Key Takeaways:

- Botanix cofounder Alisia Painter says the stablecoin market will exceed $1 trillion in 2026.

- Growth to be driven by institutional adoption, new yield-bearing tokens and cross-border payments.

- Over 20% of all active stablecoins will offer embedded yield or programmability features next year.

The stablecoin market will more than triple to reach $1 trillion in circulation next year, spurred by institutional adoption, new yield-bearing tokens and stronger cross-border payments, according to one industry executive.

“The biggest shift will be from static stablecoins to yield-bearing stablecoins and synthetic dollars backed by real assets,” Alisia Painter, co-founder and chief operating officer of Bitcoin DeFi builder Botanix Labs, told Cryptonews.

“More than 20% of all active stablecoins will offer embedded yield or programmability features [in 2026]. This trend will accelerate cross-chain settlement, payroll, and international commerce.”

Painter users will start to “treat digital dollars as savings instruments rather than static balances, especially in ecosystems anchored to Bitcoin where users already view on-chain assets as long-term stores of value.”

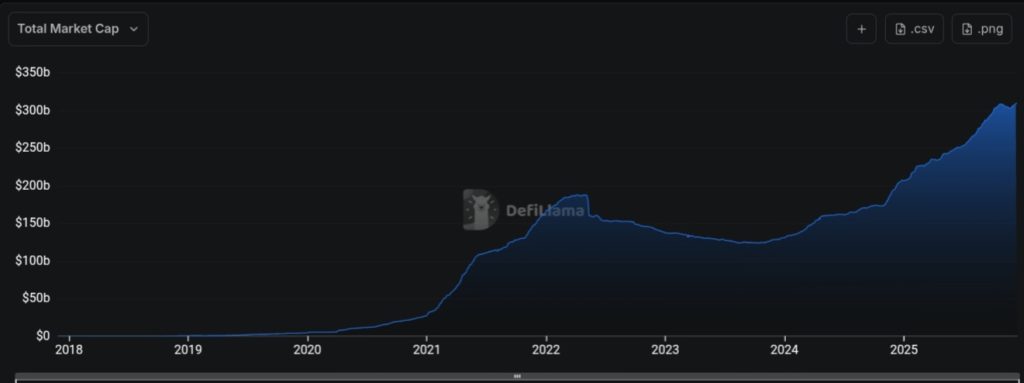

The stablecoin market is currently worth $310 billion, an all-time high, according to Defillama. Tether’s USDT dominates, accounting for 60%, or $186 billion, of market share, followed by Circle’s USDC at $78.5 billion.

Ethena’s so-called “synthetic dollar” USDe ($6.6 billion), Sky Dollar’s USDS ($6.4 billion), and MakerDAO’s DAI ($4.6 billion) round out the top five largest dollar-pegged stablecoins.

Painter says while stablecoins will continue to grow as a sub-sector, focus is moving into programmable instruments that can be embedded in payment systems, tokenized Treasury products and fintech apps.

“Institutions will demand stablecoins that do more than sit idle, and yield models anchored in Bitcoin-based collateral will become more popular,” she said, adding:

“Institutions and fintech platforms are integrating stablecoins as payment and settlement tools. Circle processed more than $12 trillion [in USDC] on-chain transaction volume in 2023, demonstrating how quickly stablecoins are becoming mainstream financial infrastructure.”

From Static Stablecoins to Programmable Dollars

Another key driver is the rise of tokenized U.S. Treasuries, whose supply exceeded $3 billion this year, a 10x increase in about two years, showing “significant institutional appetite for yield-backed digital dollars.”

The demand for high-yield, blockchain-settled assets is underpinned by synthetic dollars such as USDe and USDf – stablecoins that do not rely on physical dollars or government debt to maintain their dollar peg. Instead, they combine assets like Ethereum or Bitcoin with derivatives positions.

Painter said upgrades at major blockchains, including new Bitcoin-based networks and Ethereum scaling systems, have reduced fees and boosted speed, “making stablecoins more practical for everyday payments.”

She spoke about how growth will not come simply from more usage, but newer stablecoin designs that put yield directly into balances.

“Users will no longer need to move between a stablecoin and a separate yield product. The stablecoin performs both functions [accruing return].”

Yield-bearing stablecoins are particularly attractive in emerging markets battling high inflation — economies where dollar-denominated savings already play a huge role, said Painter, who has been involved with Bitcoin since 2015.

