Bitcoin survived crypto’s largest liquidation event in history with October (Uptober) still holding positive territory, prompting analyst Scott Melker to call it “a small miracle.”

The $21 billion deleveraging event wiped out leveraged positions across the top 100 assets, yet Bitcoin trades around $113,000 after briefly touching $102,000 during Friday’s crash triggered by escalating U.S.-China trade tensions.

Melker wrote on Tuesday that despite expecting “October to be deep in the red” after the historic liquidation, the market’s resilience changed his outlook.

“I don’t think we’re entering a bear market,” he stated, noting, “this isn’t 2017. Nor is it 2021. What happened last week was purely structural.“

After the largest liquidation in crypto history, I expected October to be deep in the red. Somehow, it’s still holding on. Which honestly feels like a small miracle.

Let’s get this out of the way: I don’t think we’re entering a bear market.

If I wanted to argue that, I could -…— The Wolf Of All Streets (@scottmelker) October 14, 2025

The liquidation forced a repricing of risk as Bitcoin fell 7% and Ethereum dropped 12%.

Gold’s rally past $4,100 supports Melker’s argument that “investors aren’t panicking, they’re reallocating.”

On-chain data reveal that 97% of the circulating supply is in profit, with short-term holders accounting for 44% of realized capitalization, the highest level ever recorded.

Bitcoin Market Enters Speculative Phase as New Whales Dominate

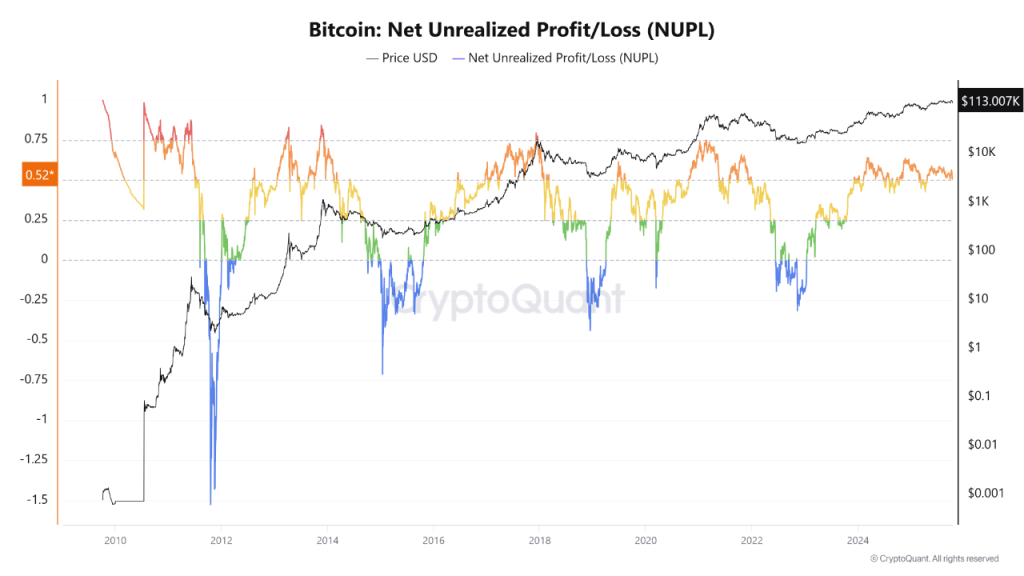

According to a CryptoQuant analyst, Bitcoin’s Net Unrealized Profit/Loss (NUPL) currently stands at +0.52, a zone historically associated with the shift from optimism to euphoria.

In previous cycles during 2017 and 2021, NUPL readings above 0.5 signaled most investors were in profit, driving speculative activity before corrections.

According to the analyst, short-term holders now control 44% of Bitcoin’s realized capitalization while long-term holders realize profits, transferring dominance to “new whales.”

This shift typically coincides with the final expansion phase of bull markets.

However, ETF inflows, expanding stablecoin liquidity, and institutional participation are effectively absorbing sell pressure.

According to CryptoQuants’ October 14 report, the stablecoin market capitalization rose by $14.9 billion over 60 days, the fastest pace since January, providing capital capacity to support the recovery.

XwinFinance analysts noted “the key signal to watch next will be a decline in STH share, which would mark the start of a renewed accumulation phase led by long-term investors.“

Bitcoin’s Bull Score Index dropped from 80 to 20 following the liquidation, while Apparent Demand shows a 30-day decline of 111,000 BTC, which is the steepest since April.

Despite weakened fundamentals, whale accumulation remains strong, with 1-year holdings change crossing above its moving average on October 8.

Infrastructure Expansion Supports Bull Case Despite Structural Weakness

Melker emphasized that infrastructure development continues regardless of volatility.

“Public companies are adding BTC to balance sheets. Luxembourg just made Eurozone history. CME is prepping for 24/7 trading. States are preparing to buy Bitcoin.“

He quoted Howard Marks: “Valuations are high but not crazy. Expensive and going down tomorrow are not synonymous.”

This perspective acknowledges elevated prices while rejecting the assumption of inevitable correction.

Bitcoin broke above $114,000 to $117,000, reaching $126,000 before the liquidation, driven by record ETF inflows of over $2.2 billion.

The breakout flipped 190,000 BTC into support, providing structural depth.

Notably, rising leverage preceded the crash.

A Glassnode report earlier this month shows that Futures open interest set new highs while funding rates exceeded 8% annualized.

Options markets also showed crowded positioning with 25-Delta Skew narrowing from 18 volatility points to just 3, a 21-point swing in under a week.

While Uptober has been both rosy and stormy, data from Timothy Peterson suggests that “Bitcoin’s most explosive Uptober moves generally happen in the second half of the month,” indicating that historical precedent supports continued strength.

October has constantly delivered gains in 10 of the past 12 years.

Technical Outlook: Wick Fill Expected Before Recovery Attempt

Bitcoin currently trades at $112,600 after the flash crash to $102,000, with analysts expecting a wick fill toward $109,513, which is the 50% retracement level.

Similarly, MVRV analysis from Ali Martinez also shows Bitcoin approximately 19.4% above the Mean fair value band at $96,526, creating vulnerability to correction if the +0.5σ resistance at $119,018 cannot be reclaimed.

Bitcoin $BTC must reclaim $119,000 to keep bullish momentum alive! Otherwise, the Pricing Bands signal a correction toward $96,530. pic.twitter.com/I7IGhKcXjX

— Ali (@ali_charts) October 15, 2025

The current positioning between the Mean and +0.5σ suggests a greater downside risk toward fair value than upside potential.

Bitcoin stabilized above the 135-day moving average, while the Young Supply MVRV reset toward 1.0, a level that often means the market is cooling from speculative extremes while maintaining its structure.

Looking forward,Bitcoin faces a probable downside toward $109,500 wick-fill target and potentially $105,000-$107,000 if selling pressure intensifies.

The critical test remains whether these levels provide recovery support or merely pause deeper correction toward the $96,500 MVRV fair value.

Failure to reclaim $115,000 Traders’ Realized Price confirms weakened momentum, while breaking above $119,000 would validate the “small miracle” narrative and resume bullish structure toward year-end.

The post ‘Uptober’ Saw Crypto’s Biggest Liquidation Ever, Yet Analysts Call It a ‘Small Miracle’ – Bulls Win? appeared first on Cryptonews.