Get your daily, bite-sized digest of blockchain and crypto news today – investigating the stories flying under the radar of today’s news.

In crypto news today:

- Why is crypto up today?

- ‘Bitcoin Attacks the ATH’ – Glassnode

- Nexo’s Dubai Entity Receives Initial Approval from Dubai’s Regulator

- MakerDAO Achieves 52% Market Share in ETH Lending Underpinned by Spark Growth

__________

Why is crypto up today?

The crypto market is seeing a relatively mixed picture today.

The market capitalization is up 1.4% over the past 24 hours. According to CoinGecko, it reached $2.649 trillion.

Looking at the 100 coins per market capitalization and the top 10 coins category, we see both red and green today, nearly equally.

Four out of eight top 10 coins have appreciated over the last day. Four have dropped. The remaining two are stablecoins.

Out of the green coins, Ethereum (ETH) and Lido Staked Ether (STETH) are up the most: 4.2%. The former currently sits at $3,849, and the latter at $3,840.

Solana (SOL) is up 2.8% to nearly $134, and Bitcoin (BTC) increased by 0.7% to $67,219.

As for the red coins, BNB, XRP, Cardano (ADA), and Dogecoin (DOGE) fell between 1.3% and 3.2%.

Meanwhile, as reported, Bitcoin’s recent price correction, following its surge to a new all-time high above $69,000, resulted in the closure of leveraged perpetual futures bets worth more than $1 billion across digital asset markets.

However, RealVision CEO Raoul Pal, a former Goldman Sachs hedge fund manager, suggested that periods of significant liquidation offered favorable buying chances for Bitcoin.

‘Bitcoin Attacks the ATH’ – Glassnode

Bitcoin rallied towards the last all-time high even before the halving in April. This is the first such time this has occurred, according to blockchain analytics firm Glassnode.

