Crypto investors have been paying exceedingly close attention to the U.S. presidential election — and with Joe Biden dramatically quitting his campaign, there’s feverish speculation as to who will take his place as the Democratic nominee.

The 2024 race marks the first time that digital assets have meaningfully been discussed by candidates, with Donald Trump and his vice presidential pick JD Vance both adopting a pro-Bitcoin stance and attracting donations worth millions in the process.

While Biden’s current vice president, Kamala Harris, appears to be gaining early ground as the favorite to face Trump in November, with endorsements from a slew of senior party officials, others have called for a more open contest.

One way of reading the tea leaves and navigating all of the drama has been by looking at the betting markets, where odds change in real time. There’s been no shortage of frenzied activity in recent weeks — once after Trump faced an assassination attempt during a stump speech, and again when Biden unexpectedly announced he was bowing out in a social media post.

The crypto-focused platform Polymarket has proven itself to be an especially popular outlet for those who fancy a flutter — with topics spanning politics, sports, and pop culture.

Here’s how it works: the cost of a bet is determined by current odds. So, if there was a 70% chance of Manchester United beating Liverpool in a soccer game, someone who supports Man U would be able to buy shares for 70 cents each. Each share would be worth $1 if their prediction was right — a 30-cent profit — and Liverpool fans get nothing.

But crucially, these shares can be sold at any time until an event is over. So if a Man U share ends up surging to 88 cents in the middle of a match, the fan can exit a position there and then.

Hundreds and hundreds of millions of dollars have been bet on the U.S. election so far — with $321 million wagered on who will win the presidency this autumn.

At the time of writing, Donald Trump is seen to have a 65% chance of being re-elected, with his odds improving considerably since the year began. Amid a backdrop of legal troubles, that figure stood at just 41% back in January.

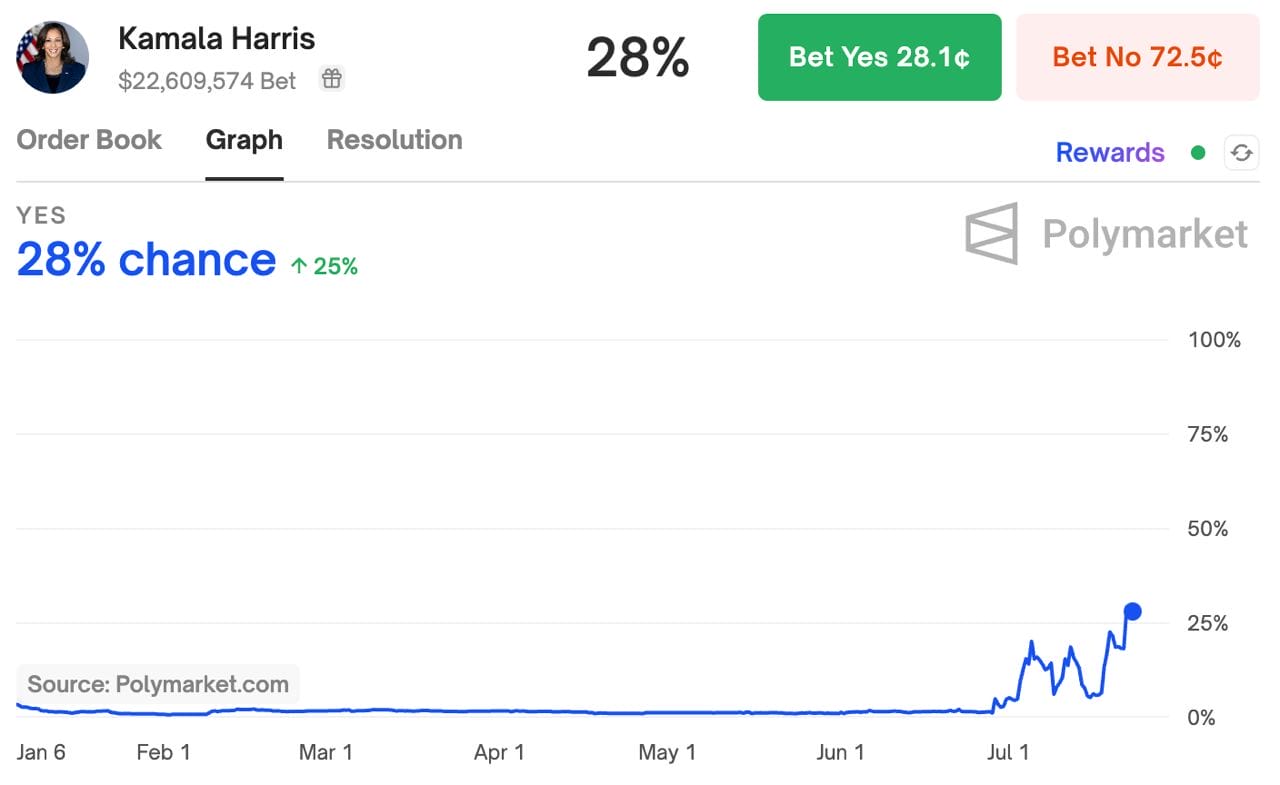

It’s also been fascinating to see how the markets have shifted in favor of Kamala Harris, with her odds starting to increase in the immediate aftermath of Biden’s disastrous TV debate performance. On January 1, Polymarket bettors gave her a mere 5% chance of becoming America’s first female president — but now, that figure stands at 28%.

