Wall Street executives expect digital assets to capture 10% of post-trade market turnover by 2030, representing approximately $2 trillion in daily trading volume as tokenized securities reach a critical adoption tipping point, according to Citi’s Securities Services Evolution 2025 survey.

The prediction is based on 537 industry leaders across five years of data, with North American respondents being the most bullish, expecting 14% digital turnover driven by recent regulatory clarity.

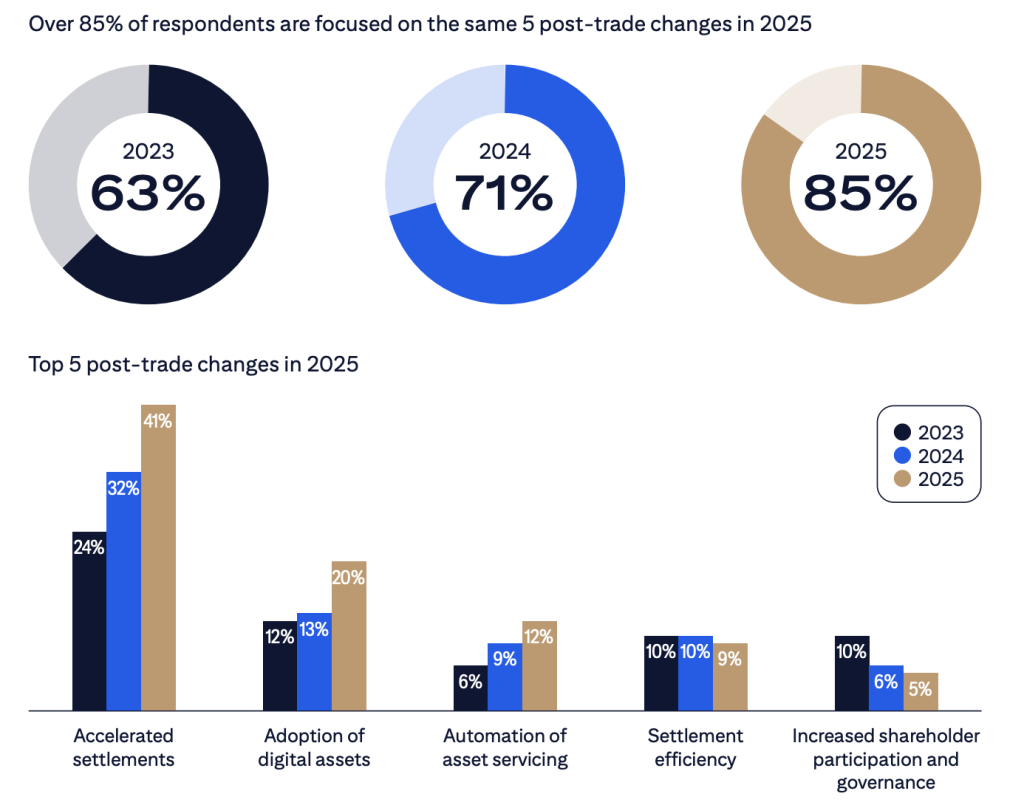

The survey reveals big hope in fast settlement infrastructure, with 85% of respondents prioritizing accelerated settlements, digital asset adoption, and automation.

Traditional financial market infrastructures, which support 40% of global market capitalization, are undergoing massive transformation programs while facing competition from zero-legacy “neobrokers” that demand 24/7 access to cryptocurrencies.

Stablecoins emerged as critical infrastructure for the digital transition, with bank-issued tokens positioned for significant growth as optimal bridges between traditional and decentralized finance.

The convergence maintains traditional institutions as trusted gateways while leveraging DeFi engines to improve speed and efficiency.

Settlement Revolution Drives DeFi-TradFi Convergence

Over 52% of survey respondents expect existing financial market infrastructures to become core enablers of digital markets for equities and fixed income.

Custodians will serve as essential network providers connecting to multiple blockchains rather than being disrupted by distributed ledger technology.

The industry shifted focus from broad blockchain development to specific business use cases with clear cost benefits.

Tokenized collateral and funds are the fastest-growing areas, enabling automated intraday funding processes that replace manual overnight procedures.

This velocity improvement enhances balance sheet efficiency, reduces funding costs, and improves liquidity ratios.

Digital money adoption supports the new ecosystem through various forms, with bank-issued stablecoins providing an optimal balance of automation, regulation, and benefits across trade lifecycles.

The infrastructure enables atomic payment-versus-payment transactions that eliminate counterparty credit risk, while combining messaging and settlement into a single, programmable layer.

Stablecoin settlement can process transactions 3-5 times faster and up to 10 times cheaper than SWIFT-based systems.

Brazilian businesses settling in Euros achieve settlement times over 500 times faster than traditional methods, while remittance costs drop 4-13 times through near-instantaneous processing.

Traditional settlement systems rely on correspondent banks, SWIFT messaging separation, and prefunding requirements that trap $27 trillion globally in idle accounts.

Legacy architectures created during pre-digital eras accumulate inefficiencies through multiple intermediaries and batch processing cycles that DLT eliminates through unified messaging and settlement.

Stablecoin Growth Projections Spark Industry Debate

Earlier in August, Goldman Sachs predicted Circle’s USDC could grow $77 billion between 2024 and 2027, representing 40% compound annual growth as the “stablecoin gold rush” accelerates.

The investment bank expects regulatory clarity and wider digital asset integration to fuel expansion beyond the current $271 billion market valuation.

Treasury Secretary Scott Bessent also privately told Wall Street that stablecoins backed by dollars and U.S. Treasuries could become a major source of government bond demand.

The GENIUS Act framework requires one-to-one reserves in highly liquid assets, potentially creating multitrillion-dollar engines for US debt markets.

However, industry projections vary dramatically. JPMorgan forecasts conservative growth to $500 billion by 2028, citing limited mainstream adoption beyond crypto trading.

The bank estimates that only 6% of stablecoin demand comes from actual payment activity, which questions the trillion-dollar expansion scenarios.

Before this survey, Citi had earlier highlighted institutional ambivalence as the bank explores stablecoin custody services while warning of risks similar to those of the 1980s, including deposit flight.

Citi executive warns stablecoin interest payments could drain bank deposits like the 1980s crisis amid GENIUS Act loophole concerns.#Stablecoin #Bankshttps://t.co/aaHxz9bXHM

— Cryptonews.com (@cryptonews) August 25, 2025

CEO Jane Fraser confirmed plans for Citi stablecoin issuance, while analyst Ronit Ghose compared potential disruption to money market funds draining $32 billion from banks between 1981 and 1982.

Most recently, Nobel Prize-winning economist Jean Tirole has warned that weak oversight of stablecoins could trigger government bailouts during financial crises.

He cautioned that reserve portfolio losses could spark token runs, forcing intervention to protect retail investors who view stablecoins as “perfectly safe deposits.”

Former People’s Bank of China Governor Zhou Xiaochuan has also previously identified systemic amplification risks beyond stated reserves through deposit lending and collateralized financing.

Backing it, recent Investopedia analysis suggests annualized risk estimates of 3.3-3.9% for major stablecoins, which is roughly a one-in-three chance of crisis over a decade-long period.

Looking forward, the current stablecoin market is growing, with a capitalization of $284 billion with 22 consecutive months of growth, while weekly expansion rates moderate from $4-8 billion peaks to current $1.1 billion levels.

The post Wall Street Leaders Believe Crypto Will Capture 10% of Post-Trade Market Within 5 Years: Citi Survey appeared first on Cryptonews.