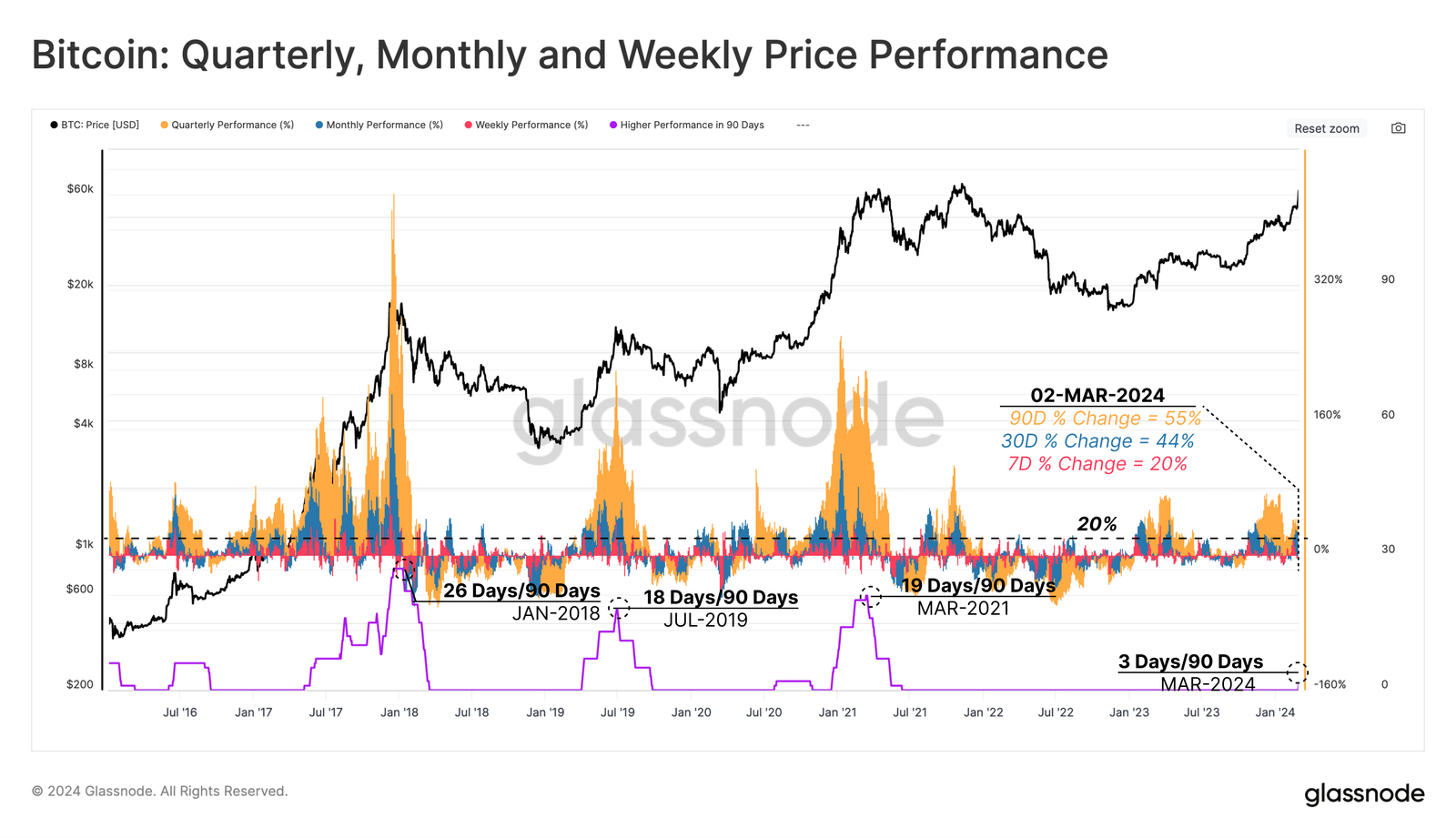

The report included a chart below that shows the rolling performance over Weekly (red), Monthly (blue), and Quarterly (orange) timeframes.

They have hit +20%, +44%, and +55% at the time of writing the report on Tuesday.

“If we count the number of trading days over the last quarter where all three performance indicators exceed +20%, we can see that the rally late last week has been the most powerful since the 2021 bull market,” Glassnode noted.

While many expected strong demand following the approval of spot Bitcoin exchange-traded funds (ETFs) in the US, others argued that the ETF news was already priced in.

With Bitcoin hitting above $68,000, nearly 60% higher than $42,800 at the time of ETF approvals, “the sell-the-news camp have found themselves offside,” said the analysts.