“In markets where annual inflation exceeds 20%, a yield-bearing dollar becomes a natural default for both personal savings and small business treasury management, and it often acts as an entry point into Bitcoin.”

Stablecoins are a lifeline for people in Nigeria who send money across borders and trade. Traditional remittance channels charge up to 7% in fees, but crypto cuts those costs in a big way, according to a Chainalysis adoption report.

Crypto adoption is also rising in Southeast Asia. The Philippines, where remittances account for about 9% of GDP, has seen more than a million merchants accept stablecoins through mobile wallet-linked platforms.

It’s a change that’s affecting Bitcoin-based decentralized finance (DeFi), Painter tells Cryptonews. Lending markets will need to adjust for the fact that their baseline collateral, the stablecoin itself, earns yield, she stated.

Automated market makers will need new pricing models that account for continuous stablecoin interest accrual, the Botanix COO added.

“New primitives designed specifically for Bitcoin-based financial systems will emerge, including products that separate principal and yield streams or combine stable yield with native Bitcoin incentives.”

However, new stablecoin functions also come with technical and regulatory challenges.

Regulatory and Technical Challenges

“Yield-bearing products require more granular and more frequent reporting, including duration of assets, counterparty exposure, and proof that user assets are segregated,” Painter detailed.

Draft U.S. legislation may restrict certain forms of interest distribution to retail users, she said. On the technical side, questions remain about how yield is delivered on-chain, how interest rates are updated, and how the assets interact with DeFi lending and automated market systems.

“Poorly designed yield logic could create accounting issues across DeFi.”

Didier Lavallée is the founder and CEO of Canadian crypto company Tetra Digital Group. Tetra is developing CADD, a fully-regulated stablecoin, with backing from the National Bank of Canada, Shopify and Wealthsimple.

Speaking to Cryptonews, Lavallée said 2026 will be the year when non-USD stablecoins grow in adoption and volume, driven by increased regulatory clarity across the world.

“More and more countries are adopting frameworks and regulations to allow for innovation. It’s only a matter of time before stablecoin ecosystems fragment into regional and local markets.”

Stablecoin oversight advanced sharply in 2025, with frameworks such as Europe’s MiCA, the U.S. GENIUS regulatory blueprint and recent guidance from the U.S. Office of the Comptroller of the Currency (OCC).

“Banks now have a clearer framework for how they can hold stablecoins for network fees, offer custody, and participate directly in blockchain networks,” said Kevin Lehtiniitty, CEO of stablecoin payments network Borderless.xyz, in an interview with Cryptonews.

“Around the world, regulators are publishing similar roadmaps focused on payments innovation and stablecoin integration,” he added. Lehtiniitty expects the trend to continue in 2026, as more institutions enter the market.

2025: A Breakout Year for Stablecoins

Borderless has started to integrate directly with banks and stablecoin issuers, the CEO said, expanding its coverage across new corridors, to align with the changing regulatory environment.

The company also launched a public benchmark, which shows stablecoin-to-fiat foreign currency (FX) rates to increase transparency in a market long criticized for opaque trading. Borderless tracks real-time FX spreads across stablecoin venues.

“Our goal is to ensure partners can access safe and regulated liquidity as stablecoins become more embedded in global cross-border payments,” Lehtiniitty said.

He predicts a bifurcated FX market next year as liquidity deepens.

“We generally see two types of liquidity providers,” he noted. “‘Bare-metal’ venues competing [on the narrowest possible spreads], and ‘orchestrator or aggregator’ venues that focus on premium features and functionality.”

As liquidity grows, spreads in low-cost venues are tightening, making stablecoin FX increasingly competitive with traditional fiat payments.

Lehtiniitty said the amount of spread charged will continue to fragment as companies explore different strategies.

“For payment companies and fintechs, it will be increasingly important to have multi-venue connectivity and execution capabilities.”

Meanwhile, 2025 was a breakout year for stablecoins, experts say. Key milestones included:

- Regulatory clarity across the U.S., Europe, and emerging markets.

- Stablecoin issuers going public, signaling market maturity.

- A surge in institutional adoption, from banks to global fintechs. More than 80% of banks have a digital asset strategy in place.

- Record usage in cross-border payments and trading.

“We believe that these developments are setting the stage for stablecoins to become an essential financial instrument in 2026 as well as more use cases for it,” said Borderless’ Lehtiniitty.

The post Stablecoins to Reach $1 Trillion in 2026 Spurred by Yield Tokens: Expert appeared first on Cryptonews.