Other outside candidates include Michelle Obama on 4% and a different Democrat politician on 3%. The likes of Robert F. Kennedy Jr, Hillary Clinton and Gavin Newsom are all seen to have less than a 1% chance of emerging victorious.

If anything, spare a thought for those who had placed their cash behind Biden, with the total value of bets on the former candidate now standing at a jaw-dropping $43.6 million. He was seen to have a 45% chance of a second term just two months ago — and supporters with shares on this outcome will have seen their value crash to nothing.

But it’s also been interesting to see how this particular market matches up with other potential scenarios.

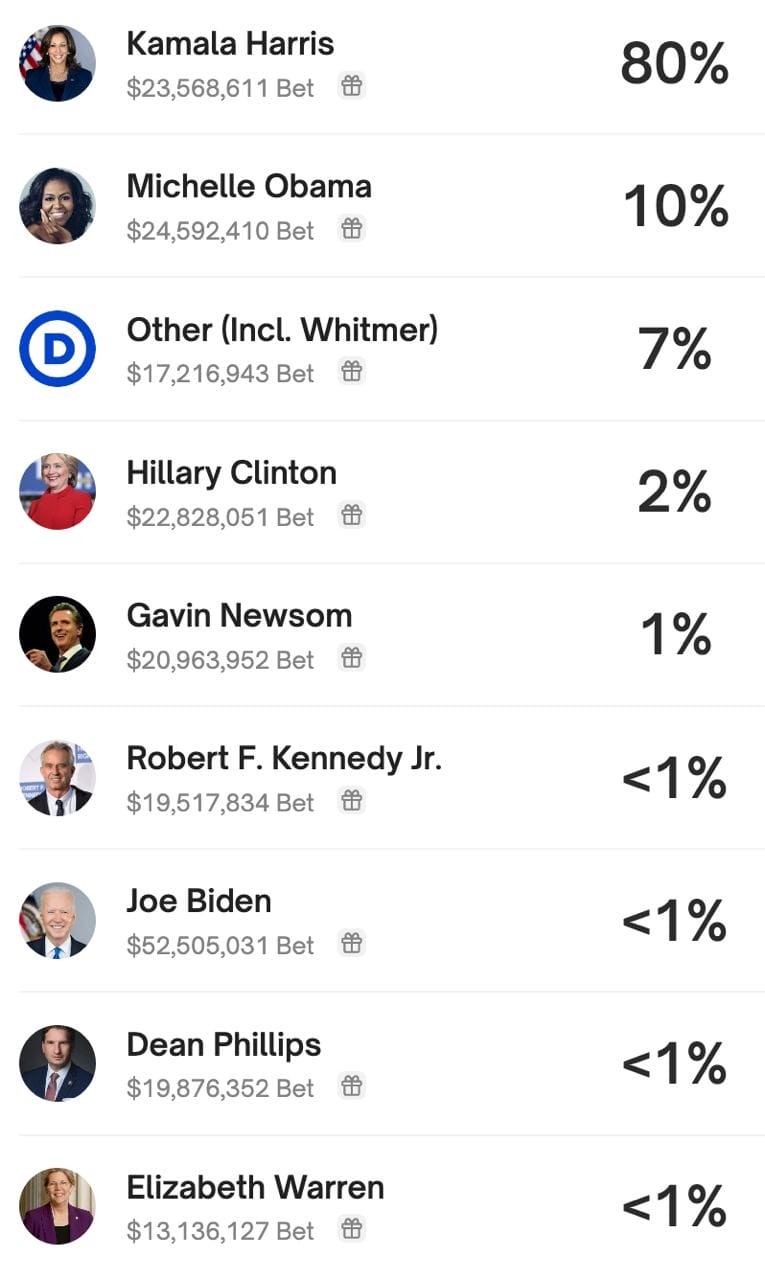

More than $214 million has now been bet on who will be the Democratic nominee, with Harris coming out as the undisputed favorite. Just 10% have thrown their support for Michelle Obama — the wife of former president Barack Obama — amid murmurings that she might be primed to throw her hat into the ring. Crypto supporters will breathe a sigh of relief that Senator Elizabeth Warren — a vocal critic of Bitcoin — is seen to have a 0.1% chance of success.

Elsewhere, there doesn’t seem to be clear consensus on who might emerge as the Democratic nominee for vice president. North Carolina Governor Roy Cooper — who recently vetoed calls within his state to block central bank digital currencies from becoming legal tender — is narrowly in the lead on 29% at the time of writing. His Pennsylvania counterpart, Josh Shapiro, appears to have a 24% chance of getting the nod.

And while Polymarket users appear to be pretty confident that Trump will retake the presidency, there seems to be a little bit of disagreement on whether he’ll win the popular vote.

Candidates need 270 Electoral College votes to win, but it is possible to hit this milestone without having a majority of Americans support you in the ballot box. This happened to Trump back in 2016, when he rose to power despite having three million fewer votes than his Democratic rival Hillary Clinton. Right now, 48% of bettors believe the Republican nominee will win the popular vote in 2024, compared with an impressive 43% for Harris.

According to Polymarket, research suggests that such prediction markets end up being “considerably more accurate, on average, than polls and pundits.”

But given the uncharted territory that the U.S. currently finds itself in, that theory could end up being put to the test. It’s very difficult to gauge where we’ll be in a month’s time, let alone by November.

Whatever happens, this is an election that will have huge ramifications for the state of crypto — not to mention the wider world.

The post What Crypto Prediction Markets Tell Us About the U.S. Election appeared first on Cryptonews.