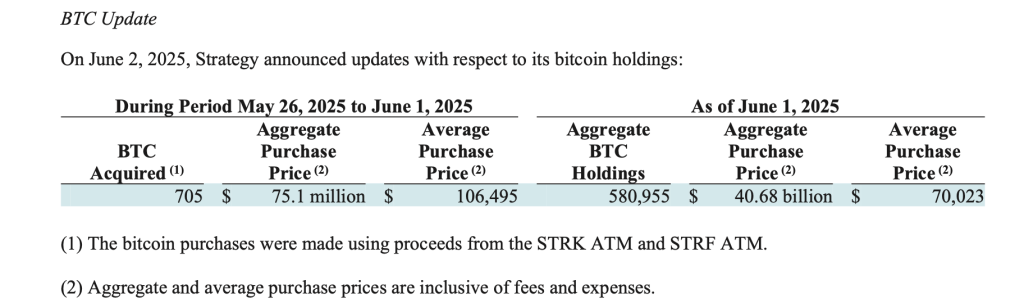

Strategy, led by Executive Chairman Michael Saylor, announced on Monday that the firm has purchased an additional 705 Bitcoin for approximately $75.1 million between May 26 and 30, reinforcing the company’s ongoing commitment to the cryptocurrency.

Strategy has acquired 705 BTC for ~$75.1 million at ~$106,495 per bitcoin and has achieved BTC Yield of 16.9% YTD 2025. As of 6/1/2025, we hodl 580,955 $BTC acquired for ~$40.68 billion at ~$70,023 per bitcoin. $MSTR $STRK $STRF https://t.co/K4tex3qHrN

— Michael Saylor (@saylor) June 2, 2025

This purchase was funded by proceeds from the company’s active at-the-market (ATM) offerings of its preferred stock classes, STRK and STRF. The purchase period spanned from May 26 to June 1, 2025, and marks another milestone in the company’s long-running Bitcoin accumulation strategy.

The firm now holds a total of 580,955 BTC acquired for an aggregate purchase price of roughly $40.68 billion, representing an average purchase price of $70,023 per bitcoin.

This latest buy reflects Strategy’s ongoing commitment to its Bitcoin-centric corporate treasury strategy, where excess capital, including proceeds from equity offerings, is consistently redeployed into the cryptocurrency.

With this move, Strategy also disclosed a bitcoin yield of 16.9% year-to-date, reinforcing its position as the largest corporate holder of BTC globally.

The timing of this acquisition, at a higher average price compared to its long-term cost basis, suggests that Strategy views Bitcoin’s recent rally as a sign of longer-term strength rather than a peak.

ATM Programs Fuel Expansion

During the same period, Strategy said it has made use of its ATM equity programs to raise funds for both operational and investment purposes.

Between May 26 and June 1, the company raised a total of $74.6 million across its ATM programs: $36.2 million from the sale of 353,511 STRK shares and $38.4 million from the sale of 374,968 STRF shares.

These preferred stock instruments, each carrying attractive dividend yields of 8.00% and 10.00% respectively, were established earlier this year and have already shown strong traction in the market.

As of June 1, there remains substantial capacity within these programs for future issuance—$20.68 billion for STRK and $2.05 billion for STRF—indicating Strategy’s intent to continue leveraging these instruments for growth and BTC accumulation.

The company also declared quarterly cash dividends on both series of preferred shares, with STRK shareholders receiving $2.00 per share and STRF shareholders receiving approximately $2.64 per share. These payments are scheduled for June 30, 2025, to shareholders of record as of June 15.

The dividend on the STRF shares includes an accrual from the issuance date of March 25, further underlining the firm’s attention to maintaining shareholder value alongside its bitcoin-centric strategy.

K33 Says Strategy Slows Bitcoin Buys as MSTR Premium Shrinks

K33 Research reports that Strategy appears to be easing its pace of Bitcoin acquisitions. In its latest filing, Strategy revealed it bought 4,020 BTC between May 19 and May 25 for $427.1 million, using proceeds from its ongoing $21 billion at-the-market (ATM) offering.

However, capital raised from the program has slowed. Only $348.7 million was deployed during that week—down from $705.7 million the week prior and $1.31 billion in early May.

K33 Head of Research Vetle Lunde attributes the deceleration to two key factors: a declining premium for MSTR shares relative to the firm’s Bitcoin holdings, and intensifying competition among corporations entering the Bitcoin treasury space.

“The pace of ATM utilization is notably slower than the first round,” Lunde noted.

Between early November and mid-December, Strategy raised an average of $2.13 billion weekly. In contrast, recent averages have dropped to $788 million.

The post Strategy Doubles Down on Crypto with $75M Purchase of 705 Bitcoin appeared first on Cryptonews.