British blockchain investment firm KR1 has announced plans to move its stock listing from the Aquis Stock Exchange to the main market of the London Stock Exchange (LSE), a move seen as a major step for crypto companies seeking legitimacy in traditional finance.

The uplisting, expected to be completed next month pending approval from the Financial Conduct Authority (FCA) and shareholders, would make KR1 the first dedicated digital asset company to trade on the LSE’s primary market.

KR1 to Expand Blockchain Staking Operations Following LSE Listing

KR1 co-founder Keld Van Schreven told the Financial Times that the move represents “a starter gun for this new asset class on the LSE,” adding that it could pave the way for more blockchain companies to follow.

With a market capitalization of about £56 million ($75 million), KR1 distinguishes itself from previous listings by being fully focused on blockchain infrastructure and staking, rather than simply holding cryptocurrencies such as Bitcoin or Ether.

UK crypto firm @KR1plc announced plans to uplist its stock to the main market of the London Stock Exchange. The firm aims to enhance visibility and broaden its investor base with the move.

KR1 generates revenue from DeFi initiatives and investments on $ETH $DOT & $ATOM pic.twitter.com/iTYnxRUgIW— ALLINCRYPTO (@RealAllinCrypto) October 28, 2025

The company was founded in 2014 and is based on the Isle of Man. KR1 invests in early-stage blockchain projects and earns income from staking networks, including Ethereum and Polkadot.

The company has completed more than 100 digital asset investments and plans to expand its staking operations through a new share placement program following the LSE listing.

Van Schreven said the firm is “doubling down on staking” as institutional demand for blockchain validation services continues to grow.

The decision comes amid a broader shift in the UK’s stance toward crypto regulation. After years of caution, the country is taking active steps to position itself as a hub for digital assets.

The FCA has recently lifted its four-year ban on crypto-based exchange-traded notes, allowing asset managers to list such products on the London Stock Exchange.

The UK FCA will allow retail investors to access crypto ETNs starting Oct 8—reversing a 4+ year ban.#FCA #ETNshttps://t.co/aK2NkOS0Md

— Cryptonews.com (@cryptonews) August 1, 2025

Market analysts at IG Group expect this change to boost domestic crypto activity by as much as 20%, signaling increasing mainstream acceptance despite tightening tax scrutiny.

UK Boosts Crypto Oversight with New Approvals, Stablecoin Caps, and Expanded Tax Powers

The FCA has also accelerated its approval process for crypto firms.

Since April, five companies, including BlackRock and Standard Chartered, have received registration under the agency’s anti-money laundering regime, bringing the approval rate up to 45%, a sharp increase from less than 15% in previous years.

The regulator says it is committed to ensuring the UK’s digital asset framework matches international standards as it prepares to roll out a full regulatory regime next year.

Meanwhile, the Bank of England is advancing plans to regulate stablecoins, proposing “temporary” limits on holdings of systemic tokens used for payments, capped between £10,000 and £20,000 for individuals and £10 million for businesses.

Deputy Governor Sarah Breeden said the limits are designed to protect credit availability and would be lifted once the transition to digital money no longer poses risks to the real economy.

Bank of England imposes "temporary" stablecoin caps of £10K-£20K for individuals and £10M for businesses with no end date as global market hits $300B.#England #UK #Stablecoinhttps://t.co/KcKT7Xurft

— Cryptonews.com (@cryptonews) October 16, 2025

Critics, including Coinbase’s Tom Duff Gordon, argue the caps could disadvantage UK investors compared to other major jurisdictions that have avoided similar restrictions.

Tax authorities are also intensifying oversight. HM Revenue & Customs (HMRC) has sent 65,000 “nudge letters” to crypto investors suspected of underreporting gains, a 134% increase from last year.

The agency is using data from exchanges to identify potential tax evasion and will gain even broader powers under the Crypto-Assets Reporting Framework (CARF), a global standard taking effect in January 2026.