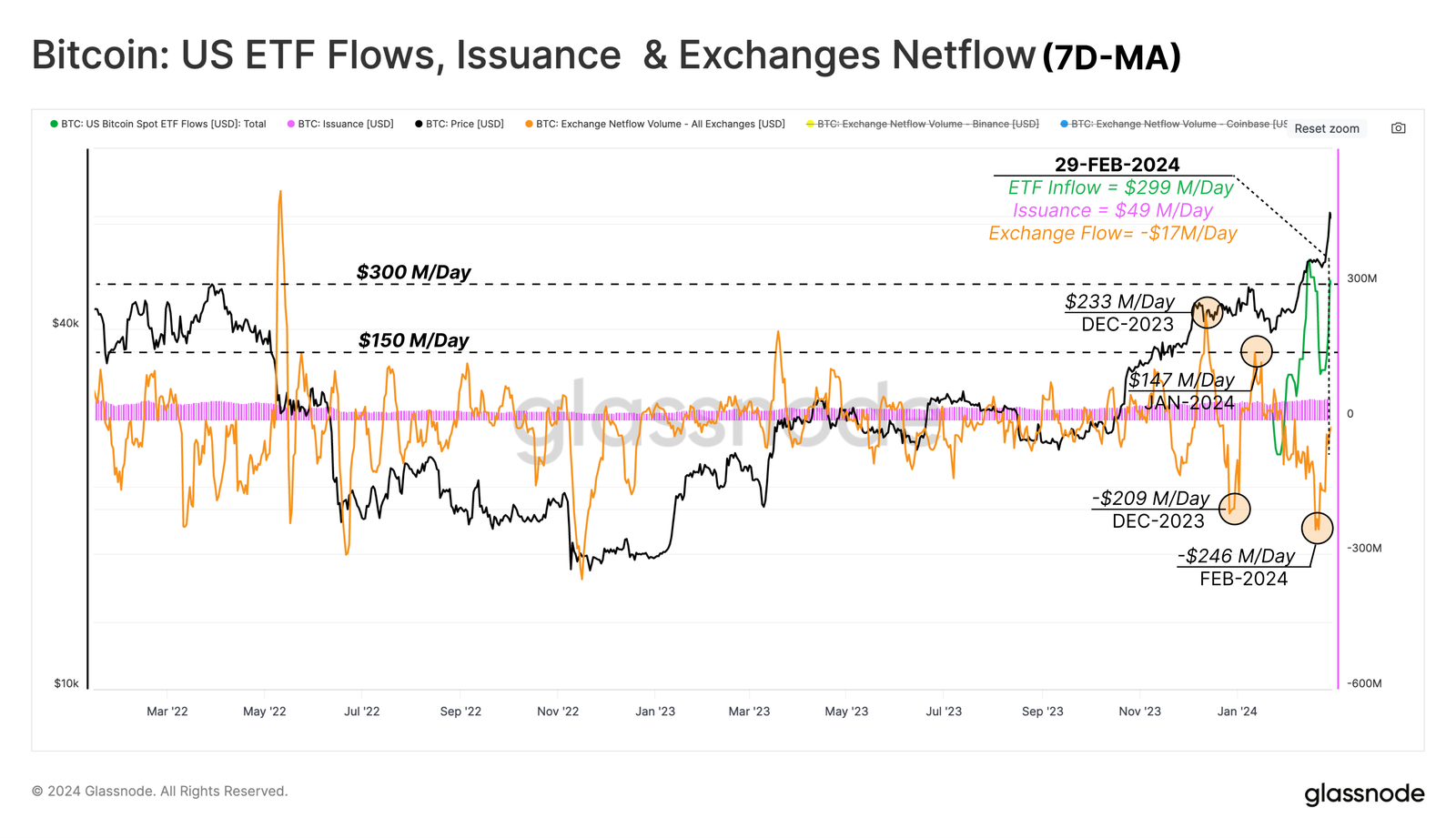

The chart below shows the weekly average of the USD flows through:

- network issuance (violet): the daily network reward to miners has increased from $22M/day in September 2023 to $49M/day on Tuesday;

- all exchanges’ netflow (orange): in the months leading up to the ETF approval date, centralized exchanges saw significant swings between positive (sell-side) and negative (buy-side) waves of capital flows. Since the ETFs started trading, there has been a consistent outflow or buying pressure of up to $246M/day. At the end of last week, the aggregate exchange netflow was experiencing a $17M/day outflow.

- US Spot ETFs netflow (green): despite an initial and significant sell-side pressure by existing GBTC holders, the aggregate net flow into US Spot ETFs averaged $299M/day.

Overall, this represents an on-balance and net capital inflow into Bitcoin of around $267M/day.

“This represents a meaningful phase shift in market dynamics and a valid explanation for the market’s rebound towards new ATHs,” said the report.

Furthermore, with the market approaching ATHs, both the unrealized profit held by long-term investors and the magnitude of their distribution pressure have increased accordingly, Glassnode noted.

Nexo’s Dubai Entity Receives Initial Approval from Dubai’s Regulator

Crypto lender Nexo announced that its Dubai entity, Nexo DWTC, has been awarded an Initial Approval (IA) by the Virtual Assets Regulatory Authority (VARA) for Virtual Asset Lending & Borrowing, Management & Investment, and Broker-Dealer activities.

Per the press release, the IA positions Nexo as “one of the first digital asset lending institutions seeking to expand into the pivotal Dubai market.”

Once licensed, the Nexo platform will be available to local clients in compliance with local regulations and accessible through mobile and web platforms.

Nexo’s Dubai entity, Nexo DWTC, has been awarded an Initial Approval from Dubai’s Virtual Assets Regulatory Authority (VARA) for a vast range of virtual asset service activities.

Dubai’s forward-looking culture of innovation is a natural fit for our goal in contributing to… pic.twitter.com/H5dPjzXru2

— Nexo (@Nexo) March 5, 2024

According to the announcement, the UAE is “renowned for attracting top financiers, tech pioneers, and visionary companies.” It embraces advanced technologies, including blockchain.

Kalin Metodiev, CFA, Co-founder and Managing Partner at Nexo, commented that the platform – from the UAE – aims to contribute to the regional ecosystem through its lending, brokerage, management, and investment solutions.

“Nexo is enthusiastic about the pursuit of new market strategies aligned with the transformative guidance” of Dubai’s VARA, the co-founder said.

Notably, the Dubai market is “pivotal” for Nexo and its 7 million users, the company added.

