As U.S. Federal Reserve rate cuts loom, decentralized finance (DeFi) yields are positioned well for a resurgence, according to a recent report by analysts at research and brokerage firm Bernstein.

With the possibility of a 25- to 50-basis-point cut anticipated on Wednesday, analysts Gautam Chhugani, Mahika Sapra, and Sanskar Chindalia forecast a promising outlook for DeFi, particularly on Ethereum.

The analysts wrote in a note:

“DeFi yields look attractive again with a rate cut likely around the corner. This could be the catalyst to reboot crypto credit markets and revive interest in DeFi and Ethereum.”

DeFi platforms allow global participants to earn a yield on stablecoins like USDC and USDT by providing liquidity in decentralized lending markets.

While the explosive growth of the 2020 “DeFi summer” has faded, and the high yields incentivized by app tokens are long gone, stablecoin lending on Aave, the largest lending market on Ethereum, continues to offer competitive rates of around 3.7% to 3.9%.

DeFi’s Gradual Reawakening: Will US Rate Cut Affect The Market?

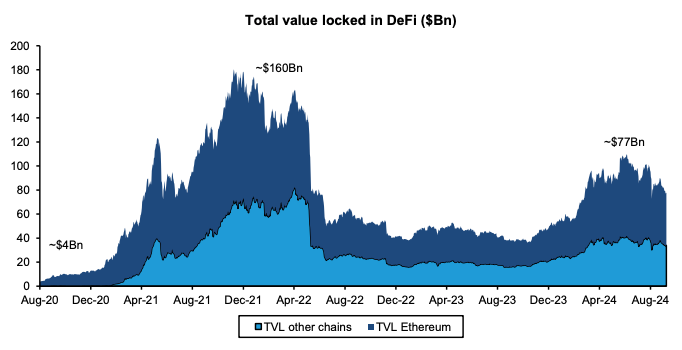

According to Bernstein’s analysis, the total value locked (TVL) in DeFi protocols, although still only half of its 2021 peak, has surged from the lows of 2022, doubling to approximately $77 billion.

The number of monthly active DeFi users has increased three to four times since the market’s lowest point.

Stablecoins have also seen a resurgence, with total issuance returning to around $178 billion. Active wallet numbers have stabilized, hovering at about 30 million monthly users.

“These are all signs of a recovering crypto DeFi market that should see further acceleration as rates head down,”

Particularly on stablecoins, Jeremy Allaire, CEO of Circle, predicts that stablecoins will account for 10% of the global economy within the next decade, driven by advancements in blockchain technology and increased integration into financial systems.

I’m more bullish than I have ever been about crypto.

I have been building @Circle for over 11 years, and at no time have I been more optimistic than right now.

I also believe that the overwhelming majority of people have an extremely narrow and limited understanding of what’s…— Jeremy Allaire – jda.eth / jdallaire.sol (@jerallaire) June 19, 2024

He expressed optimism about the future of cryptocurrency, emphasizing stablecoins’ growing role in global transactions and services.

Allaire also noted the rapid acceptance of digital assets, with many governments establishing clear regulations for their use.

He anticipates that by 2025, stablecoins will be considered “legal electronic money” in most places, further expanding their share of the $100 trillion electronic money market.

If demand for crypto credit rises, DeFi stablecoin yields could surpass 5%, outpacing yields from U.S. dollar money market funds.

The analyst further claimed that such an increase could reignite crypto credit markets, which would provide an upward momentum for digital asset prices.

Bitcoin and Ethereum In Danger

In light of the improving outlook, Bernstein has added Aave to its digital assets portfolio, replacing derivative protocols GMX and Synthetix.

Aave, a DeFi lending giant, has seen outstanding debt triple from its January 2023 low, while its token price has risen 23% in the past 30 days despite relatively stagnant Bitcoin prices.

The analysts also believe that Ethereum’s underperformance relative to Bitcoin might be temporary. Over the last 12 months, Ethereum has dropped 36% against Bitcoin, reaching its lowest point since April 2021.

The analysts attribute Ethereum’s struggles to weaker spot exchange-traded fund (ETF) flows.

However, strengthening DeFi lending on Ethereum could attract large institutional investors and whales back into the crypto credit markets.

“We believe it may be time to turn back attention to DeFi and Ethereum,”

As the rate cuts approach, the DeFi market’s resurgence may increase yields and play a key role in shaping the next phase of the crypto credit market.

Notably, 10x Research has warned that an aggressive interest rate cut by the U.S. Federal Reserve could signal deeper economic concerns, negatively affecting risk assets like Bitcoin.

Reports suggest that while a modest 25 basis point cut could favor long-term Bitcoin price appreciation, a more aggressive 50 basis point cut might indicate heightened recession fears.

This could lead investors to reduce their exposure to Bitcoin, potentially triggering a 15-20% decline. The Federal Reserve will likely focus on mitigating economic risks, not market reactions.

The post US Rate Cuts Expected to Boost DeFi Yields, Bernstein Predicts appeared first on Cryptonews.