Each bull cycle has a dominant narrative — and this time, it facilities on feverish expectation that the U.S. will create a strategic Bitcoin reserve.

The notion of an financial superpower investing on this cryptocurrency was as soon as a pipe dream, however gained momentum when Donald Trump made it one in every of his marketing campaign pledges… and received the election.

However what precisely would all of this contain? How might it have an effect on Bitcoin’s worth? And can this spark a world race that’ll see different nations clamor to construct their very own stockpiles?

What’s a Strategic Bitcoin Reserve?

Supporters argue it is a Twenty first-century model of stockpiles created for different commodities with restricted provides.

Again within the Nineteen Seventies, the U.S. created a Strategic Petroleum Reserve — and commenced storing huge portions of crude oil in underground caverns, petrified of financial ramifications ought to provides run low.

This large community has the potential to carry as much as 713.5 million barrels of crude oil, with the most recent figures suggesting it’s at about 50% capability. The president can permit this oil to be offered if there’s provide disruption — and permit producers to retailer reserves securely in instances of low demand.

The rationale for making a strategic Bitcoin reserve is that it might provide “a hedge in opposition to financial uncertainty and financial instability.” Cussed inflation and the specter of de-dollarization have fueled considerations about the way forward for the dollar.

It’s price noting that the U.S. has maintained greater than 8,000 tonnes of gold reserves for many years — once more as a defend in opposition to market volatility — and Bitcoiners have lengthy argued this digital asset is a type of “digital gold.”

What Would a Bitcoin Strategic Reserve Look Like?

That’s an excellent query, and it’s fairly unclear at this level.

The U.S. authorities at present owns about 200,000 BTC seized from criminals — however moderately than being held as an funding, it’s been commonly auctioned off, seeing Uncle Sam miss out on billions in earnings.

Trump has instructed that this could possibly be used as the place to begin for creating his strategic Bitcoin reserve, however authorized questions stay — particularly in the case of shifting it out of the Justice Division.

The forty seventh president’s motivation seems to heart on gaining a first-mover benefit over China, and the nations embracing digital belongings.

Some Republican lawmakers need this coverage to go even additional, particularly Wyoming’s pro-crypto Senator Cynthia Lummis, who was an early investor in Bitcoin.

Final summer time, she unveiled the BITCOIN Act, which calls on the U.S. to accumulate a jaw-dropping 1 million BTC over the following 5 years. That’s about 5% of this cryptocurrency’s whole provide of 21 million. To place that determine into context, this may appeal to a price ticket of $100 billion, assuming a single coin was price $100,000.

This could include strict guidelines that the Bitcoin have to be held for 20 years, and might solely be offered off to pay down federal debt.

Trump hasn’t indicated whether or not he’s keen to go that far, but it surely’s fascinating to notice that Lummis has been tipped to grow to be the first-ever chair of a Senate subcommittee targeted on crypto.

24h7d30d1yAll time

How Would It Have an effect on Bitcoin’s Value?

As you’d count on, Bitcoiners are salivating over the impression that such a coverage would have on BTC’s worth — particularly contemplating the insatiable curiosity amongst establishments now that ETFs have been obtainable for a yr. Even the prospect of a reserve following Trump’s landslide final November helped this cryptocurrency’s worth surge into six-figure territory for the primary time.

JAN3 CEO Samson Mow, who has been intimately concerned with El Salvador’s Bitcoin efforts, just lately instructed Cryptonews that he believes “important worth appreciation into the $1 million vary” lies forward.

“Many nation-states are actively deepening their investments in Bitcoin, not solely as a strategic reserve but additionally as a software for enhancing sovereignty and vitality manufacturing,” he stated.

There’s little doubt that the creation of the stockpile could be one of the bullish developments in Bitcoin’s historical past, and result in immense shopping for strain.

However some specialists have questioned whether or not or not Bitcoin could be sufficient to resolve America’s monetary woes by itself — particularly contemplating that U.S. nationwide debt now stands at $35.5 trillion.