MakerDAO Achieves 52% Market Share in ETH Lending Underpinned by Spark Growth

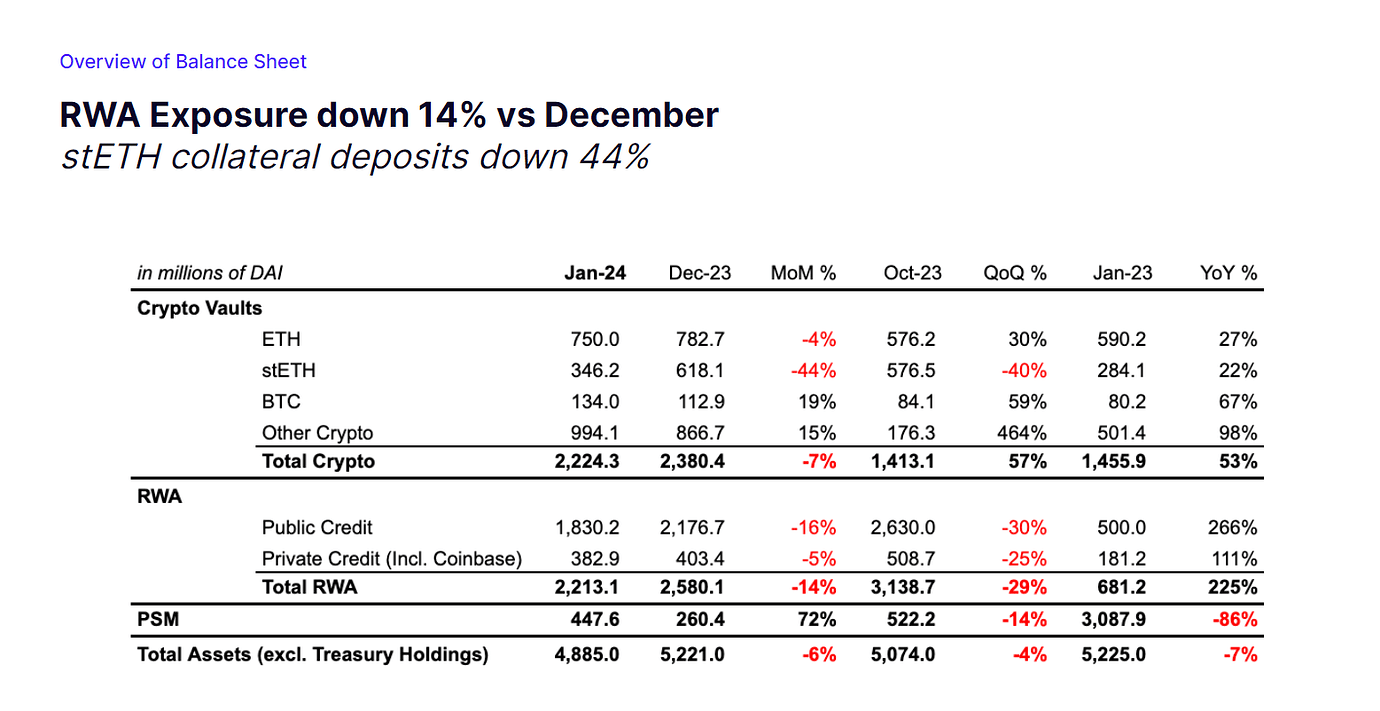

MakerDAO, the longest-standing DeFi lending protocol and creator of the DAI stablecoin, has surpassed 52% market share in ETH lending, accounting for ETH/stETH deposited into mainnet lending protocols, said the press release shared with Cryptonews.

The protocol has seen “significant growth.” It was primarily driven by a 22% increase in ETH lending through crypto-vaults on Spark. The announcement cited the ‘January 2024 MakerDAO Protocol Economics Report’ by Steakhouse Financial.

Spark is a community-built decentralized finance (DeFi) infrastructure sustained by the Spark SubDAO. The latter is the first operational SubDAO within the MakerDAO ecosystem.

Meanwhile, the announcement noted that Spark has “a direct line of credit” from Maker.

Spark’s “particularly high liquidity and competitive DeFi borrowing rates,” Maker said, have driven sustained growth since its launch in May 2023.

As a result of this growth, Maker accounts for over half of the ETH mainnet lending market. This is up from 43% market share the previous year, it said.

Sam MacPherson, CEO at Phoenix Labs, the R&D company behind Spark, commented that Spark is showcasing what can be achieved by a thriving SubDAO.

Its “rapid growth” has led the protocol to the third position in Lending Total Value Locked (TVL) Rankings as measured by DeFiLlama. This is “underscoring a robust product-market fit at scale.”

Spark is continuously evolving and enhancing its products and offerings, MacPherson added.