Under CARF, exchanges will be required to report detailed transaction data to tax authorities, with the first submissions due in 2027.

Can the UK Turn Regulation Into Its Competitive Edge in Crypto?

Despite tighter compliance measures, Britain’s crypto market remains one of the most active globally.

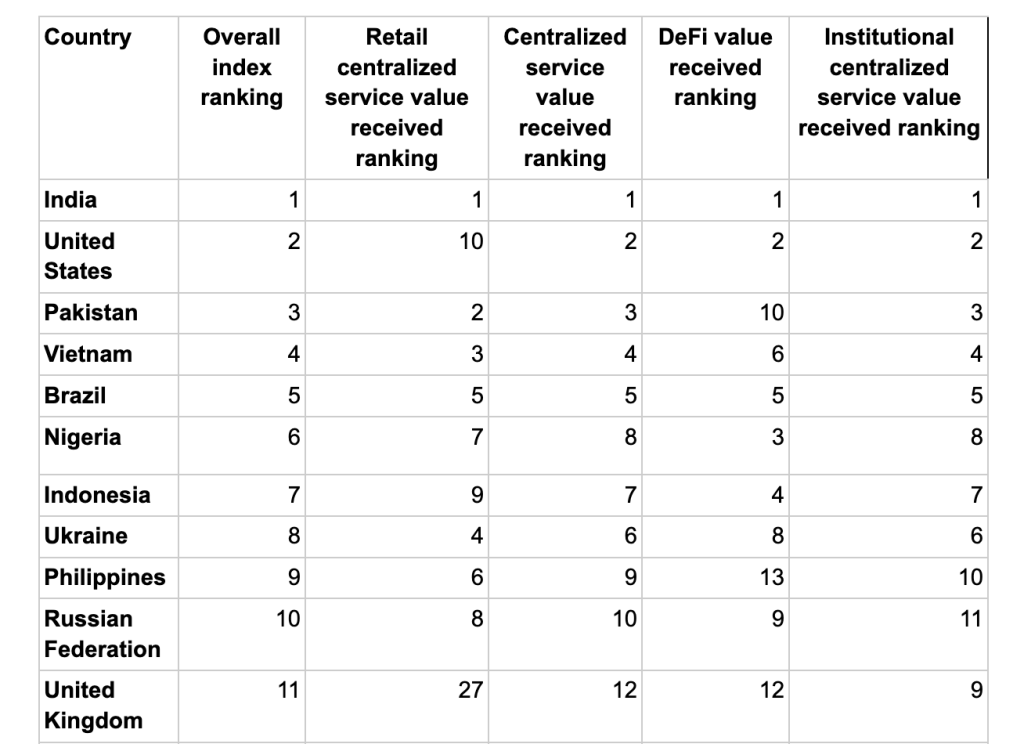

The UK currently ranks 11th in the Chainalysis Global Crypto Adoption Index and serves as Coinbase’s second-largest market after the United States.

Policymakers are also seeking closer alignment with Washington through the newly created Transatlantic Taskforce for Markets of the Future, a joint initiative between the UK and U.S. treasuries to coordinate digital asset regulation and capital market innovation.

The UK and US have launched the Transatlantic Crypto Task Force to coordinate digital asset regulation and capital markets policy. #Crypto #UK #US https://t.co/3oVXOws8mq

— Cryptonews.com (@cryptonews) September 22, 2025

The growing alignment and regulatory clarity have attracted major players back to the UK market. Binance recently restored access to its full suite of Earn products for professional investors following clarification that staking is not considered a collective investment scheme under UK law.

Former Chancellor George Osborne has called for even bolder reforms, warning that the UK risks falling behind global rivals unless it acts decisively.

He compared the current moment to the “Big Bang” reforms of the 1980s, which helped transform London into a world financial center.

The post UK Opens Arms to Crypto as KR1 Targets London Stock Exchange Listing appeared first on Cryptonews.