The recent introduction of fees by Uniswap sparked speculation about a ‘sell the news’ reaction, a closer examination, however, offers a different perspective.

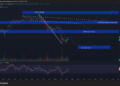

Despite a 5% decline in UNI’s price since the initial announcement, Uniswap’s on-chain activity has grown.

- According to the latest insight by Santiment, a noticeable disparity is observed in the diminishing UNI price and the increasing on-chain activity.

- The crypto analytic platform said that the negative MVRV suggests short-term UNI holders are perhaps feeling some pain.

- But Active Addresses and Network Growth are two metrics that have surged to levels not seen since July this year. Interestingly, this trend has been on the rise despite a downtrend on the price side of things.

- Uniswap Labs, the organization behind the decentralized crypto exchange, imposed a 0.15% fee starting Tuesday on trades involving ETH, USDC, and other tokens. Only swaps that execute through Uniswap Labs’ front end will be taxed.

- This fee differs from Uniswap’s current “protocol fee,” which is overseen by governance voters. Uniswap Labs is imposing this fee as part of its effort to sustainably fund its operations.

- According to Uniswap creator Hayden Adams, this interface fee will enable them to continue to research, develop, build, ship, improve, and expand crypto and DeFi.

- While the introduction of the fee has led many investors to dump the asset and create FUD, a hook enabling Know Your Customer (KYC) verification on the upcoming Uniswap v4 pools has sparked discussions regarding the future of DeFi, despite it being an opt-in functionality.

SPECIAL OFFER (Sponsored) Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO50 code to receive up to $7,000 on your deposits.