US financial institutions processed $312 billion in suspicious transactions linked to Chinese money laundering networks between January 2020 and December 2024, according to a new FinCEN analysis of 137,153 Bank Secrecy Act reports.

These surprisingly unexpected big figures emerge as crypto exchanges face intensified regulatory scrutiny for money laundering, despite traditional banking systems handling vastly larger volumes of illicit funds.

FinCEN has issued an Advisory and Financial Trend Analysis raising the alarm on Chinese money laundering networks, which pose a significant threat to the U.S. financial system.https://t.co/QejJmzQaYw

— Financial Crimes Enforcement Network (FinCEN) (@FinCENnews) August 28, 2025

Chinese money laundering networks have established sophisticated partnerships with Mexico-based drug cartels, exploiting currency restrictions in both countries.

Mexican currency laws prevent large dollar deposits in local banks, while China’s currency controls limit overseas transfers by its citizens. This regulatory gap allows cartels to sell illicit dollars to Chinese nationals seeking to circumvent Beijing’s capital controls.

The networks extend beyond drug trafficking into human trafficking, healthcare fraud, and real estate purchases worth $53.7 billion in suspicious activity.

FinCEN identified 1,675 reports involving human trafficking and 43 reports covering $766 million in suspicious adult day care center activity in New York alone.

Banks Handle Bulk of Criminal Money While Crypto Faces Heat

Banks accounted for $246 billion of the total suspicious transactions, while money service businesses handled $42 billion and securities firms processed $23 billion.

The average annual flow through US banking systems reached $62 billion from Chinese money laundering operations alone.

Historical cases reveal systematic banking vulnerabilities to criminal exploitation.

Wachovia Bank laundered $350 billion for Mexican drug cartels between 2007 and 2010, receiving only a $160 million penalty despite the massive scale.

Danske Bank processed $228 billion in suspicious transactions from Russia between 2007 and 2015, ignoring internal warnings throughout the period.

Similarly, HSBC paid $1.9 billion in 2012 for allowing drug cartels to transfer hundreds of millions through accounts, with criminals using specially designed cash deposit boxes that fit perfectly into bank slots.

TD Bank agreed to pay over $3 billion after prosecutors found the institution had been used to launder more than $470 million through Chinese networks in New York and New Jersey.

In fact, dating back to 2021, the 1MDB scandal involved over $1 billion stolen through global banking networks, with funds used to purchase luxury real estate, yachts, and artwork across major cities.

Bank of Credit and Commerce International laundered billions for drug cartels and corrupt governments before its 1991 closure forced stricter international banking regulations.

Criminal organizations recruit bank employees as complicit insiders and use counterfeit Chinese passports to facilitate account openings.

Money mules often report occupations as “student,” “housewife,” or “retired” during onboarding to explain large transaction volumes that are inconsistent with their stated professions.

Regulators Target Crypto Despite Minimal Illicit Activity Share

Cryptocurrency transactions represent ‘less than 1%’ of total money laundering activity globally, according to TRM Labs.

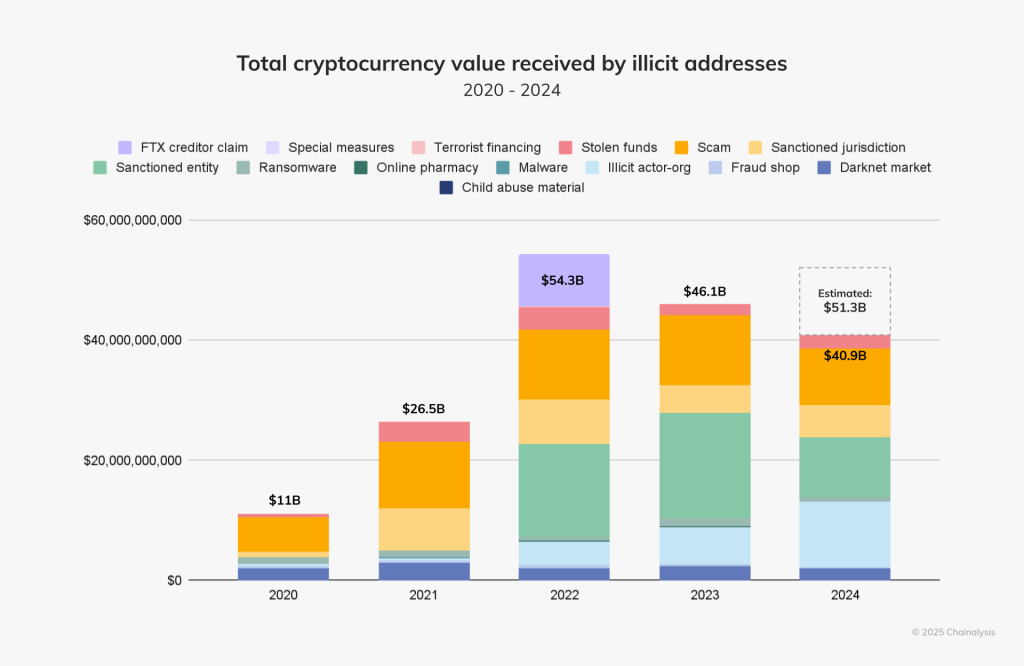

In fact, Chainalysis data shows illicit crypto volumes totaled approximately $189 billion over five years, compared to over $2 trillion laundered annually through traditional financial systems worldwide.

Despite this disparity, regulators are intensifying their enforcement actions against crypto.

Most recently, Binance Australia was required to appoint an external auditor within 28 days after AUSTRAC identified “serious concerns” with its anti-money laundering controls.

French authorities have also launched investigations into Binance over alleged violations, while European regulators are considering penalties against OKX following $100 million in allegedly laundered funds.

Australian enforcement expanded through systematic compliance reviews, with AUSTRAC targeting 13 remittance providers while investigating 50 additional platforms.

The agency cancelled or refused renewals for nine providers that failed to comply with their obligations, contrasting sharply with the limited penalties imposed on the banking sector despite vastly larger suspicious transaction volumes.

Senator Elizabeth Warren continues to demand tougher crypto regulations, stating, “Bad actors are increasingly turning to cryptocurrency to enable money laundering.”

However, FinCEN data reveals that Chinese money laundering networks primarily operate through traditional banking channels rather than digital assets.

Blockchain analytics firm Chainalysis reported illicit crypto transactions reached $51.3 billion in 2024, an 11.3% increase, but still representing a fraction of the $312 billion in suspicious banking transactions identified during the same period.

The post US Banks Moved $312B in Chinese Drug Money, But Crypto Gets the Blame appeared first on Cryptonews.