Tether, the world’s largest player in the digital asset sector, has taken a deeper step into crypto-backed credit markets with a new investment in Ledn, one of the most established providers of Bitcoin-backed loans.

The move comes during a renewed wave of activity across the lending sector, which has already surpassed $1 billion in loan originations this year and is now showing signs of a broader comeback after the severe collapse of 2022–2023.

Ledn Crosses $2.8B in Bitcoin Loans as Crypto Lending Market Rebounds

Ledn has originated more than $2.8 billion in Bitcoin-backed loans since launch, cementing its position as a major lender in the crypto credit market.

The company has already issued over $1 billion in 2025 alone, its strongest year on record, and nearly equaled its entire 2024 lending volume in the latest quarter with $392 million in Q3.

Its annual recurring revenue now exceeds $100 million, showing growing demand from both retail and institutional borrowers seeking liquidity without selling their Bitcoin.

Tether said the investment reflects its long-term vision of building financial infrastructure that allows users to unlock credit while continuing to hold their digital assets.

Chief Executive Paolo Ardoino said the partnership strengthens the role of digital assets in real-world finance and supports self-custody models that many crypto users rely on.

Ledn’s platform includes custodial safeguards, risk controls, and liquidation systems designed to protect users’ collateral throughout the life of each loan.

The investment arrives as the Bitcoin-backed lending market begins to expand again. According to DataIntelo’s outlook, the broader crypto-collateralized credit segment is forecast to grow from $7.8 billion in 2024 to more than $60 billion by 2033.

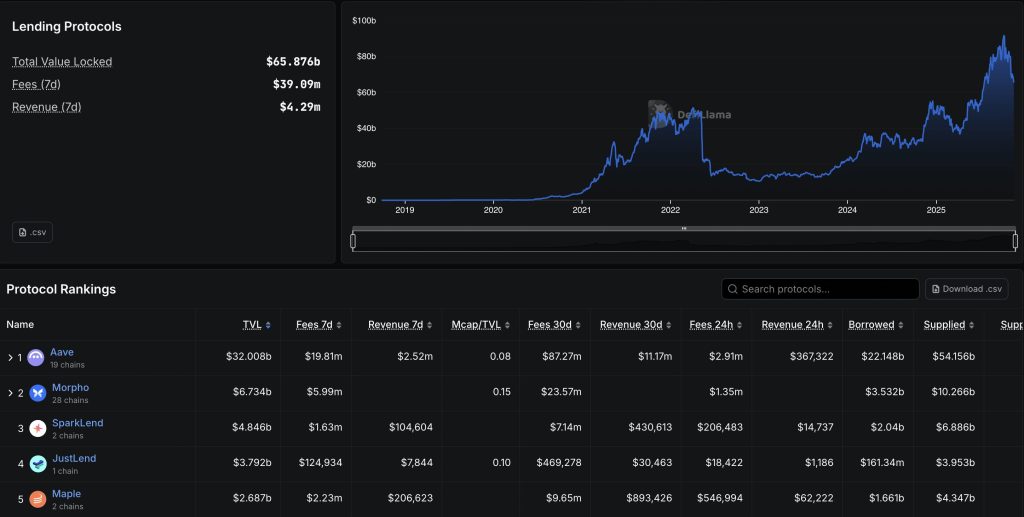

The sector already reached $90 billion in October and is currently at $65.87 billion.

Much of the industry’s recovery has been shaped by tighter risk practices after the failures of Celsius, Voyager, BlockFi, Genesis, and other lenders during the last bear market, a collapse driven by reckless lending, toxic collateral, and unsecured loans.

Ledn’s decision to double down on Bitcoin-backed products is reinforced by this shift toward safer structures.

Co-founder and CEO Adam Reeds said the company’s loan book is on track to nearly triple from 2024 levels, and that demand for Bitcoin financial services is rising quickly as investors seek more predictable forms of credit access across both centralized and decentralized platforms.

Tether’s investment is also aligned with the company’s broader strategy of expanding its presence across global financial markets.

In its latest attestation, prepared by BDO, Tether reported more than $10 billion in net profit for the year to date, along with $6.8 billion in excess reserves.

The firm issued more than $17 billion in new USDT during Q3, lifting the stablecoin’s circulating supply above $174 billion. Tether’s exposure to U.S. Treasuries hit a record $135 billion, placing the company among the world’s largest foreign holders of U.S. debt.

Lending Activity Reignites as Major Platforms Expand Services and Regulators Tighten Rules

The lending sector as a whole is experiencing renewed movement.

Crypto.com recently began integrating Morpho, the second-largest DeFi lending protocol, into its platform, allowing users to borrow stablecoins against wrapped Bitcoin and Ether directly on its Cronos chain.

Morpho’s services, already holding over $7.7 billion in value, will be available even to U.S. users despite new restrictions on stablecoin yield payments under the GENIUS Act.

Regulators are also adjusting to increased activity. South Korea introduced sweeping guidelines in September that cap lending rates at 20% annually and ban leveraged products that exceed collateral value.

The rules follow concerns over aggressive lending programs at major exchanges, where firms had begun offering unusually high borrowing limits before authorities intervened.

The post Tether Dives Into Bitcoin-Backed Lending as Market Soars Past $1B in Loans appeared first on Cryptonews.