Treasury Secretary Scott Bessent urged the Federal Reserve to accelerate interest rate cuts, calling them the “only ingredient missing” for stronger U.S. economic growth ahead of scheduled remarks in Minnesota on Thursday.

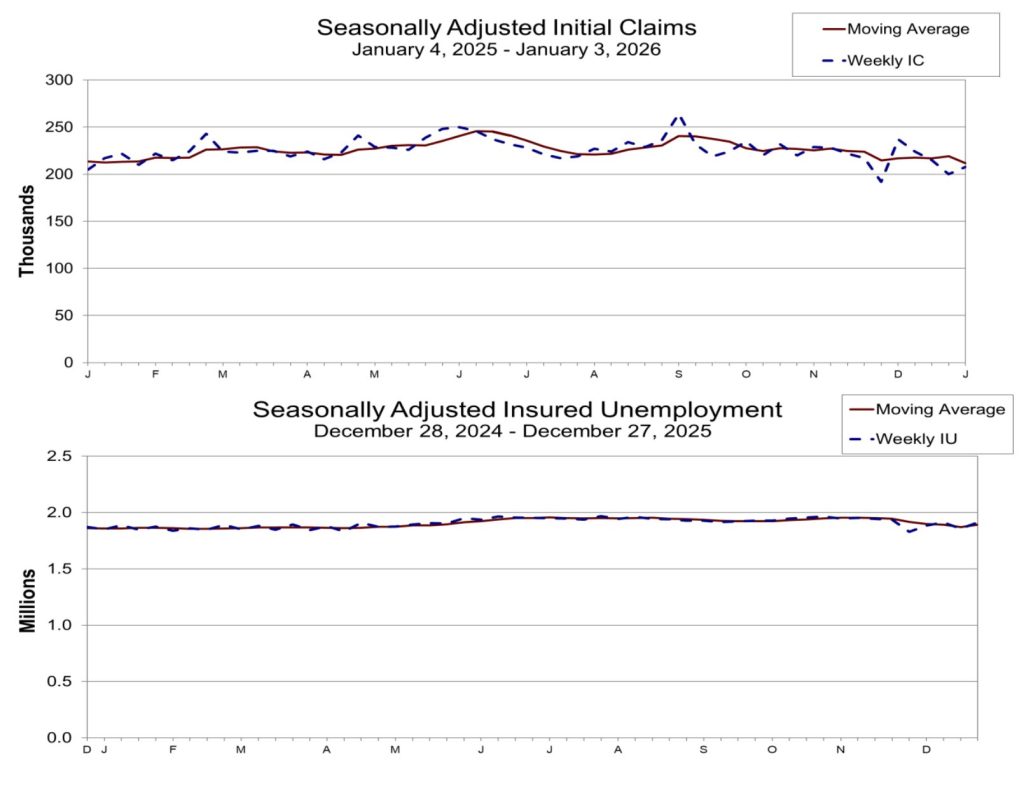

The push comes as fresh labor market data showed initial jobless claims at 208,000 for the week ending January 3, slightly better than the 210,000 expected, challenging arguments for aggressive monetary easing.

Bessent backed President Donald Trump’s economic agenda in prepared excerpts obtained by CNBC, arguing that easier monetary policy would directly benefit households and support growth objectives.

“Cutting interest rates will have a tangible impact on the lives of every Minnesotan,” he said. “It is the only ingredient missing for even stronger economic growth. Which is why the Fed should not delay.“

BESSENT SAYS MORE FED RATE CUTS ARE KEY TO STRONGER GROWTH

Treasury Secretary Scott Bessent said lower interest rates are the “only ingredient missing” for stronger U.S. economic growth, urging the Federal Reserve to move faster on rate cuts. Speaking ahead of remarks to the…— *Walter Bloomberg (@DeItaone) January 8, 2026

Labor Market Shows Resilience

The Department of Labor’s weekly report revealed jobless claims increased by 8,000 from the previous week’s revised 200,000 figure, marking the lowest four-week moving average since April 2024 at 211,750.

Insured unemployment held steady at 1.2% for the week ending December 27, with continued weeks claimed rising to 1,914,000 from 1,858,000 the prior week.

State data showed mixed trends, with New Jersey reporting the largest initial claims increase at 6,871, followed by Pennsylvania at 5,406 due to layoffs in transportation, construction, and manufacturing sectors. Texas saw the sharpest decline at 7,951 claims, while California dropped 6,514.

While the Fed implemented three consecutive rate cuts in late 2025 totaling 75 basis points, bringing the benchmark rate to a range of 3.5 to 3.75%, markets now expect substantially fewer reductions in 2026.

Fed officials’ most recent projections point to just one cut this year, despite the Treasury’s call for more aggressive action.

However, Jerome Powell’s term as Fed chair expires in May, and Bessent is already overseeing the selection process, which has narrowed to five candidates.

Policy Tensions Mount

Minneapolis Fed President Neel Kashkari indicated on Monday that monetary policy is near neutral, suggesting limited room for additional cuts.

“My guess is we’re pretty close to neutral right now,” Kashkari told CNBC. “We just need to get more data to see which is the bigger force. Is it inflation or is it the labor market?“

Kashkari, a voting member on the Federal Open Market Committee this year, emphasized that inflation risks remain elevated despite unemployment drifting to 4.6%.

“Inflation risk is one of persistence, that these tariff effects take multiple years to work their way all the way through the system,” he said, though acknowledging unemployment could spike quickly from current levels.

He also noted artificial intelligence adoption among large companies was creating hiring slowdowns while generating productivity gains.

“AI is really a big company story,” Kashkari said, adding that businesses previously skeptical are now seeing tangible benefits from the technology.

Fed Governor Stephen Miran, whose term ends January 31, offered a contrasting view in a Fox Business interview Tuesday, calling for aggressive rate cuts of more than 100 basis points this year.

“I think policy is clearly restrictive and holding the economy back,” Miran said, arguing that underlying inflation has reached the Fed’s 2% target. His dissent in favor of a 50-basis-point cut at December’s meeting pointed out growing divisions within the central bank.

Bessent framed his own case for rate cuts within Trump’s broader economic strategy, noting that 2025’s “One Big Beautiful Bill” passage, trade realignment deals, and deregulation agenda created foundations for robust growth.

“Now, in 2026, we will reap the rewards of President Trump’s America First agenda,” he said in the prepared remarks scheduled for delivery at 12:45 PM ET.

Crypto Markets React to Rate Policy Uncertainty

Bitcoin slipped toward $90,000 today as traders digested tensions over rate policy and stronger-than-expected employment figures.

The crypto market dropped nearly 2% while gold rose.

Investor Ray Dalio touched on the broader economic outlook in his recent market analysis, noting that currency devaluation distorts return perceptions.

“When one’s own currency goes down, it makes it look like the things measured in it went up,” Dalio wrote, adding that gold returned 65% in dollar terms last year while the S&P gained just 18%, making gold “the best major investment of the year.”

Speaking with Cryptonews, Kurt Hemecker, CEO of Gold Token S.A., noted the evolving relationship between the assets.

“Bitcoin and gold responding differently to macro stresses isn’t new. This is what we’re seeing play out today, as again gold is strengthening as Bitcoin pulls back,” he said.

The post Treasury Secretary Calls for More Rate Cuts Despite Strong Jobs Data appeared first on Cryptonews.