Stablecoin giant Tether has announced a strategic investment in Parfin, a Latin American platform for digital asset custody, tokenization, trading, and institutional management.

Tether Invests in Parfin to Accelerate Institutional Use Cases of Digital Assets in LATAM

Learn more: https://t.co/a6e0HvlYTt— Tether (@Tether_to) November 20, 2025

The investment is intended to accelerate the adoption of USDT in enterprise-grade use cases and expand blockchain-based settlement infrastructure across the region.

Strengthening USDT for Institutional Settlement and RWA Markets

Tether’s investment reflects its broader commitment to establishing USDT as a core settlement and liquidity asset for high-value institutional applications. These use cases include cross-border transactions, real-world asset (RWA) tokenization, and the growth of yield-bearing credit markets such as trade finance receivables, commercial receivables, and credit card receivables.

With institutions across Latin America increasingly exploring blockchain-based financial rails, the partnership positions USDT at the center of the region’s evolving digital financial architecture.

Parfin as a Catalyst for Institutional Blockchain Adoption

Parfin has emerged as one of Latin America’s most influential digital asset infrastructure providers, equipping financial institutions with secure, compliant, and scalable tools to manage digital assets.

The company has focused on building systems that adhere to strict regulatory standards, while ensuring the technology can expand to meet rising demand in markets transitioning toward digital finance.

“At Tether, we believe in global, unrestricted access to financial freedom and real-world digital asset use cases,” said Paolo Ardoino, CEO of Tether.

“Strengthening the bridge between traditional finance and blockchain technology is essential, and Parfin has shown a deep commitment to this mission. This investment also demonstrates our belief in Latin America as a global powerhouse for blockchain innovation,” Ardoino added.

Parfin’s CEO, Marcos Viriato, added that Tether’s backing validates the company’s long-term vision. “Parfin has positioned itself as a pioneer in building the Parfin Platform and Rayls to bring the global financial system on-chain in a secure, private, and compliant way. Tether’s investment reinforces our mission to accelerate tokenization and integrate USDT across institutional solutions.”

Latin America’s Rapid Growth in Digital Asset Activity

The investment comes amid major expansion in Latin America’s crypto economy. According to the Chainalysis 2025 Geography of Cryptocurrency Report, the region recorded nearly $1.5 trillion in cryptocurrency transaction volume, making it one of the most dynamic digital asset markets in the world.

Institutional participation has been a major driver of this growth, supported by regulatory developments enabling banks and corporates to adopt blockchain-based financial tools.

Shaping the Region’s Digital Finance Future

By combining Tether’s global scale with Parfin’s institutional infrastructure, the partnership seeks to accelerate the region’s transition toward blockchain-based financial systems.

Together, the companies plan to unlock new enterprise use cases for USDT, strengthen digital settlement rails, and drive broader institutional adoption of tokenization throughout Latin America.

USDT Price Action

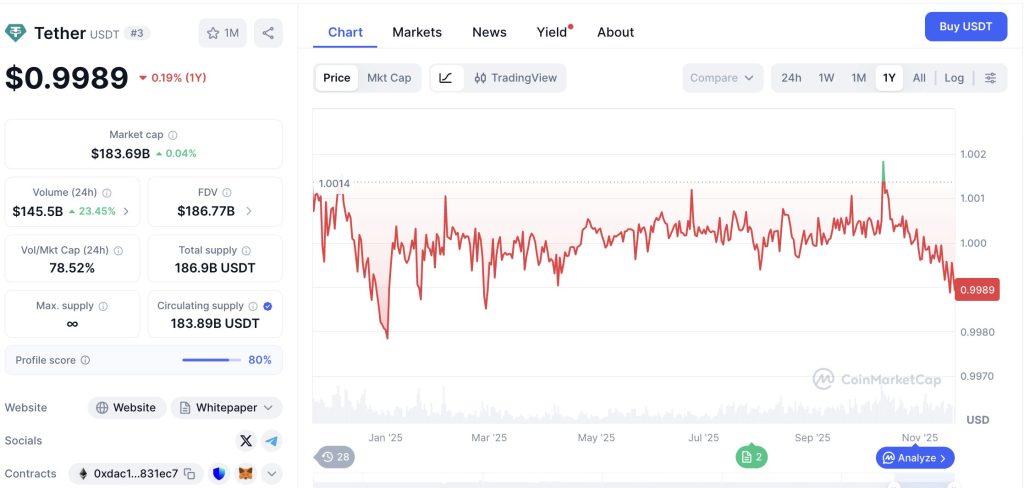

Tether’s USDT has traded in a tight, stable range, maintaining its peg close to $1 despite periodic micro-volatility across the past 12 months.

The chart shows USDT fluctuating between $0.9970 and $1.0014, reflecting normal liquidity-driven deviations typical of high-volume stablecoins. The current price sits at $0.9989, marking a slight 0.19% dip year-over-year—well within historical stability norms.

Trading volume remains extremely strong at $145.5 billion over the past 24 hours, up more than 23%, demonstrating deep liquidity and sustained global demand for the stablecoin.

Market capitalization is $183.69 billion, making USDT the largest stablecoin by far and the third-largest crypto asset overall.

While USDT briefly spiked above $1.001 early in the year and dipped below $0.998 during isolated volatility events, the peg held consistently. The data reinforces USDT’s position as the market’s most traded and most liquid stable asset, with volatility staying inside a very narrow band despite broader market swings.

The post Tether Invests in Parfin to Target Institutional USDT Settlement and Tokenization Across Latin America appeared first on Cryptonews.