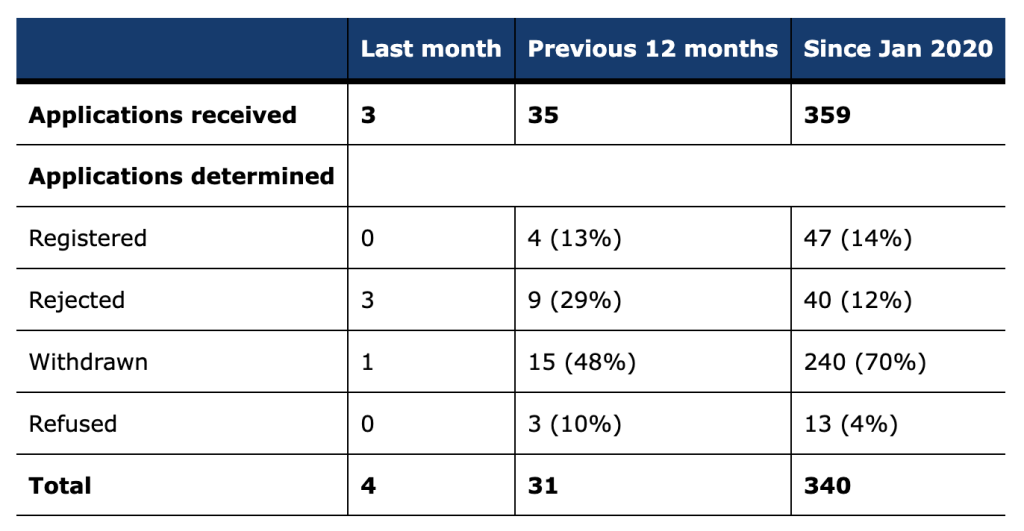

The UK Financial Conduct Authority (FCA) reported on September 3 a massive 87% failure rate among crypto firms seeking licensing under the country’s money laundering regulations in the latest fiscal year.

According to the report, only four companies, BNXA (a payments partner of Binance), a PayPal U.K. unit, and Komainu (a crypto custody joint venture of Nomura), secured approval out of 35 applications submitted between April 2023 and March 2024.

The rest were either rejected, refused, or withdrawn due to incomplete submissions or failing to meet the FCA’s rigorous standards.

Since the FCA began overseeing the crypto sector’s anti-money laundering compliance in January 2020, the regulator has processed 359 applications, but only 44 firms have successfully registered.

44 Out of 356 Applications Passed, What Is Going On?

The FCA’s report indirectly shows many crypto firms’ difficulties during registration.

According to feedback from industry participants, long wait times, minimal feedback, and what some describe as inconsistent treatment by the FCA have made the process particularly challenging.

This has led some companies to abandon their applications or seek registration in more crypto-friendly jurisdictions, allowing them to continue serving UK customers from abroad.

One of the main criticisms of rejected applicants is the lack of transparency and clarity in the FCA’s expectations. The FCA has defended its position, noting that it provides detailed guidance to help firms understand the requirements for registration.

The regulator’s feedback indicates that many applications lacked key components necessary for a thorough assessment, with some submissions deemed invalid due to poor quality or incomplete information.

The FCA’s stringent standards are intended to ensure that crypto firms adhere to robust anti-money laundering (AML) and counter-terrorist financing (CTF) measures.

However, the regulator’s strict approach has sparked debate about whether the regulatory environment is too restrictive, potentially stifling innovation and pushing businesses offshore.

UK Crypto Stance Amid Increased Interest from Citizens

Looking ahead, the FCA is poised to gain more authoritative control over the crypto sector pending new legislation granting it the power to authorize crypto companies to operate fully within the UK.

However, this regulatory evolution may take time due to the new Labour government’s decision to pause crypto-specific legislative plans after taking office in July 2024.

As of September 2024, the FCA’s ongoing challenge lies in balancing stringent regulatory oversight with the need to foster a vibrant and innovative crypto industry.

The regulator has been vocal about its commitment to upholding high standards, but recent statistics showed otherwise. The hurdles faced by crypto firms attempting to navigate this are becoming even more complex.

To help potential applicants, the FCA has made available comprehensive feedback on the quality of applications received, outlining both good and poor practices under the Money Laundering, Terrorist Financing, and Transfer of Funds (Information on the Payer) Regulations 2017.

This feedback aims to assist firms in better preparing their applications and understanding the FCA’s requirements, potentially improving the approval rate in the future.

Aligning with the FCA’s expectations and maintaining rigorous compliance standards will be key for current and prospective applicants to secure a foothold in the UK market.

This is particularly important as a recent survey by Zumo and Focaldata found that over a third of young adults in the UK view cryptocurrency as a key electoral issue ahead of the upcoming General Election.

The survey, which included over 3,000 UK adults, revealed that 34% of individuals aged 18-34 believe politicians should prioritize the crypto industry’s growth, with 38% of 18-24 year-olds having directly invested in crypto.

Many young adults see digital assets as a potential long-term financial gain; many have friends or family involved in crypto investments.

The interest in digital assets among young adults suggests that the country’s regulatory stance needs to be improved.

The post UK FCA Reveals 87% of Crypto Firms Failed to Secure Licensing Under Money Laundering Rules appeared first on Cryptonews.