Minutes from the January meeting show rate hikes are not off the table. If inflation stalls, policymakers are ready to tighten again. That is a direct warning to risk markets.

For Bitcoin price, this flips the script. The market was leaning toward cuts. More liquidity. Easier conditions. Now the Fed is signaling the opposite.

Higher rates. Tighter liquidity. And that changes everything for crypto.

Key Takeaways

- The Signal: Fed officials discussed “upward adjustments” to rates if inflation stays above target levels.

- The Split: The vote was 10-2 to hold rates, but a significant “hawkish” contingent is pushing back against cuts.

- The Risk: Higher-for-longer rates typically drain liquidity, creating headwinds for Bitcoin and ETF inflows.

Why Does This Matter for Crypto and Bitcoin Price?

Markets were relaxed. Cuts in 2026 felt almost guaranteed. Now that confidence got shaken again.

The Fed held rates at 3.5% to 3.75%, hitting pause after three straight cuts in late 2025. But the tone was not soft. Inside the discussion, a hawkish group made it clear they are not ready to promise more easing.

hawkish fed stance dampening macro sentiment

— Binan Smart Kid

(@Binansmartkid) February 18, 2026

Some officials even floated “upward adjustments” if inflation sticks around. That is a big shift. The market had assumed a smooth path lower. The minutes analysis say otherwise.

The Fed wants clear proof that disinflation is real before cutting again. That puts serious weight on the February CPI print. If inflation runs hot, rate hikes move from theory back to reality.

What Happens Next?

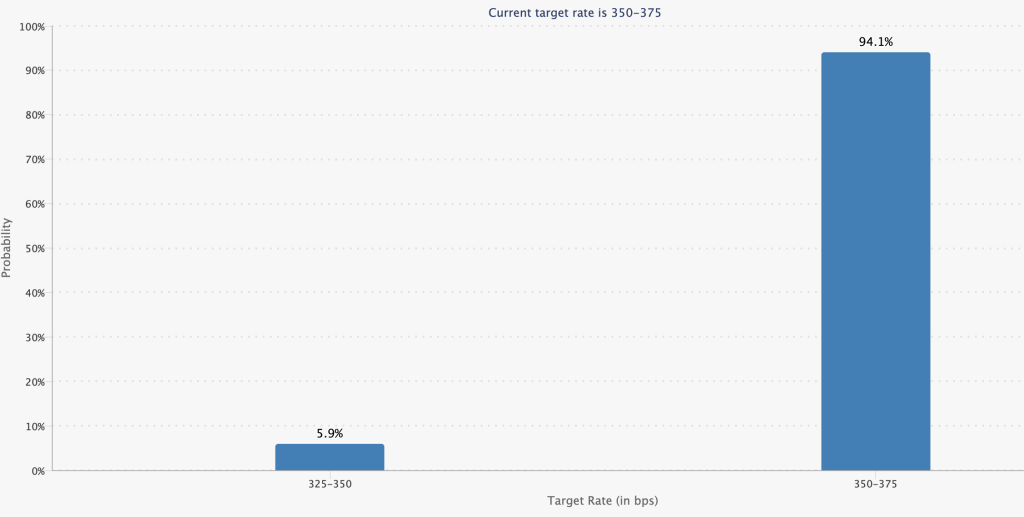

Pricing is getting messy. CME futures still show a 94% chance of a pause in March. But the hike risk is no longer zero.

Now it all comes down to inflation data. If the next print runs hot, the Fed fears get validated. If not, this scare might fade just as fast as it appeared.

Discover: Here are the crypto likely to explode!

The post The Market Priced in Cuts, the Fed Mentioned Hikes. What Is Means For Bitcoin Price? appeared first on Cryptonews.