Is it Achievable… or a Good Thought?

With wars waging throughout two continents, financial challenges, a migration disaster and a divided nation, Trump has no scarcity of urgent points to take care of as his second time period will get underway.

It’s troublesome to understand how a strategic Bitcoin reserve matches into this record of priorities — regardless of the brand new president’s enthusiasm on the marketing campaign path.

And within the worst-case situation, it’s potential Trump received’t ship on any of his pro-crypto guarantees. He received’t have the ability to run for re-election once more, so there’s technically little stopping him from pocketing donations from the trade and reneging on these pledges.

Right here’s the factor: even when Trump desires to get this reserve up and working, he’ll face challenges of his personal. BitMEX co-founder Arthur Hayes just lately warned the president “has at finest one yr” to enact his most bold coverage modifications — and the razor-thin majority that the Republicans at present get pleasure from in Congress might evaporate by the tip of 2026. These midterms can even decelerate enterprise on The Hill.

NYDIG’s world head of analysis Greg Cipolaro expressed “warning on anticipating quick modifications” in a latest notice, including:

“The U.S. Bitcoin strategic reserve is a extremely topical merchandise, however the way it involves be (regulation vs government order) and its implementation (acquisition vs utilizing current seized cash) matter enormously as a catalyst.”

And given Bitcoin’s creation lies in an inherent mistrust of governments and monetary establishments, is Uncle Sam turning into one of many world’s largest holders actually what Satoshi Nakamoto envisioned?

Will Different International locations Comply with Swimsuit?

The mere chatter of the U.S. beginning to discover a strategic Bitcoin reserve has been sufficient to get rival economies wanting into this coverage.

Canadian opposition chief Pierre Poilievre has supported BTC for years — and will additionally pursue establishing a stockpile if he wins an election that should happen this yr.

Lawmakers from Germany to Hong Kong are additionally calling for his or her governments to look at this chance.

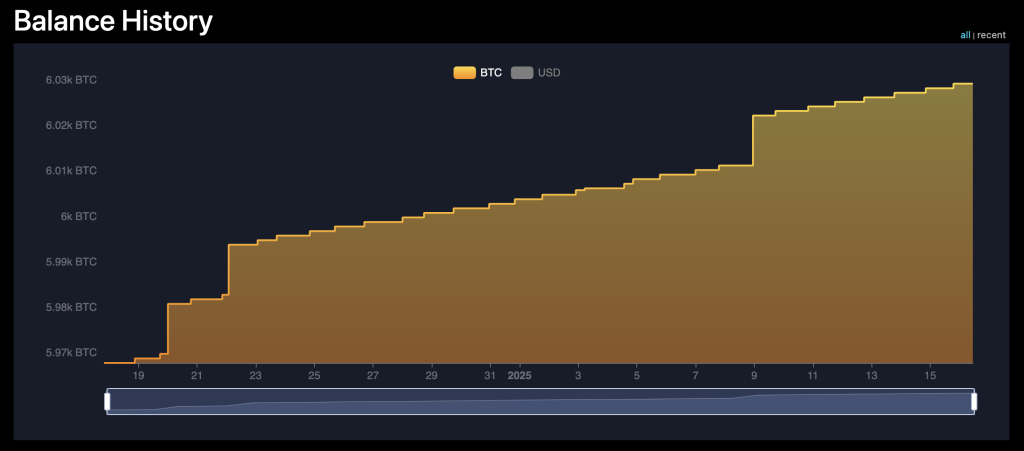

El Salvador technically has a strategic reserve too, with the nation buying 1 BTC a day and making lots of of thousands and thousands of {dollars} in paper earnings.

As former Binance CEO Changpeng Zhao instructed the Bitcoin Center East and North Africa convention:

“It’s very good for the U.S. to be doing this — and this additionally has a knock-on impact to different nations on the planet. If the U.S. is doing this, then each different nation should do that.”

The put up Strategic Bitcoin Reserves: All the things You Have to Know appeared first on Cryptonews.