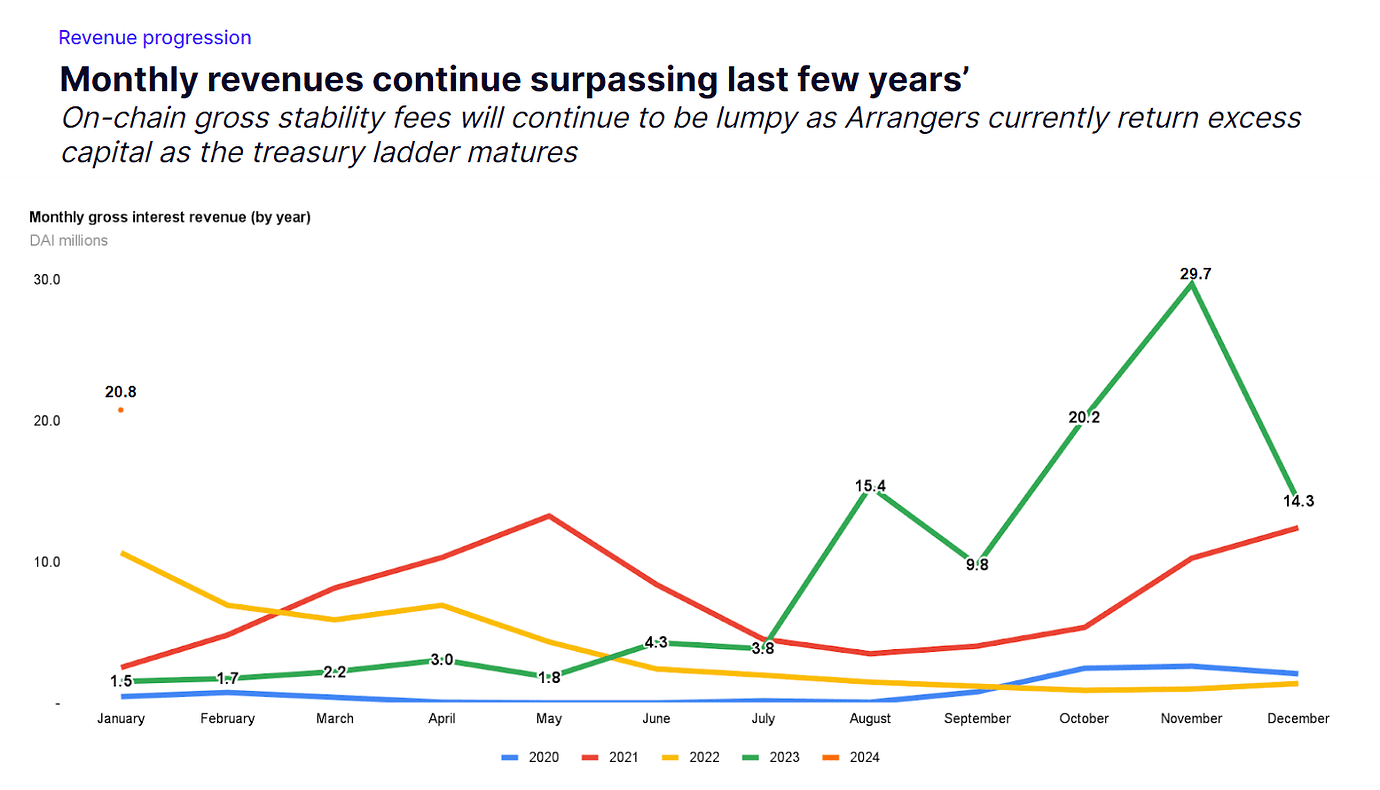

Meanwhile, the January report further noted that the gross monthly protocol revenue for Maker was 20.8 million DAI.

There was “a significant contribution” of 10.3 million DAI coming from crypto-vault revenue, it explained.

Additionally, revenue from Real-World Assets (RWA) stood at 10.2 million DAI. It rose to 10.5 million DAI upon including revenue from the Peg Stability Module (PSM).

According to Steakhouse Financial co-founder Sébastien Derivaux, MakerDAO’s “strong January results demonstrate the effectiveness of the community’s dual-engine strategy. As the cryptocurrency market rallies, driving up demand for leverage, the protocol has strategically shifted its balance sheet allocation from T-bills to higher-yielding crypto-backed loans.”

The post What’s Happening In Crypto Today? Daily Crypto News Digest appeared first on Cryptonews.