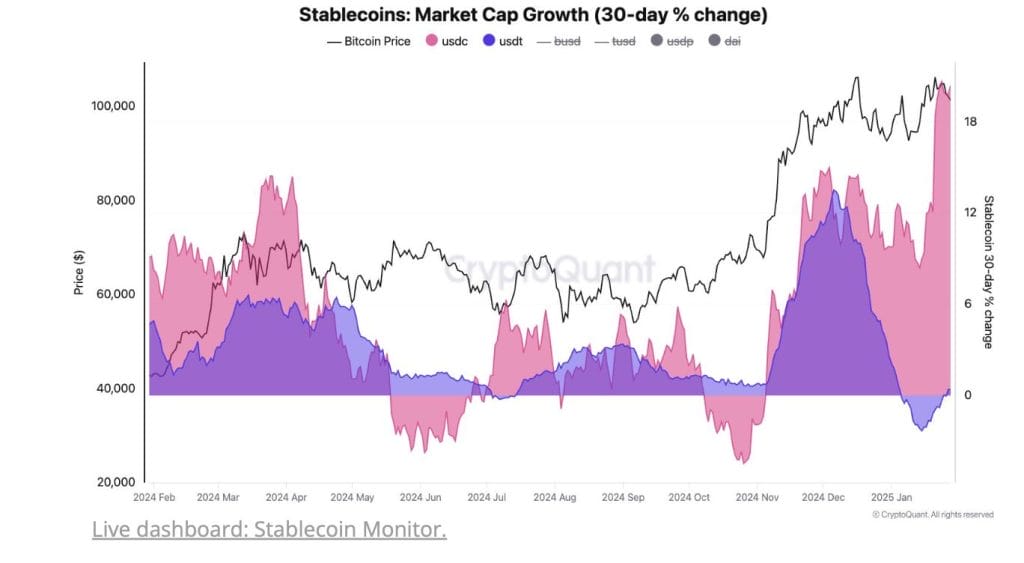

USDT’s 30D market cap simply turned constructive (after contracting -2%), whereas USDC is surging 20%—its quickest tempo in a yr.

If stablecoin momentum continues, larger costs could also be subsequent. pic.twitter.com/fD8sQkKSKM— CryptoQuant.com (@cryptoquant_com) January 30, 2025

In line with information from CryptoQuant, stablecoin liquidity has elevated because the U.S. presidential election, with main stablecoins like Tether’s USDT and Circle’s USDC main the growth.

Market Cap Hits Report Excessive Amid Rising Liquidity

The entire worth of USD-denominated stablecoins reached an all-time excessive of $200 billion final week. Since then, it has grown additional to $204 billion, representing a rise of $37 billion since November 4.

CryptoQuant reviews that this surge in stablecoin liquidity displays rising investor confidence, which has traditionally catalyzed crypto market upswings.

The growth has been primarily pushed by Tether’s USDT, the dominant stablecoin out there. Nevertheless, USDC, which had been shedding market share, is now regaining traction.

A rising stablecoin provide usually signifies elevated shopping for energy for merchants, fueling demand for cryptocurrencies like Bitcoin and Ethereum.

One other key indicator of market liquidity, in accordance with CryptoQuant, is the amount of stablecoins held on centralized exchanges.

The entire worth of USDT on these platforms has risen from $30.5 billion on November 4 to $43 billion, a rise of about 41% ($12.5 billion).

Extra stablecoins on exchanges present that merchants have massive quantities of capital readily available to deploy into crypto belongings.

Such liquidity inflows have usually preceded main value rallies, as merchants convert stablecoins into unstable belongings to hunt positive aspects.

USDT and USDC Lead the Stablecoin Growth

Stablecoin liquidity impulse, measured because the 30-day proportion change in market capitalization, has turned constructive.

CryptoQuant analysts counsel this will likely sign an upward transfer in Bitcoin and the broader crypto market.

USDT’s liquidity impulse had been contracting by 2% at first of 2024 however has now turned barely constructive, hinting at an uptick in crypto demand.

In the meantime, USDC’s liquidity impulse has expanded by 20%, the quickest progress charge in a minimum of a yr.

Tether’s USDT stays the dominant participant, with its market capitalization reaching $139 billion, rising by $19 billion (15%) since November 4.

In the meantime, USDC has skilled a robust comeback, rising by $17 billion (48%) over the identical interval to succeed in a market cap of $52.5 billion.

The rise in liquidity and buying and selling capital has traditionally coincided with crypto market rallies.

If previous developments proceed, an increasing stablecoin provide might contribute to elevated market exercise in Bitcoin and different digital belongings.

The submit Stablecoin Growth to Drive the Subsequent Crypto Rally as Market Cap Hits $200B: CryptoQuant appeared first on Cryptonews.