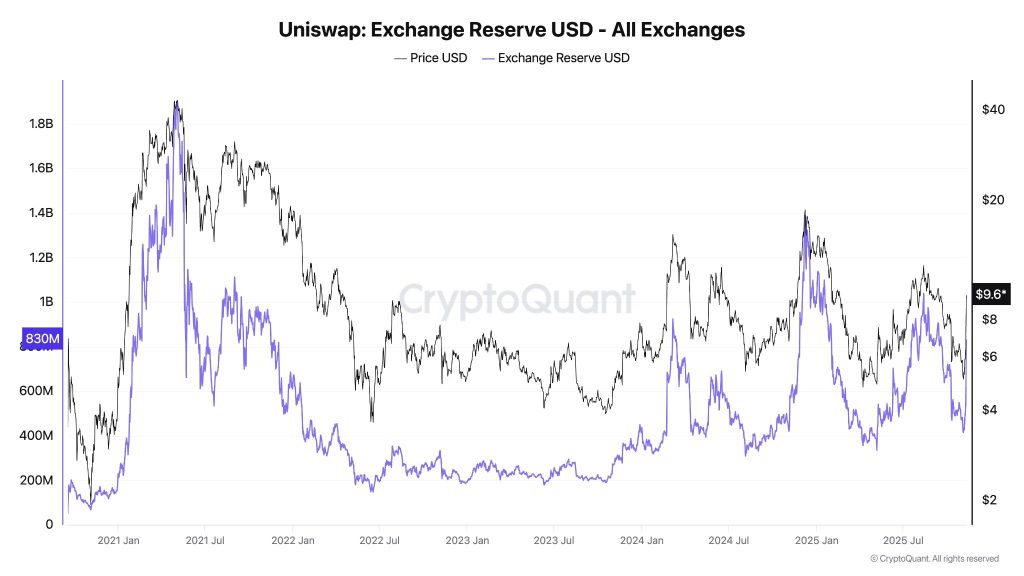

Uniswap’s UNI token surged approximately 30% following Monday’s proposal announcement, with the crypto trading above $8.70 as markets responded enthusiastically to the long-awaited fee switch activation plan.

CryptoQuant CEO Ki Young Ju predicted the token could experience “parabolic” growth once the mechanism goes live, estimating around $500 million in annual token burns based on current trading volumes.

The “UNIfication” proposal, jointly submitted by Uniswap Labs and the Uniswap Foundation, marks founder Hayden Adams’ first governance proposal in the protocol’s history.

The plan would redirect between one-quarter and one-sixth of protocol fees to a smart contract called the “token jar,” where UNI holders could burn their tokens to withdraw an equivalent amount of crypto.

Historic Proposal Ends Years-Long Debate

Adams revealed that Uniswap Labs has been unable to meaningfully participate in governance for five years, greatly restricted in building value for the community due to a hostile regulatory environment that has cost thousands of hours and tens of millions of dollars in legal fees.

The proposal arrives as that regulatory climate shifts following the departure of former SEC Chair Gary Gensler, with Hyden saying Gensler “really sucked.”

For Uniswap v2 pools, liquidity provider fees would drop from 0.3% to 0.25%, with 0.05% going to the protocol, while v3 pools would see protocol fees set at one-fourth or one-sixth of LP fees, depending on the tier.

The activation would initially cover Uniswap v2 and major v3 pools on Ethereum mainnet, representing up to 95% of liquidity provider fees.

Beyond fee activation, the proposal includes an immediate retroactive burn of 100 million UNI tokens from the treasury, valued at approximately $800 million.

All Unichain sequencer fees, after covering Layer 1 data costs and the 15% allocation to Optimism, would also flow into the burn mechanism.

Today, I’m incredibly excited to make my first proposal to Uniswap governance on behalf of @Uniswap alongside @devinawalsh and @nkennethk

This proposal turns on protocol fees and aligns incentives across the Uniswap ecosystem

Uniswap has been my passion and singular focus for… pic.twitter.com/Ee9bKDric5— Hayden Adams

(@haydenzadams) November 10, 2025

Structural Changes and Growth Strategy

The UNIfication plan fundamentally restructures Uniswap’s organizational framework.

The proposal seeks to disband the Uniswap Foundation, shifting most staff to Uniswap Labs, while remaining Foundation employees would administer the nonprofit’s $100 million grants program before the organization folds.

Uniswap Labs would pivot away from monetizing its products, setting interface, wallet, and API fees to zero to enhance competitiveness.

The Uniswap Ethereum frontend has earned a cumulative $137 million to date, including $48 million in 2025 alone.

The proposal also establishes an annual growth budget of 20 million UNI tokens starting January 2026, distributed quarterly to fund protocol development.

The plan introduces Protocol Fee Discount Auctions, which would auction fee-free trading rights for short periods, internalizing MEV that typically flows to validators.

Aggregator hooks would transform Uniswap v4 into an on-chain aggregator that collects protocol fees from external liquidity sources.

Really glad that Uni chooses an inferior mechanism of revenue distribution. Things are proceeding as planned.

For those curious, here's a research comparing veLocks and buy-and-burnhttps://t.co/KKV8qHX9Il https://t.co/IFufF5CXKS— Michael Egorov (@newmichwill) November 10, 2025

Notably, Curve Finance founder Michael Egorov suggested Uniswap chose an “inferior mechanism” compared to Curve’s veLocks model, pointing to research showing vote-escrow systems lock approximately three times more tokens than burn mechanisms would remove.

However, the broader DeFi community expressed strong support for UNIfication’s value alignment approach.

Industry Splits Over Fee Switch Impact

Industry analysts responded positively to the proposal’s comprehensive scope. A16z CTO Eddy Lazzarin highlighted how the plan creates a “closed loop” network token where protocol fees return value to token holders.

“A lot of legal work went into making this possible — the DUNI and a lot of research,” he said.

Delphi Labs contributor RedPhone also declared that Hyden has now taken “DeFi mainstream” and “made token value accrual non-negotiable.”

“The line is drawn: your token either accrues value or it’s dead,” he added.

However, some analysts raised concerns about potential market distortions.

A Dune analyst estimated that roughly half of recent Uniswap volume on Base consists of scammy pools that rely on zero protocol fees.

“Half of Base volume on Uniswap will vanish overnight once the fee switch goes live. Anyone running analysis about revenue rates and burn rates for UNI will be off if they are looking just at unfiltered top line values,” the analyst noted.

So, one thing a fee switch will do is make scammy pools (honeypots, automated rugs, etc.) vanish overnight. These rely on the protocol take rate being exactly 0.

By my rough estimation, half of recent Uniswap volume on Base falls into this camp.

Uniswap's official Dune tracker… https://t.co/M0Wg4eVJEX pic.twitter.com/Jmh2A9Z3h5— jpn memelord

(@jpn_memelord) November 11, 2025

Similarly, Stable Lab’s Doo Wan also cautioned about fiscal discipline as the DAO transitions from treasury depletion to potential replenishment.

“We now have a more aligned DAO that is transitioning from a phase of treasury depletion to one that may ‘potentially’ begin replenishing the treasury. The key word here is potentially,” Wan wrote.

He advised that “delegates must therefore remain vigilant and continue to review proposals carefully.“

The post Uniswap Could Go Parabolic With Fee Switch Activation, Says CryptoQuant CEO appeared first on Cryptonews.